Answered step by step

Verified Expert Solution

Question

1 Approved Answer

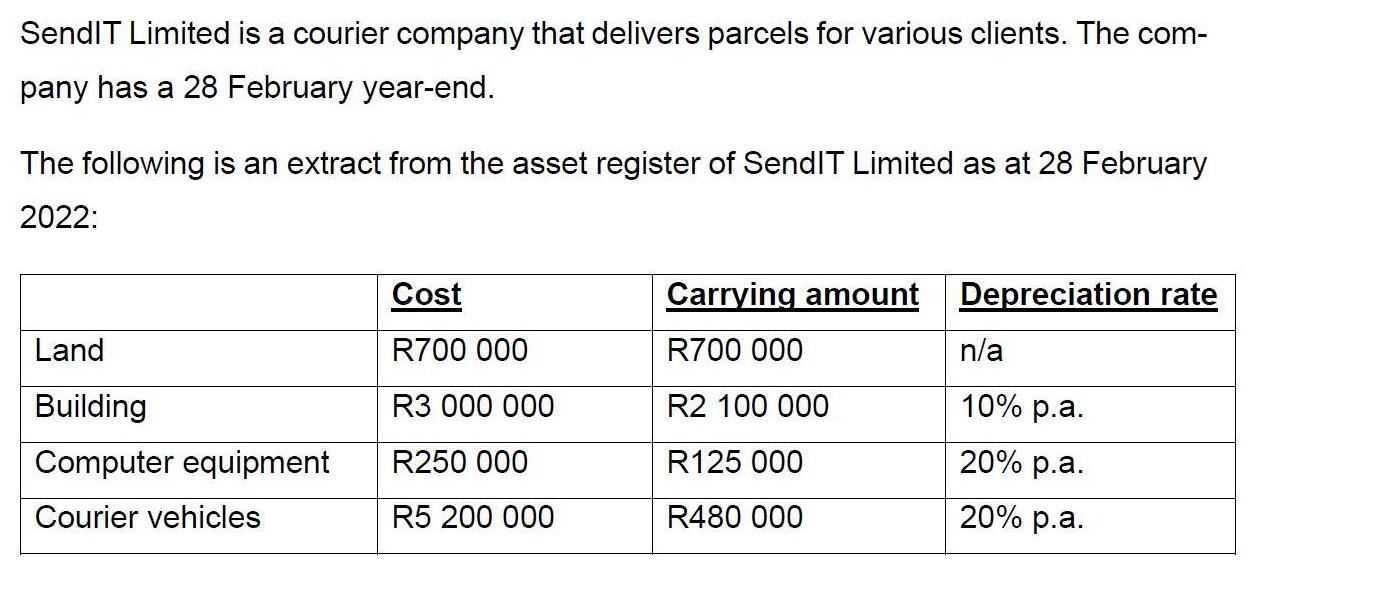

SendIT Limited is a courier company that delivers parcels for various clients. The com- pany has a 28 February year-end. The following is an

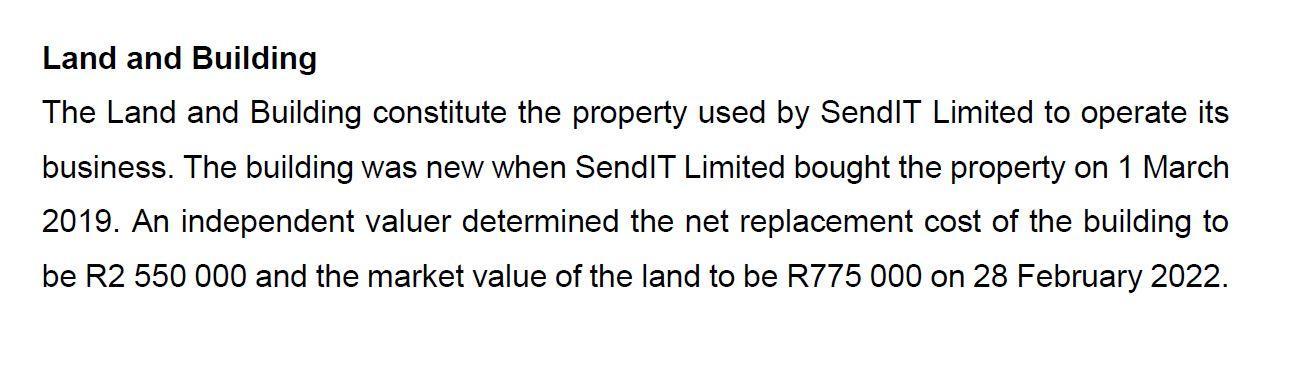

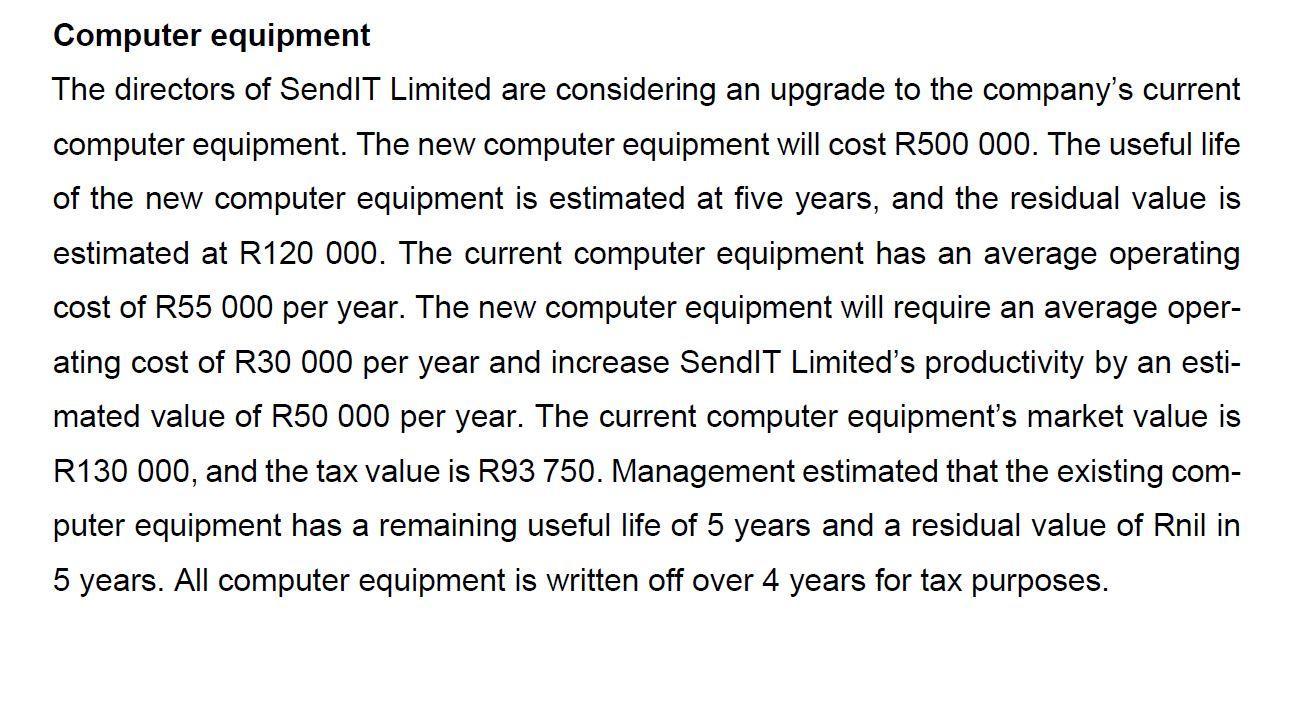

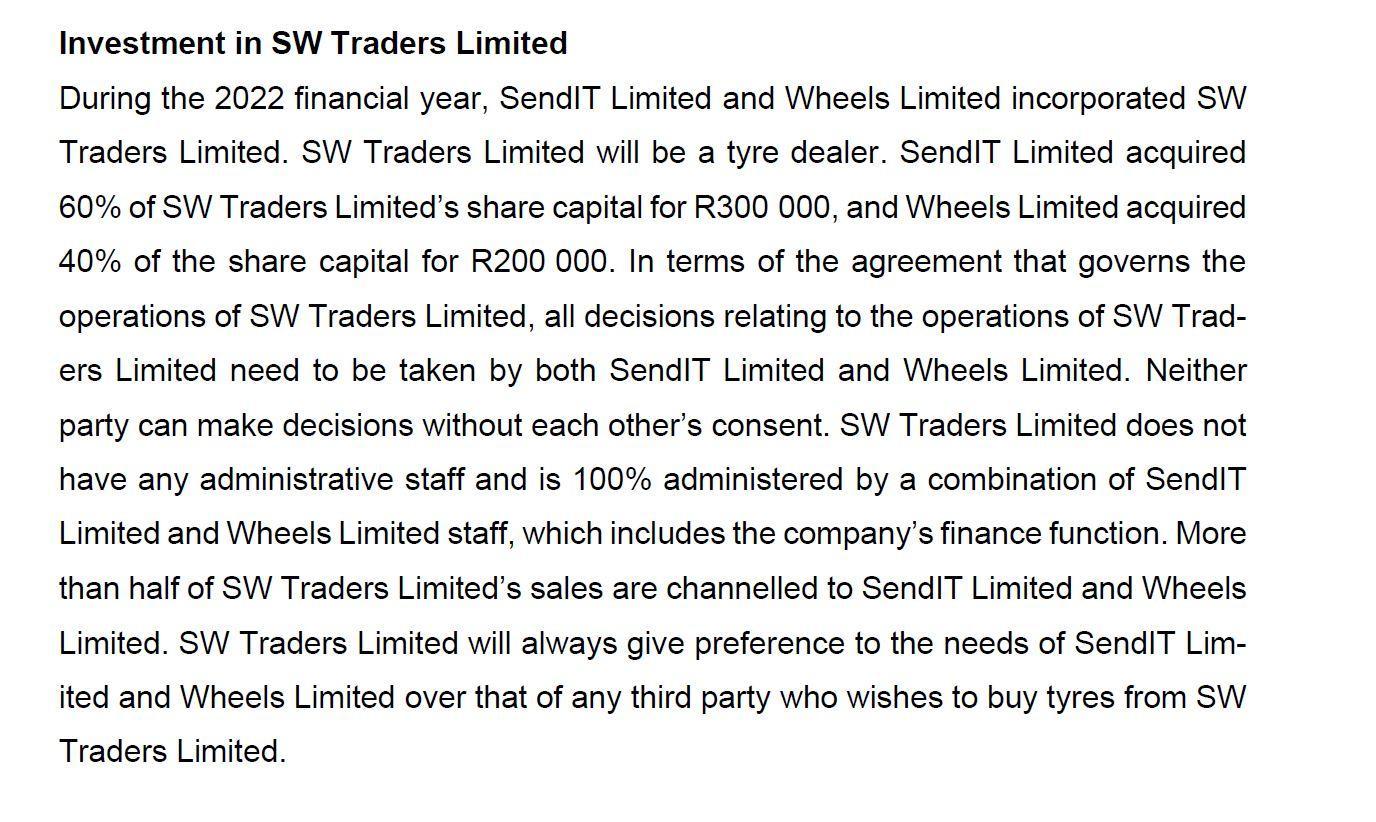

SendIT Limited is a courier company that delivers parcels for various clients. The com- pany has a 28 February year-end. The following is an extract from the asset register of SendIT Limited as at 28 February 2022: Land Building Computer equipment Courier vehicles Cost R700 000 R3 000 000 R250 000 R5 200 000 Carrying amount R700 000 R2 100 000 R125 000 R480 000 Depreciation rate n/a 10% p.a. 20% p.a. 20% p.a. Land and Building The Land and Building constitute the property used by SendIT Limited to operate its business. The building was new when SendIT Limited bought the property on 1 March 2019. An independent valuer determined the net replacement cost of the building to be R2 550 000 and the market value of the land to be R775 000 on 28 February 2022. Computer equipment The directors of SendIT Limited are considering an upgrade to the company's current computer equipment. The new computer equipment will cost R500 000. The useful life of the new computer equipment is estimated at five years, and the residual value is estimated at R120 000. The current computer equipment has an average operating cost of R55 000 per year. The new computer equipment will require an average oper- ating cost of R30 000 per year and increase SendIT Limited's productivity by an esti- mated value of R50 000 per year. The current computer equipment's market value is R130 000, and the tax value is R93 750. Management estimated that the existing com- puter equipment has a remaining useful life of 5 years and a residual value of Rnil in 5 years. All computer equipment is written off over 4 years for tax purposes. Investment in SW Traders Limited During the 2022 financial year, SendIT Limited and Wheels Limited incorporated SW Traders Limited. SW Traders Limited will be a tyre dealer. SendIT Limited acquired 60% of SW Traders Limited's share capital for R300 000, and Wheels Limited acquired 40% of the share capital for R200 000. In terms of the agreement that governs the operations of SW Traders Limited, all decisions relating to the operations of SW Trad- ers Limited need to be taken by both SendIT Limited and Wheels Limited. Neither party can make decisions without each other's consent. SW Traders Limited does not have any administrative staff and is 100% administered by a combination of SendIT Limited and Wheels Limited staff, which includes the company's finance function. More than half of SW Traders Limited's sales are channelled to SendIT Limited and Wheels Limited. SW Traders Limited will always give preference to the needs of SendIT Lim- ited and Wheels Limited over that of any third party who wishes to buy tyres from SW Traders Limited. Courier vehicle SendIT Limited sold a courier vehicle to