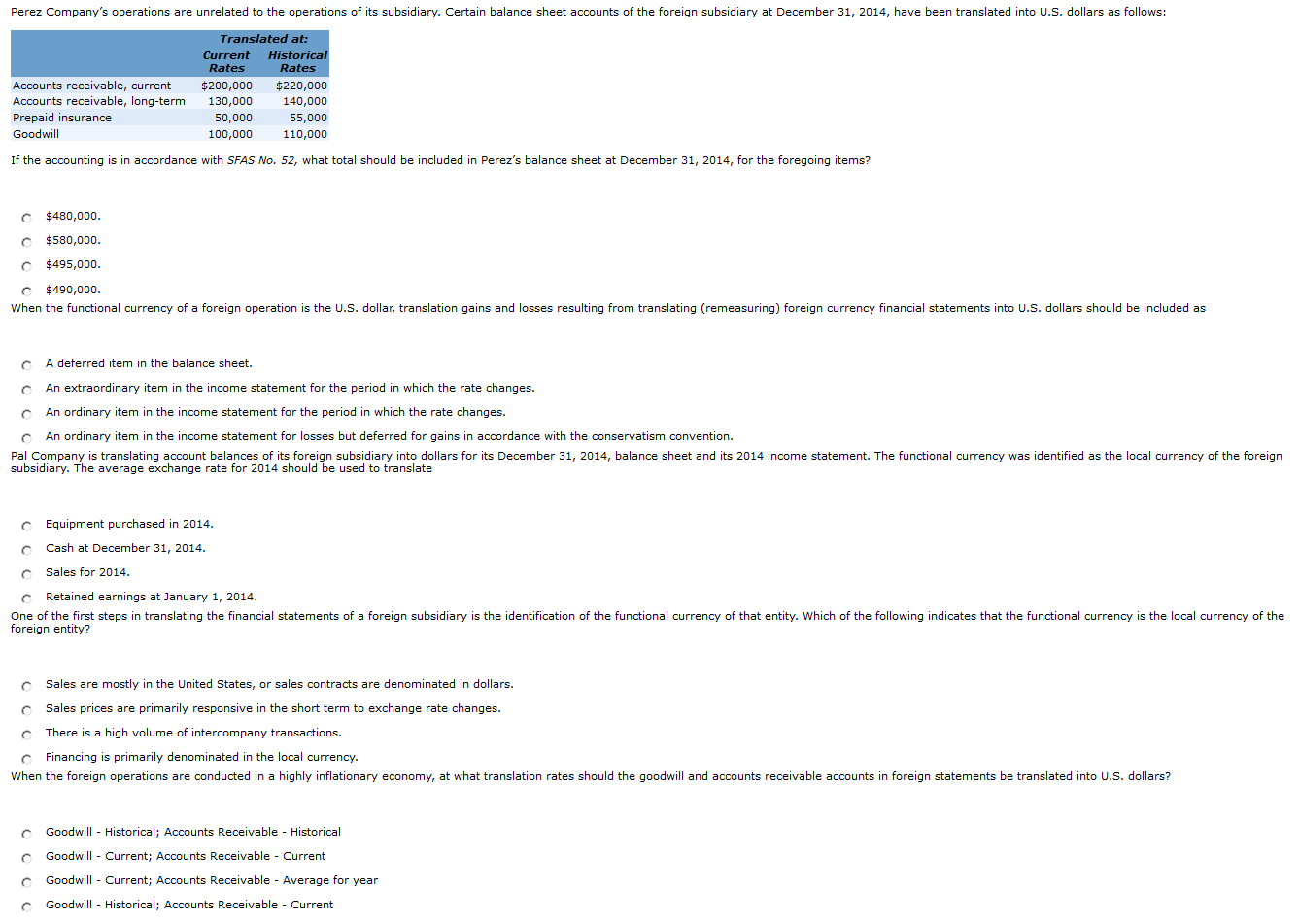

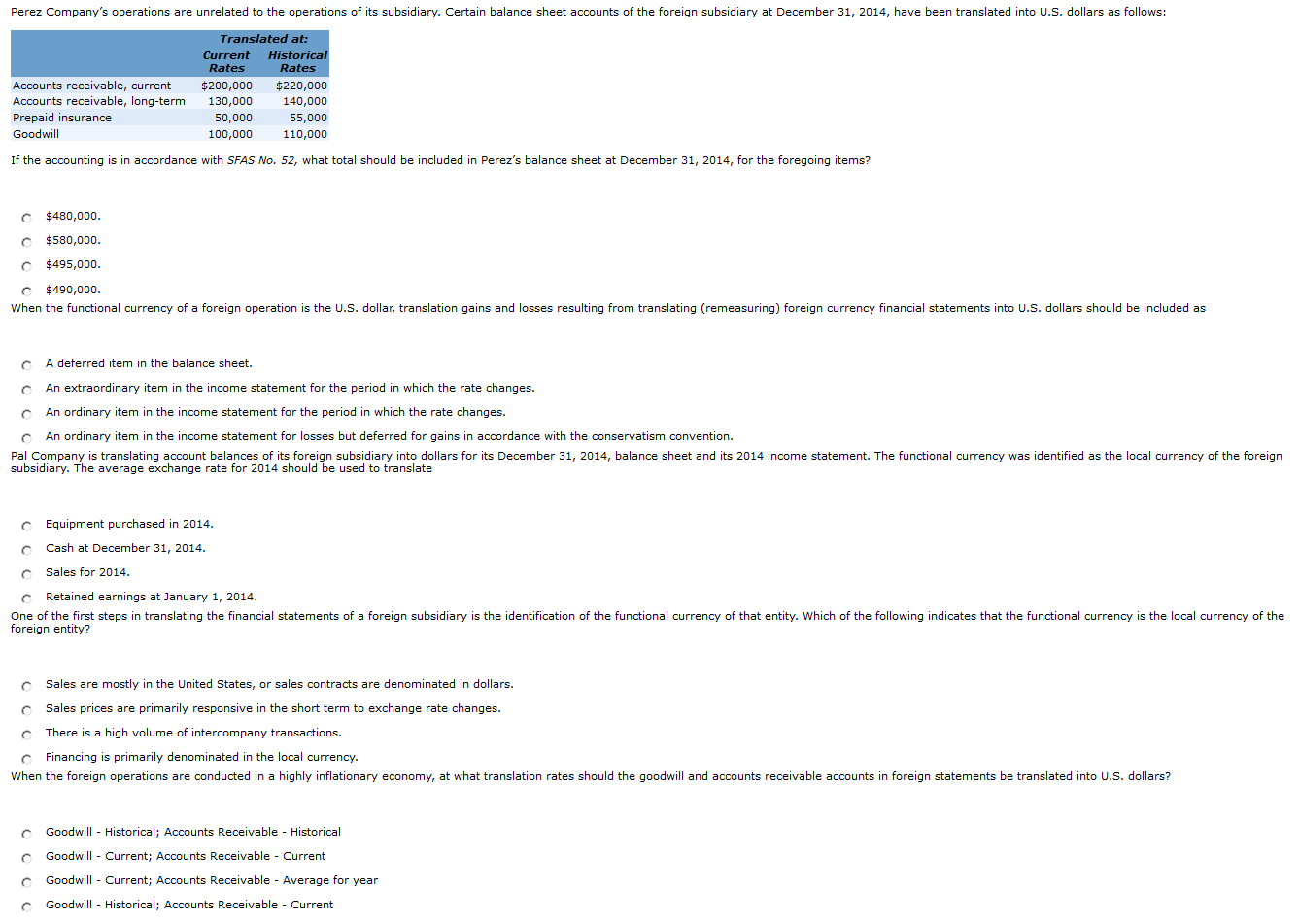

Perez Company's operations are unrelated to the operations of its subsidiary. Certain balance sheet accounts of the foreign subsidiary at December 31, 2014, have been translated into U.S. dollars as follows: Translated at: Historical Current Rates Rates Accounts receivable, current Accounts receivable, long-term $200,000 $220,000 130,000 140,000 Prepaid insurance 55,000 50,000 Goodwill 100,000 110,000 If the accounting is in accordance with SFAS No. 52, what total should be included in Perez's balance sheet at December 31, 2014, for the foregoing items? $480,000. C $580,000. C $495,000. $490,000. When the functional currency of a foreign operation is the U.S. dollar, translation gains and losses resulting from translating (remeasuring) foreign currency financial statements into U.S. dollars should be included as A deferred item in the balance sheet. An extraordinary item in the income statement for the period in which the rate changes. An ordinary item in the income statement for the period in which the rate changes. An ordinary item in the income statement for losses but deferred for gains in accordance with the conservatism convention. Pal Company is translating account balances of its foreign subsidiary into dollars for its December 31, 2014, balance sheet and its 2014 income statement. The functional currency was identified as the local currency of the foreign subsidiary. The average exchange rate for 2014 should be used to translate C Equipment purchased in 2014. Cash at December 31, 2014. Sales for 2014. Retained earnings at January 1, 2014. One of the first steps in translating the financial statements of a foreign subsidiary is the identification of the functional currency of that entity. Which of the following indicates that the functional currency is the local currency of the foreign entity? Sales are mostly in the United States, or sales contracts are denominated in dollars. Sales prices are primarily responsive in the short term to exchange rate changes. There is a high volume of intercompany transactions. O Financing is primarily denominated in the local currency. When the foreign operations are conducted in a highly inflationary economy, at what translation rates should the goodwill and accounts receivable accounts in foreign statements be translated into U.S. dollars? Goodwill - Historical; Accounts Receivable - Historical Goodwill - Current; Accounts Receivable - Current Goodwill - Current; Accounts Receivable - Average for year Goodwill - Historical; Accounts Receivable - Current