Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Percy and Penny Payne, recently married, are feeling the financial weight of homeownership, and have come to see you about applying for a car

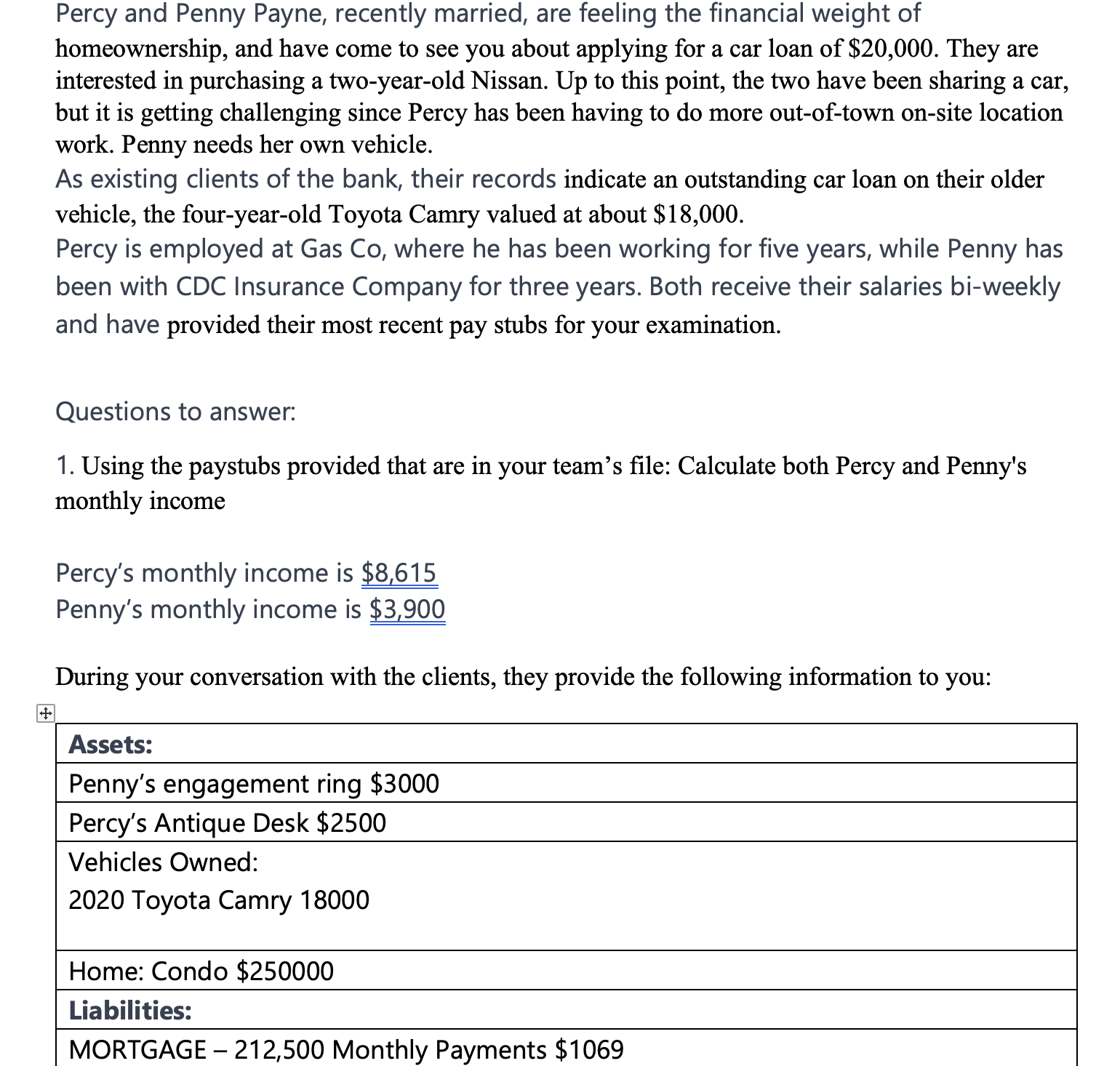

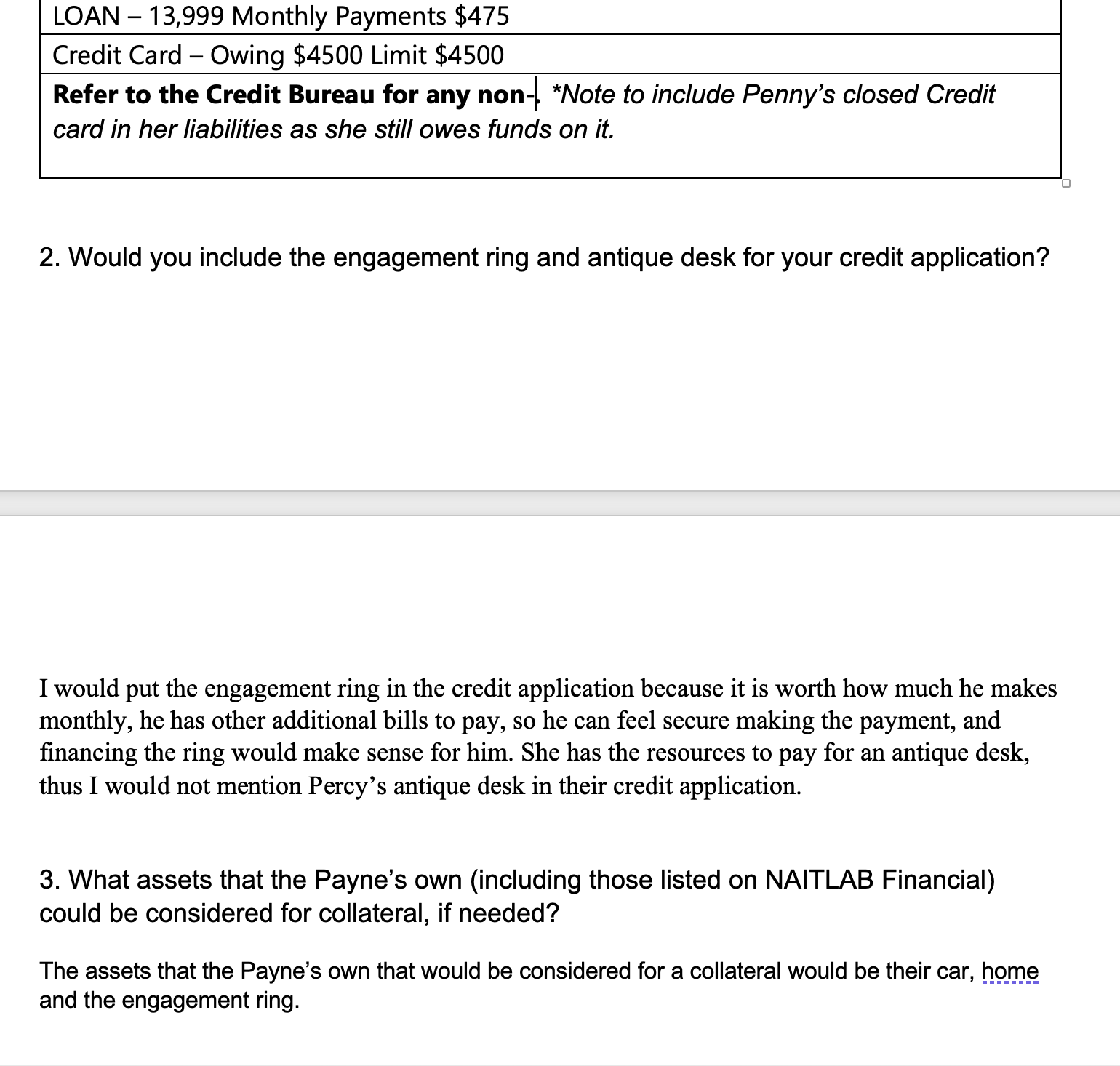

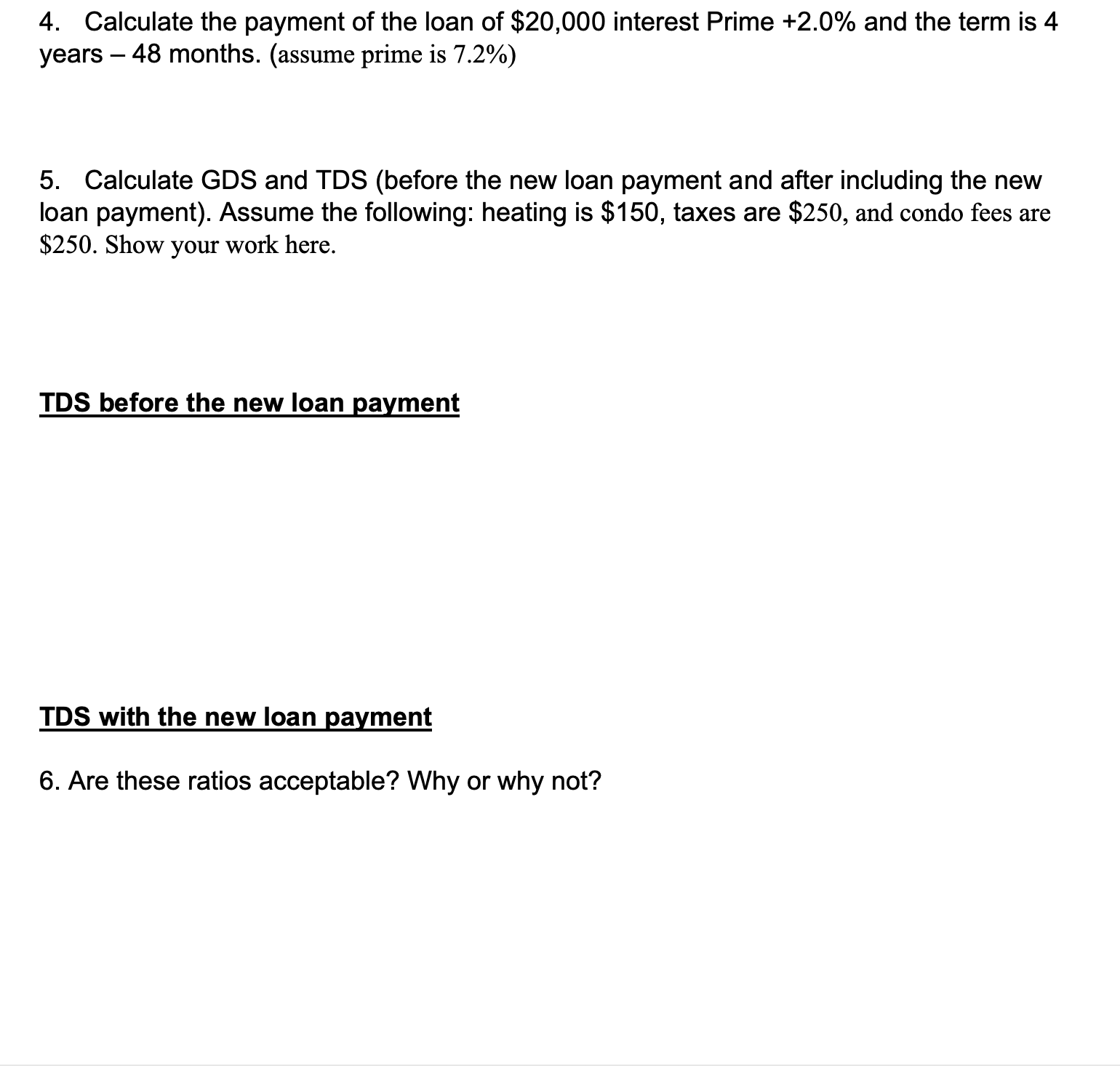

Percy and Penny Payne, recently married, are feeling the financial weight of homeownership, and have come to see you about applying for a car loan of $20,000. They are interested in purchasing a two-year-old Nissan. Up to this point, the two have been sharing a car, but it is getting challenging since Percy has been having to do more out-of-town on-site location work. Penny needs her own vehicle. As existing clients of the bank, their records indicate an outstanding car loan on their older vehicle, the four-year-old Toyota Camry valued at about $18,000. Percy is employed at Gas Co, where he has been working for five years, while Penny has been with CDC Insurance Company for three years. Both receive their salaries bi-weekly and have provided their most