Mr. Adams, a natural person and not related to the company, at an open market value of R350 000 (including VAT) on 1 December 2021. The sale was made in terms of an instalment sale agreement. No deposit was paid, but he is liable for instalments of R18 000 per month (including VAT), which is payable from 1 January 2022. SendIT Limited acquired this courier vehicle for R869 000 (including VAT) from an unrelated VAT vendor on 1 March 2018. This cou- rier vehicle was brought into use immediately. Courier vehicles are written off over four years for tax purposes. However, at the beginning of February 2022, Mr. Adams called SendIT Limited and complained about a serious problem being experienced with the courier vehicle. He was furious and threatened to report the matter to a newspaper. SendIT Limited agreed to cancel the agreement, effective 15 February 2022, to avoid bad publicity. Mr. Adams returned the courier vehicle and was fully refunded for the two instalments he had already paid, and all further instalments were cancelled. At the time of cancelation of the agreement, the courier vehicle was valued at R260 000. The courier vehicle was not used by SendIT Limited or repaired since Mr. Adams returned it. Mr. Adams is not registered for VAT. Tax liability Included in the current liabilities balance in the statement of financial position for the 2022 financial year is an amount of R213 415, which represents income tax owed by SendIT Limited to the South African Revenue Service. Audit differences The following audit differences were noted while performing the audit for the 2022 financial year: a) The company's tax calculation was found to be incorrect because an inadmissible deduction of R280 534 was claimed. The net profit of the company is currently R241 998. b) The inventory in one of the warehouses was not included in the stocktake. The value of this inventory amounted to R336 223. This was not the first year that they experienced issues with the annual stocktake. c) No provision for credit losses was made for the current year. The accounting policy of SendIT Limited is to provide for 6,5% of the outstanding debtors as a provision for credit losses annually. The debtors' final figure was R659 678. House sale One of the directors of SendIT Limited, Dillon Ceasar, is considering emigrating from South Africa to Namibia. He currently lives in Stellenbosch with his wife, to whom he is married in community of property. Although they also own a house in Namibia, they always regarded their Stellenbosch house as their primary residence. The house was acquired through a donation from Dillon's grandfather on 1 October 2009 and formed part of the couple's joint estate. Donations tax amounted to R361 087 and was paid by Dillon's grandfather. The market values of the house amounted to R2 150 000 on 1 October 2009 and R6 500 000 on 1 February 2022. Dillon's wife, Nicole, operates a small business, selling second-hand books, from their house. A room of 35m is used exclusively in her trading operations. The house covers an area of 480m in total. Nicole has been utilising the space