Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perform a financial ratio analysis selecting one of the ratios in each of the five groups: 1) Short-term solvency or liquidity 2) Long-term solvency measures

Perform a financial ratio analysis selecting one of the ratios in each of the five groups: 1) Short-term solvency or liquidity 2) Long-term solvency measures 3) Asset Management (or turnover) 4) Profitability 5) Market Value.

In addition, analyze McDonald's value chain and resources.

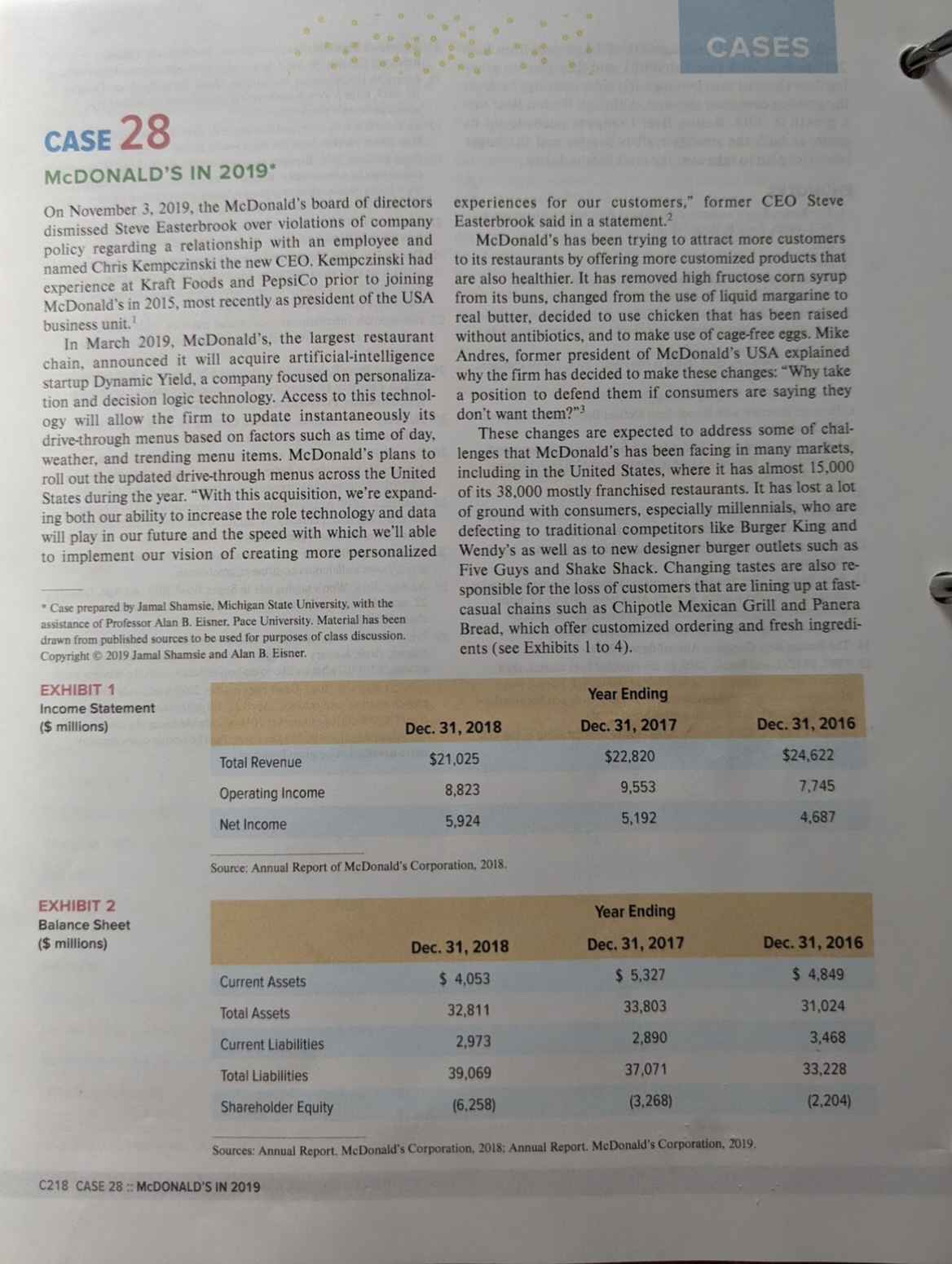

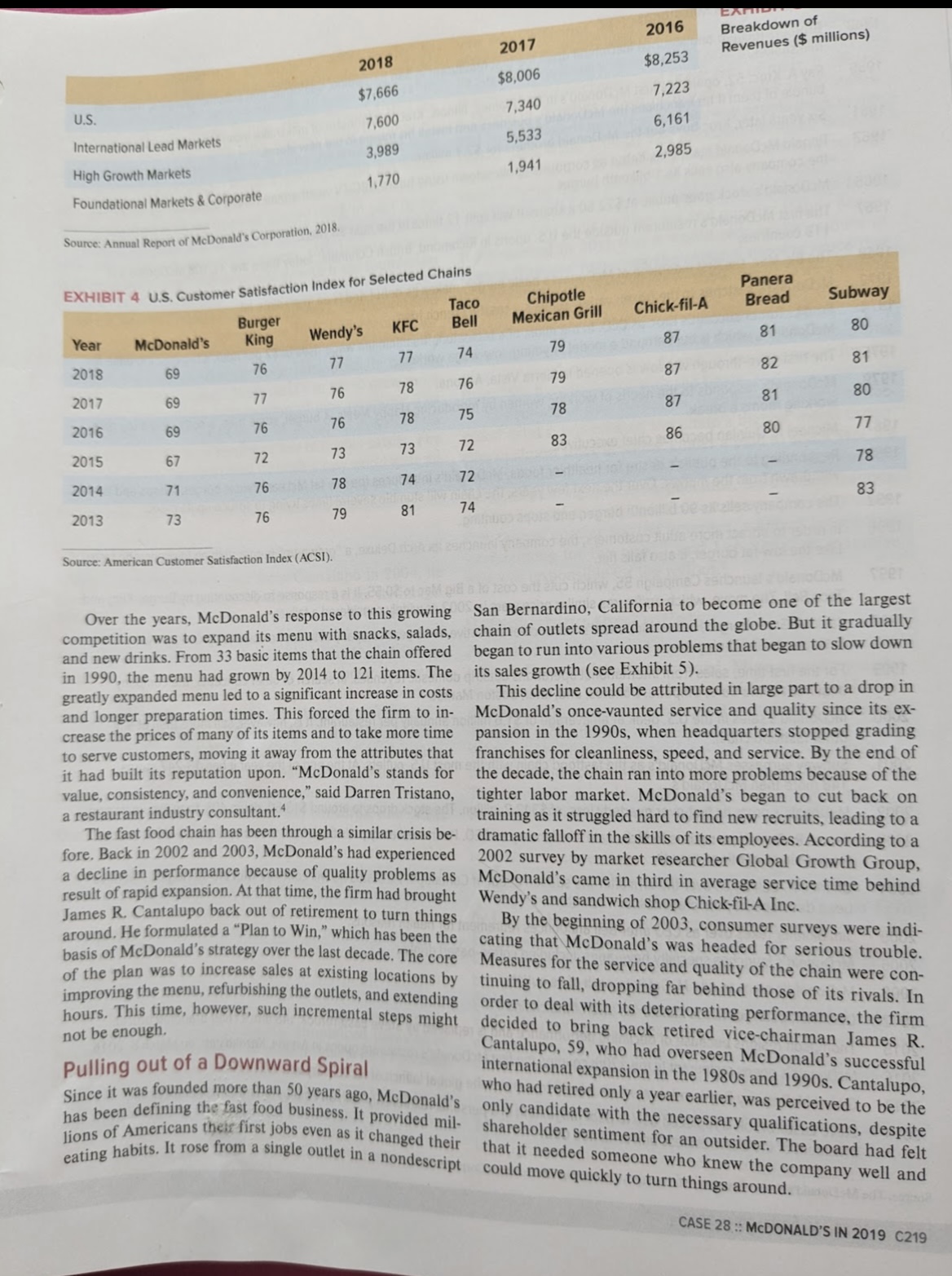

CASES CASE 28 MCDONALD'S IN 2019* On November 3, 2019, the McDonald's board of directors dismissed Steve Easterbrook over violations of company policy regarding a relationship with an employee and named Chris Kempczinski the new CEO. Kempczinski had experience at Kraft Foods and PepsiCo prior to joining McDonald's in 2015, most recently as president of the USA business unit. In March 2019, McDonald's, the largest restaurant chain, announced it will acquire artificial-intelligence startup Dynamic Yield, a company focused on personaliza- tion and decision logic technology. Access to this technol- ogy will allow the firm to update instantaneously its drive-through menus based on factors such as time of day, weather, and trending menu items. McDonald's plans to roll out the updated drive-through menus across the United States during the year. "With this acquisition, we're expand- ing both our ability to increase the role technology and data will play in our future and the speed with which we'll able to implement our vision of creating more personalized wolloque al chaguo experiences for our customers," former CEO Steve Easterbrook said in a statement.2 McDonald's has been trying to attract more customers to its restaurants by offering more customized products that are also healthier. It has removed high fructose corn syrup from its buns, changed from the use of liquid