Answered step by step

Verified Expert Solution

Question

1 Approved Answer

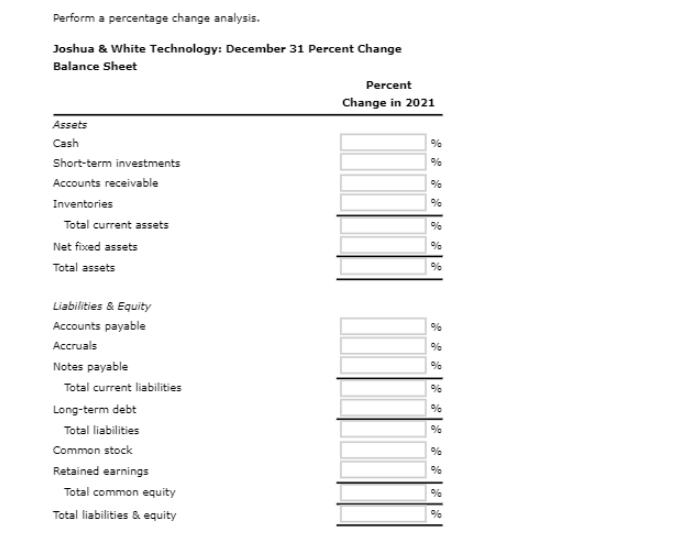

Perform a percentage change analysis. Joshua & White Technology: December 31 Percent Change Balance Sheet Assets Cash Short-term investments Accounts receivable Inventories Total current

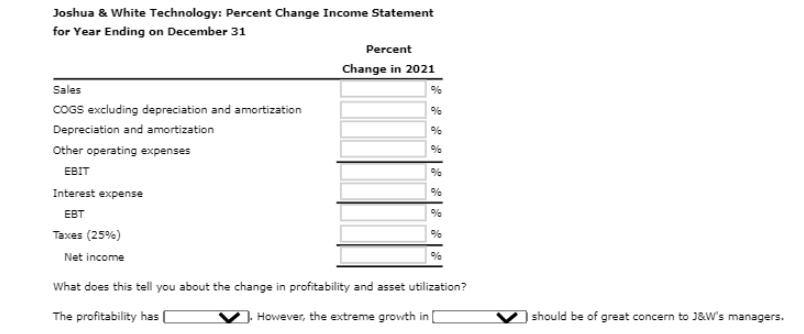

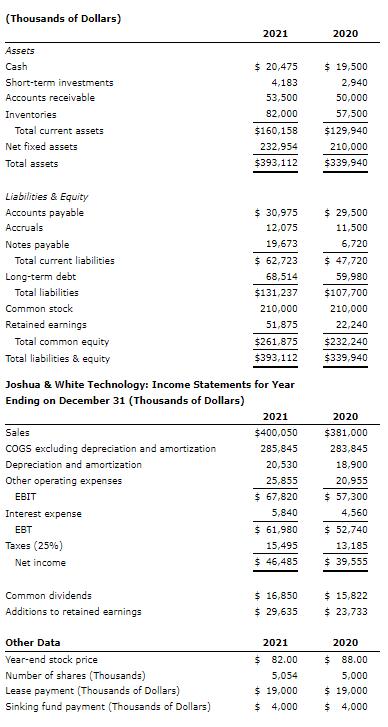

Perform a percentage change analysis. Joshua & White Technology: December 31 Percent Change Balance Sheet Assets Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities & Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities & equity Percent Change in 2021 % % % % % % % % % % % % % % % % Joshua & White Technology: Percent Change Income Statement for Year Ending on December 31 Sales COGS excluding depreciation and amortization Depreciation and amortization Other operating expenses EBIT Interest expense EBT Taxes (25%) Net income Percent Change in 2021 % % % % % % What does this tell you about the change in profitability and asset utilization? The profitability has However, the extreme growth in | should be of great concern to J&W's managers. (Thousands of Dollars) Assets Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities & Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities & equity Sales COGS excluding depreciation and amortization Depreciation and amortization. Other operating expenses EBIT Interest expense EBT Taxes (25%) Net income Common dividends Additions to retained earnings 2021 Other Data Year-end stock price Number of shares (Thousands) Lease payment (Thousands of Dollars) Sinking fund payment (Thousands of Dollars) $ 20,475 4,183 53,500 82,000 Joshua & White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) $160,158 232,954 $393,112 $ 30,975 12,075 19,673 $ 62,723 68,514 $131,237 210,000 51,875 $261,875 $393,112 2021 $400,050 285,845 20,530 25,855 $67,820 5,840 $61,980 15,495 $ 46,485 $ 16,850 $ 29,635 2021 $82.00 5,054 $ 19,000 $4,000 2020 $ 19,500 2,940 50,000 57,500 $129,940 210,000 $339,940 $ 29,500 11,500 6,720 $ 47,720 59,980 $107,700 210,000 22,240 $232,240 $339,940 2020 $381,000 283,845 18,900 20,955 $ 57,300 4,560 $ 52,740 13,185 $ 39,555 $ 15,822 $ 23,733 2020 $88.00 5,000 $ 19,000 $4,000

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To perform a percentage change analysis for Joshua White Technologys balance sheet and income statement we need to compare the values from 2021 to 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started