in her trade since Dillon acquired the house. SendIT Limited considers purchasing the house from Dillon. The house will then be provided to an employee of SendIT Limited as residential accommodation. General information: The straight-line depreciation method is used on all asset classes. Property (Land & Building) is recognised using the revaluation model and is reval- ued at the end of every third year. Accumulated depreciation is eliminated at each revaluation date, and the revaluation surplus is released only on the disposal of the asset. Courier vehicles and computer equipment is recognised according to the cost model. The residual value on all assets is insignificant unless herwise sta Assume the residual value and useful life estimates have been reviewed every year and have remained unchanged. The company's cost of capital is 11%. Assume an income tax rate of 28% and 80% of capital gains are taxable. REQUIRED: 1.1) With reference to the Land and Building, prepare the journal entries, including deferred tax, required in the records of SendIT Limited for the year ended 28 February 2022 to account for the revaluation of the property. (13 marks) 1.2) With reference to the Computer equipment, advise SendIT Limited on whether they should invest in the new computer equipment by using the net present value method. (24 marks) 1.3) With reference to the Investment in SW Traders Limited, discuss the nature of SendIT Limited's investment in SW Traders Limited in accordance with the requirements of IFRS 11. (10 marks) 1.4) 1.5) 1.6) With reference to the Tax liability, formulate the substantive procedures you would perform to substantiate the amount of income tax owed to the South Af- rican Revenue Service while conducting the audit for the 2022 financial year. (10 marks) With reference to the Courier vehicle, calculate the normal tax consequences of SendIT Limited for the 2022 year of assessment, relating to the sale of the courier vehicle. (7 marks) With reference to the Courier vehicle, discuss ALL the tax consequences in respect of the courier vehicle returned and cancellation of the instalment sale agreement on 15 February 2022. (8 marks) 1.7) With reference to the Audit differences, briefly discuss whether the audit differences in your opinion, individually or cumulatively, would have a material effect on the fair presentation of the financial statements. Show your workings clearly. Assume that the final materiality figure is R250 000. (15 marks) 1.8) With reference to the House sale, discuss the normal tax implications for Dillon Ceasar regarding the proposed disposal of the house in Stellenbosch. You may assume that the house was sold to SendIT Limited for R6 500 000 on 1 February 2022 and that this was the only disposal by Dillon Ceasar during the 2022 year of assessment. (13 marks) SendIT Limited is a courier company that delivers parcels for various clients. The com- pany has a 28 February year-end. The following is an extract from the asset register of SendIT Limited as at 28 February 2022: Land Building Computer equipment Courier vehicles Cost R700 