recent pay stubs for your examination. Questions to answer: 1. Using the paystubs provided that are in your team's file: Calculate both Percy and Penny's monthly income + Percy's monthly income is $8,615 Penny's monthly income is $3,900 During your conversation with the clients, they provide the following information to you: Assets: Penny's engagement ring $3000 Percy's Antique Desk $2500 Vehicles Owned: 2020 Toyota Camry 18000 Home: Condo $250000 Liabilities: MORTGAGE - 212,500 Monthly Payments $1069 LOAN - 13,999 Monthly Payments $475 Credit Card - Owing $4500 Limit $4500 Refer to the Credit Bureau for any non-. *Note to include Penny's closed Credit card in her liabilities as she still owes funds on it. 2. Would you include the engagement ring and antique desk for your credit application? I would put the engagement ring in the credit application because it is worth how much he makes monthly, he has other additional bills to pay, so he can feel secure making the payment, and financing the ring would make sense for him. She has the resources to pay for an antique desk, thus I would not mention Percy's antique desk in their credit application. 3. What assets that the Payne's own (including those listed on NAITLAB Financial) could be considered for collateral, if needed? The assets that the Payne's own that would be considered for a collateral would be their car, home and the engagement ring. 4. Calculate the payment of the loan of $20,000 interest Prime +2.0% and the term is 4 years - 48 months. (assume prime is 7.2%) 5. Calculate GDS and TDS (before the new loan payment and after including the new loan payment). Assume the following: heating is $150, taxes are $250, and condo fees are $250. Show your work here. TDS before the new loan payment TDS with the new loan payment 6. Are these ratios acceptable? Why or why not?

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Using the paystubs provided that are in your teams file Calculate both Percy and Pennys monthly income Based on the information provided Percys monthly income is 8615 and Pennys monthly income is 39...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started