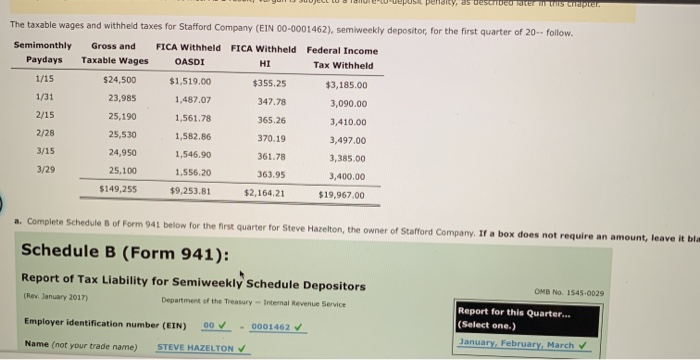

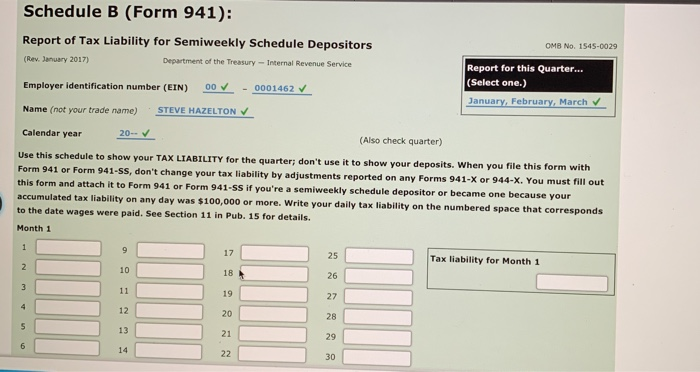

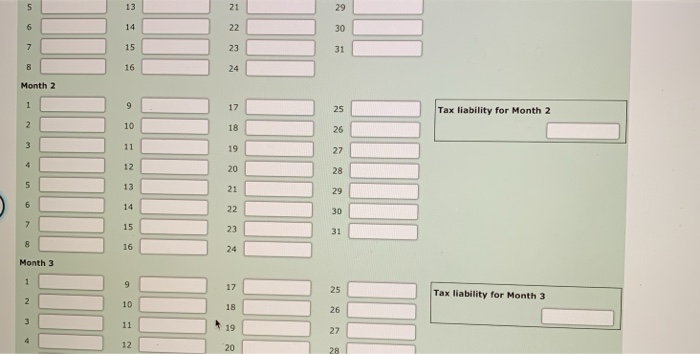

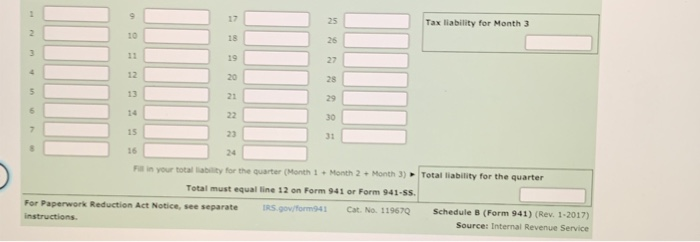

perdity, as described Super The taxable wages and withheld taxes for Stafford Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 20-- follow. Semimonthly Gross and FICA Withheld FICA Withheld Federal Income Paydays Taxable Wages OASDI HI Tax Withheld 1/15 $24,500 $1,519.00 $355.25 $3,185.00 1/31 23,985 1,487.07 347.78 3,090.00 2/15 25,190 1,561.78 365.26 3,410.00 2/28 25,530 1,582.86 370.19 3,497.00 3/15 24,950 1,546.90 361.78 3,385.00 3/29 25,100 1,556,20 363.95 3,400.00 $149,255 $9,253.81 $2,164.21 $19,967.00 . Complete Schedule of Form 941 below for the first quarter for Steve Hazelton, the owner of Stafford Company. If a box does not require an amount, leave it bla Schedule B (Form 941): Report of Tax Liability for Semiweekly Schedule Depositors OMS NO. 1545-0029 (Rev. January 2017) Department of the Treasury - Internal Revenue Service Report for this Quarter... (Select one.) Employer identification number (EIN) 00 0001462 January February March Name (not your trade name) STEVE HAZELTON Schedule B (Form 941): Report of Tax Liability for Semiweekly Schedule Depositors OMB No. 1545-0029 (Rev. January 2017) Department of the Treasury - Internal Revenue Service 0001462 Employer identification number (EIN) 00 Name (not your trade name) STEVE HAZELTON Report for this Quarter... (Select one.) January, February, March Calendar year 20- (Also check quarter) Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form 941-SS, don't change your tax liability by adjustments reported on any Forms 941-X or 944-X. You must fill out this form and attach it to form 941 or Form 941-ss if you're a semiweekly schedule depositor or became one because your accumulated tax liability on any day was $100,000 or more. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. See Section 11 in Pub. 15 for details. Month 1 1 9 17 25 Tax liability for Month 1 2 10 18 26 3 11 19 27 12 20 28 5 13 21 29 6 4 22 30 5 13 21 29 6 14 22 30 7 15 23 31 8 16 24 Month 2 9 17 25 Tax liability for Month 2 2 10 18 26 3 11 19 27 4 12 20 28 5 13 21 29 6 14 22 30 7 15 23 31 8 16 24 Month 3 1 9 17 25 Tax liability for Month 3 2 10 18 26 11 19 27 4 12 20 28 9 25 Tax liability for Month 3 2 10 18 26 11 19 27 12 20 28 5 21 29 5 30 15 23 31 16 in your totality for the quarter (Month 1 Month 2 Month 3) Total liability for the quarter Total must equal line 12 on Form 941 or Form 941-55. For Paperwork Reduction Act Notice, see separate IRS.gov/form:941 Cat No. 119670 