000 R3 000 000 R250 000 R5 200 000 Carrying amount R700 000 R2 100 000 R125 000 R480 000 Depreciation rate n/a 10% p.a. 20% p.a. 20% p.a. Land and Building The Land and Building constitute the property used by SendIT Limited to operate its business. The building was new when SendIT Limited bought the property on 1 March 2019. An independent valuer determined the net replacement cost of the building to be R2 550 000 and the market value of the land to be R775 000 on 28 February 2022. Computer equipment The directors of SendIT Limited are considering an upgrade to the company's current computer equipment. The new computer equipment will cost R500 000. The useful life of the new computer equipment is estimated at five years, and the residual value is estimated at R120 000. The current computer equipment has an average operating cost of R55 000 per year. The new computer equipment will require an average oper- ating cost of R30 000 per year and increase SendIT Limited's productivity by an esti- mated value of R50 000 per year. The current computer equipment's market value is R130 000, and the tax value is R93 750. Management estimated that the existing com- puter equipment has a remaining useful life of 5 years and a residual value of Rnil in 5 years. All computer equipment is written off over 4 years for tax purposes. Investment in SW Traders Limited During the 2022 financial year, SendIT Limited and Wheels Limited incorporated SW Traders Limited. SW Traders Limited will be a tyre dealer. SendIT Limited acquired 60% of SW Traders Limited's share capital for R300 000, and Wheels Limited acquired 40% of the share capital for R200 000. In terms of the agreement that governs the operations of SW Traders Limited, all decisions relating to the operations of SW Trad- ers Limited need to be taken by both SendIT Limited and Wheels Limited. Neither party can make decisions without each other's consent. SW Traders Limited does not have any administrative staff and is 100% administered by a combination of SendIT Limited and Wheels Limited staff, which includes the company's finance function. More than half of SW Traders Limited's sales are channelled to SendIT Limited and Wheels Limited. SW Traders Limited will always give preference to the needs of SendIT Lim- ited and Wheels Limited over that of any third party who wishes to buy tyres from SW Traders Limited. Courier vehicle SendIT Limited sold a courier vehicle to Mr. Adams, a natural person and not related to the company, at an open market value of R350 000 (including VAT) on 1 December 2021. The sale was made in terms of an instalment sale agreement. No deposit was paid, but he is liable for instalments of R18 000 per month (including VAT), which is payable from 1 January 2022. SendIT Limited acquired this courier vehicle for R869 000 (including VAT) from an unrelated VAT vendor on 1 March 2018. This cou- rier vehicle was brought into use immediately. Courier vehicles are written off over four years for tax purposes. However, at the beginning of February 2022, Mr. Adams called SendIT Limited and complained about a