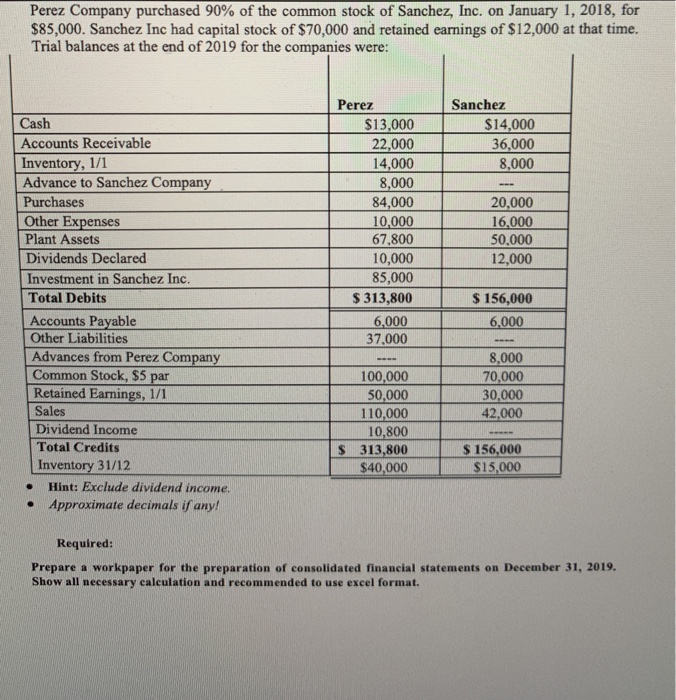

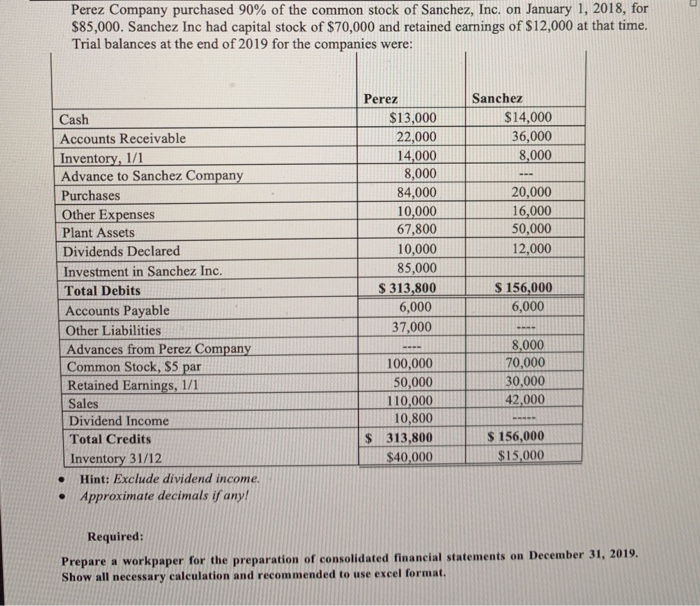

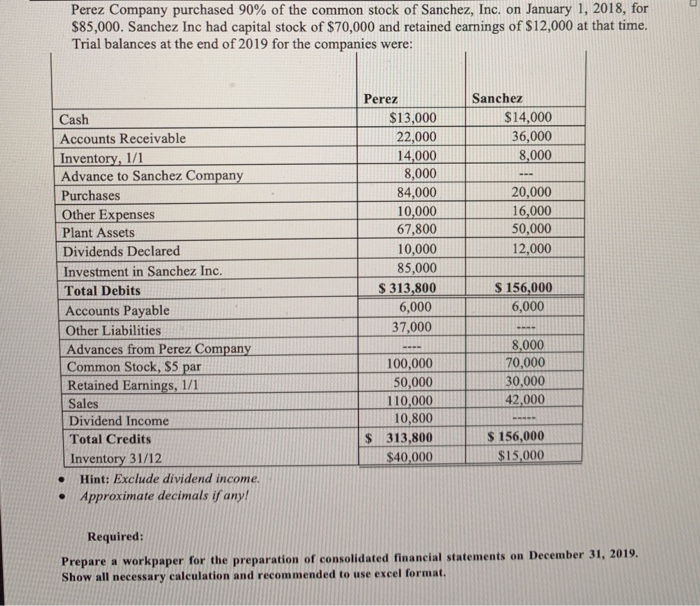

Perez Company purchased 90% of the common stock of Sanchez, Inc. on January 1, 2018, for $85,000. Sanchez Inc had capital stock of $70,000 and retained earnings of $12,000 at that time. Trial balances at the end of 2019 for the companies were: Sanchez $14,000 36,000 8,000 Perez $13,000 22,000 14,000 8,000 84,000 10,000 67.800 10,000 85,000 $ 313,800 6,000 37,000 Cash Accounts Receivable Inventory, 1/1 Advance to Sanchez Company Purchases Other Expenses Plant Assets Dividends Declared Investment in Sanchez Inc. Total Debits Accounts Payable Other Liabilities Advances from Perez Company Common Stock, $5 par Retained Earnings, 1/1 Sales Dividend Income Total Credits Inventory 31/12 Hint: Exclude dividend income. Approximate decimals if any! 20,000 16,000 50.000 12,000 $ 156,000 6,000 8,000 70,000 30,000 42,000 100,000 50,000 110,000 10,800 S 313,800 $40,000 $ 156,000 $15,000 . Required: Prepare a workpaper for the preparation of consolidated financial statements on December 31, 2019. Show all necessary calculation and recommended to use excel format. Perez Company purchased 90% of the common stock of Sanchez, Inc. on January 1, 2018, for $85,000. Sanchez Inc had capital stock of $70,000 and retained earnings of $12,000 at that time. Trial balances at the end of 2019 for the companies were: Sanchez $14,000 36,000 8,000 Perez $13,000 22,000 14,000 8,000 84,000 10,000 67,800 10,000 85,000 $ 313,800 6,000 37,000 Cash Accounts Receivable Inventory, 1/1 Advance to Sanchez Company Purchases Other Expenses Plant Assets Dividends Declared Investment in Sanchez Inc. Total Debits Accounts Payable Other Liabilities Advances from Perez Company Common Stock, $5 par Retained Earnings, 1/1 Sales Dividend Income Total Credits Inventory 31/12 Hint: Exclude dividend income. Approximate decimals if any! 20,000 16,000 50,000 12,000 $ 156,000 6,000 8,000 70,000 30,000 42,000 100,000 50,000 110,000 10,800 $ 313,800 $40,000 $ 156,000 $15,000 . Required: Prepare a workpaper for the preparation of consolidated financial statements on December 31, 2019. Show all necessary calculation and recommended to use excel format