margarine to real butter, decided to use chicken that has been raised without antibiotics, and to make use of cage-free eggs. Mike Andres, former president of McDonald's USA explained why the firm has decided to make these changes: "Why take a position to defend them if consumers are saying they don't want them?" These changes are expected to address some of chal- lenges that McDonald's has been facing in many markets, including in the United States, where it has almost 15,000 of its 38,000 mostly franchised restaurants. It has lost a lot of ground with consumers, especially millennials, who are defecting to traditional competitors like Burger King and Wendy's as well as to new designer burger outlets such as Five Guys and Shake Shack. Changing tastes are also re- Asponsible for the loss of customers that are lining up at fast- casual chains such as Chipotle Mexican Grill and Panera Bread, which offer customized ordering and fresh ingredi- ents (see Exhibits 1 to 4). *Case prepared by Jamal Shamsie, Michigan State University, with the assistance of Professor Alan B. Eisner, Pace University. Material has been drawn from published sources to be used for purposes of class discussion. Copyright 2019 Jamal Shamsie and Alan B. Eisner. EXHIBIT 1 Income Statement ($ millions) Total Revenue Operating Income Net Income Year Ending Dec. 31, 2018 Dec. 31, 2017 Dec. 31, 2016 $21,025 8,823 $22,820 $24,622 9,553 7,745 5,924 5,192 4,687 EXHIBIT 2 Balance Sheet ($ millions) Source: Annual Report of McDonald's Corporation, 2018. Year Ending Dec. 31, 2018 Dec. 31, 2017 Dec. 31, 2016 Current Assets $ 4,053 $ 5,327 Total Assets 32,811 33,803 $ 4,849 31,024 Current Liabilities 2,973 2,890 3,468 Total Liabilities Shareholder Equity 39,069 37,071 33,228 (6,258) (3,268) (2,204) Sources: Annual Report. McDonald's Corporation, 2018; Annual Report. McDonald's Corporation, 2019. C218 CASE 28 :: MCDONALD'S IN 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started