serious problem being experienced with the courier vehicle. He was furious and threatened to report the matter to a newspaper. SendIT Limited agreed to cancel the agreement, effective 15 February 2022, to avoid bad publicity. Mr. Adams returned the courier vehicle and was fully refunded for the two instalments he had already paid, and all further instalments were cancelled. At the time of cancelation of the agreement, the courier vehicle was valued at R260 000. The courier vehicle was not used by SendIT Limited or repaired since Mr. Adams returned it. Mr. Adams is not registered for VAT. Tax liability Included in the current liabilities balance in the statement of financial position for the 2022 financial year is an amount of R213 415, which represents income tax owed by SendIT Limited to the South African Revenue Service. Audit differences The following audit differences were noted while performing the audit for the 2022 financial year: a) The company's tax calculation was found to be incorrect because an inadmissible deduction of R280 534 was claimed. The net profit of the company is currently R241 998. b) The inventory in one of the warehouses was not included in the stocktake. The value of this inventory amounted to R336 223. This was not the first year that they experienced issues with the annual stocktake. c) No provision for credit losses was made for the current year. The accounting policy of SendIT Limited is to provide for 6,5% of the outstanding debtors as a provision for credit losses annually. The debtors' final figure was R659 678. House sale One of the directors of SendIT Limited, Dillon Ceasar, is considering emigrating from South Africa to Namibia. He currently lives in Stellenbosch with his wife, to whom he is married in community of property. Although they also own a house in Namibia, they always regarded their Stellenbosch house as their primary residence. The house was acquired through a donation from Dillon's grandfather on 1 October 2009 and formed part of the couple's joint estate. Donations tax amounted to R361 087 and was paid by Dillon's grandfather. The market values of the house amounted to R2 150 000 on 1 October 2009 and R6 500 000 on 1 February 2022. Dillon's wife, Nicole, operates a small business, selling second-hand books, from their house. A room of 35m is used exclusively in her trading operations. The house covers an area of 480m in total. Nicole has been utilising the space in her trade since Dillon acquired the house. SendIT Limited considers purchasing the house from Dillon. The house will then be provided to an employee of SendIT Limited as residential accommodation. General information: The straight-line depreciation method is used on all asset classes. Property (Land & Building) is recognised using the revaluation model and is reval- ued at the end of every third year. Accumulated depreciation is eliminated at each revaluation date, and the revaluation surplus is released only on the disposal of the asset. Courier vehicles and computer equipment is recognised according to the cost model. The residual value on all assets