Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perform an analysis on the financial statements using a Ratio, Horizontal and Vertical analysis techniques, Describe, discuss and evaluate the financial performance and financial position

Perform an analysis on the financial statements using a Ratio, Horizontal and Vertical analysis techniques,

Describe, discuss and evaluate the financial performance and financial position of the organisation as reflected by the financial statements and the supporting financial analysis.

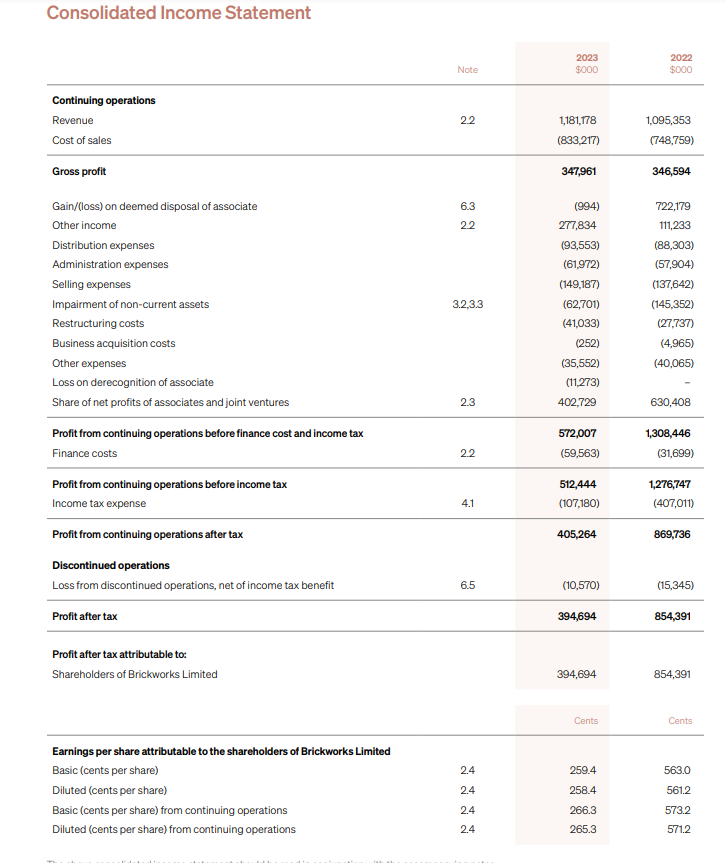

Consolidated Income Statement Note 2023 $000 2022 $000 Continuing operations Revenue Cost of sales Gross profit 2.2 1,181,178 1,095,353 (833,217) (748,759) 347,961 346,594 Gain/(loss) on deemed disposal of associate 6.3 (994) 722,179 Other income 2.2 277,834 111,233 Distribution expenses (93,553) (88,303) Administration expenses (61,972) (57,904) Selling expenses (149,187) (137,642) Impairment of non-current assets 3.2,3.3 (62,701) (145,352) Restructuring costs (41,033) (27,737) Business acquisition costs (252) (4,965) Other expenses (35,552) (40,065) Loss on derecognition of associate (11,273) Share of net profits of associates and joint ventures 2.3 402,729 630,408 Profit from continuing operations before finance cost and income tax 572,007 1,308,446 Finance costs 2.2 (59,563) (31,699) Profit from continuing operations before income tax 512,444 1,276,747 Income tax expense 4.1 (107,180) (407,011) Profit from continuing operations after tax 405,264 869,736 Discontinued operations Loss from discontinued operations, net of income tax benefit 6.5 (10,570) (15,345) Profit after tax 394,694 854,391 Profit after tax attributable to: Shareholders of Brickworks Limited Earnings per share attributable to the shareholders of Brickworks Limited Basic (cents per share) Diluted (cents per share) Basic (cents per share) from continuing operations Diluted (cents per share) from continuing operations 394,694 854,391 Cents Cents 2222 2.4 259.4 563.0 2.4 258.4 561.2 2.4 266.3 573.2 2.4 265.3 571.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started