Schedule B (Form 941) (Rev. 1-2017) instructions. Source: Internal Revenue Service perdity, as described Super The taxable wages and withheld taxes for Stafford Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 20-- follow. Semimonthly Gross and FICA Withheld FICA Withheld Federal Income Paydays Taxable Wages OASDI HI Tax Withheld 1/15 $24,500 $1,519.00 $355.25 $3,185.00 1/31 23,985 1,487.07 347.78 3,090.00 2/15 25,190 1,561.78 365.26 3,410.00 2/28 25,530 1,582.86 370.19 3,497.00 3/15 24,950 1,546.90 361.78 3,385.00 3/29 25,100 1,556,20 363.95 3,400.00 $149,255 $9,253.81 $2,164.21 $19,967.00 . Complete Schedule of Form 941 below for the first quarter for Steve Hazelton, the owner of Stafford Company. If a box does not require an amount, leave it bla Schedule B (Form 941): Report of Tax Liability for Semiweekly Schedule Depositors OMS NO. 1545-0029 (Rev. January 2017) Department of the Treasury - Internal Revenue Service Report for this Quarter... (Select one.) Employer identification number (EIN) 00 0001462 January February March Name (not your trade name) STEVE HAZELTON Schedule B (Form 941): Report of Tax Liability for Semiweekly Schedule Depositors OMB No. 1545-0029 (Rev. January 2017) Department of the Treasury - Internal Revenue Service 0001462 Employer identification number (EIN) 00 Name (not your trade name) STEVE HAZELTON Report for this Quarter... (Select one.) January, February, March Calendar year 20- (Also check quarter) Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form 941-SS, don't change your tax liability by adjustments reported on any Forms 941-X or 944-X. You must fill out this form and attach it to form 941 or Form 941-ss if you're a semiweekly schedule depositor or became one because your accumulated tax liability on any day was $100,000 or more. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. See Section 11 in Pub. 15 for details. Month 1 1 9 17 25 Tax liability for Month 1 2 10 18 26 3 11 19 27 12 20 28 5 13 21 29 6 4 22 30 5 13 21 29 6 14 22 30 7 15 23 31 8 16 24 Month 2 9 17 25 Tax liability for Month 2 2 10 18 26 3 11 19 27 4 12 20 28 5 13 21 29 6 14 22 30 7 15 23 31 8 16 24 Month 3 1 9 17 25 Tax liability for Month 3 2 10 18 26 11 19 27 4 12 20 28 9 25 Tax liability for Month 3 2 10 18 26 11 19 27 12 20 28 5 21 29 5 30 15 23 31 16 in your totality for the quarter (Month 1 Month 2 Month 3) Total liability for the quarter Total must equal line 12 on Form 941 or Form 941-55. For Paperwork Reduction Act Notice, see separate IRS.gov/form:941 Cat No. 119670 Schedule B (Form 941) (Rev. 1-2017) instructions. Source: Internal Revenue Service