is insignificant unless herwise sta Assume the residual value and useful life estimates have been reviewed every year and have remained unchanged. The company's cost of capital is 11%. Assume an income tax rate of 28% and 80% of capital gains are taxable. REQUIRED: 1.1) With reference to the Land and Building, prepare the journal entries, including deferred tax, required in the records of SendIT Limited for the year ended 28 February 2022 to account for the revaluation of the property. (13 marks) 1.2) With reference to the Computer equipment, advise SendIT Limited on whether they should invest in the new computer equipment by using the net present value method. (24 marks) 1.3) With reference to the Investment in SW Traders Limited, discuss the nature of SendIT Limited's investment in SW Traders Limited in accordance with the requirements of IFRS 11. (10 marks) 1.4) 1.5) 1.6) With reference to the Tax liability, formulate the substantive procedures you would perform to substantiate the amount of income tax owed to the South Af- rican Revenue Service while conducting the audit for the 2022 financial year. (10 marks) With reference to the Courier vehicle, calculate the normal tax consequences of SendIT Limited for the 2022 year of assessment, relating to the sale of the courier vehicle. (7 marks) With reference to the Courier vehicle, discuss ALL the tax consequences in respect of the courier vehicle returned and cancellation of the instalment sale agreement on 15 February 2022. (8 marks) 1.7) With reference to the Audit differences, briefly discuss whether the audit differences in your opinion, individually or cumulatively, would have a material effect on the fair presentation of the financial statements. Show your workings clearly. Assume that the final materiality figure is R250 000. (15 marks) 1.8) With reference to the House sale, discuss the normal tax implications for Dillon Ceasar regarding the proposed disposal of the house in Stellenbosch. You may assume that the house was sold to SendIT Limited for R6 500 000 on 1 February 2022 and that this was the only disposal by Dillon Ceasar during the 2022 year of assessment. (13 marks) SendIT Limited is a courier company that delivers parcels for various clients. The com- pany has a 28 February year-end. The following is an extract from the asset register of SendIT Limited as at 28 February 2022: Land Building Computer equipment Courier vehicles Cost R700 000 R3 000 000 R250 000 R5 200 000 Carrying amount R700 000 R2 100 000 R125 000 R480 000 Depreciation rate n/a 10% p.a. 20% p.a. 20% p.a. Land and Building The Land and Building constitute the property used by SendIT Limited to operate its business. The building was new when SendIT Limited bought the property on 1 March 2019. An independent valuer determined the net replacement cost of the building to be R2 550 000 and the market value of the land to be R775 000 on 28 February 2022. Computer equipment The directors of SendIT Limited are considering an upgrade to the company's current computer equipment. The new computer equipment will cost R500 000. The useful life of the new computer equipment is estimated at five years, and the residual value is estimated at R120 000. The current computer equipment has an average operating cost of R55 000 per year. The new computer equipment will require an average oper- ating cost of R30 000 per year and increase SendIT Limited's productivity by an esti- mated value of R50 000 per year. The current computer equipment's market value is R130 000, and the tax value is R93 750. Management estimated that the existing com- puter equipment has a remaining useful life of 5 years and a residual value of Rnil in 5 years. All computer equipment is written off over 4 years for tax purposes. Investment in SW Traders Limited During the 2022 financial year, SendIT Limited and Wheels Limited incorporated SW Traders Limited. SW Traders Limited will be a tyre dealer. SendIT Limited acquired 60% of SW Traders Limited's share capital for R300 000, and Wheels Limited acquired 40% of the share capital for R200 000. In terms of the agreement that governs the operations of SW Traders Limited, all decisions relating to the operations of SW Trad- ers Limited need to be taken by both SendIT Limited and Wheels Limited. Neither party can make decisions without each other's consent. SW Traders Limited does not have any administrative staff and is 100% administered by a combination of SendIT Limited and Wheels Limited staff, which includes the company's finance function. More than half of SW Traders Limited's sales are channelled to SendIT Limited and Wheels Limited. SW Traders Limited will always give preference to the needs of SendIT Lim- ited and Wheels Limited over that of any third party who wishes to buy tyres from SW Traders Limited. Courier vehicle SendIT Limited sold a courier vehicle to Mr. Adams, a natural person and not related to the company, at an open market value of R350 000 (including VAT) on 1 December 2021. The sale was made in terms of an instalment sale agreement. No deposit was paid, but he is liable for instalments of R18 000 per month (including VAT), which is payable from 1 January 2022. SendIT Limited acquired this courier vehicle for R869 000 (including VAT) from an unrelated VAT vendor on 1 March 2018. This cou- rier vehicle was brought into use immediately. Courier vehicles are written off over four years for tax purposes. However, at the beginning of February 2022, Mr. Adams called SendIT Limited and complained about a serious problem being experienced with the courier vehicle. He was furious and threatened to report the matter to a newspaper. SendIT Limited agreed to cancel the agreement, effective 15 February 2022, to avoid bad publicity. Mr. Adams returned the courier vehicle and was fully refunded for the two instalments he had already paid, and all further instalments were cancelled. At the time of cancelation of the agreement, the courier vehicle was valued at R260 000. The courier vehicle was not used by SendIT Limited or repaired since Mr. Adams returned it. Mr. Adams is not registered for VAT. Tax liability Included in the current liabilities balance in the statement of financial position for the 2022 financial year is an amount of R213 415, which represents income tax owed by SendIT Limited to the South African Revenue Service. Audit differences The following audit differences were noted while performing the audit for the 2022 financial year: a) The company's tax calculation was found to be incorrect because an inadmissible deduction of R280 534 was claimed. The net profit of the company is currently R241 998. b) The inventory in one of the warehouses was not included in the stocktake. The value of this inventory amounted to R336 223. This was not the first year that they experienced issues with the annual stocktake. c) No provision for credit losses was made for the current year. The accounting policy of SendIT Limited is to provide for 6,5% of the outstanding debtors as a provision for credit losses annually. The debtors' final figure was R659 678. House sale One of the directors of SendIT Limited, Dillon Ceasar, is considering emigrating from South Africa to Namibia. He currently lives in Stellenbosch with his wife, to whom he is married in community of property. Although they also own a house in Namibia, they always regarded their Stellenbosch house as their primary residence. The house was acquired through a donation from Dillon's grandfather on 1 October 2009 and formed part of the couple's joint estate. Donations tax amounted to R361 087 and was paid by Dillon's grandfather. The market values of the house amounted to R2 150 000 on 1 October 2009 and R6 500 000 on 1 February 2022. Dillon's wife, Nicole, operates a small business, selling second-hand books, from their house. A room of 35m is used exclusively in her trading operations. The house covers an area of 480m in total. Nicole has been utilising the space in her trade since Dillon acquired the house. SendIT Limited considers purchasing the house from Dillon. The house will then be provided to an employee of SendIT Limited as residential accommodation. General information: The straight-line depreciation method is used on all asset classes. Property (Land & Building) is recognised using the revaluation model and is reval- ued at the end of every third year. Accumulated depreciation is eliminated at each revaluation date, and the revaluation surplus is released only on the disposal of the asset. Courier vehicles and computer equipment is recognised according to the cost model. The residual value on all assets is insignificant unless herwise sta Assume the residual value and useful life estimates have been reviewed every year and have remained unchanged. The company's cost of capital is 11%. Assume an income tax rate of 28% and 80% of capital gains are taxable. REQUIRED: 1.1) With reference to the Land and Building, prepare the journal entries, including deferred tax, required in the records of SendIT Limited for the year ended 28 February 2022 to account for the revaluation of the property. (13 marks) 1.2) With reference to the Computer equipment, advise SendIT Limited on whether they should invest in the new computer equipment by using the net present value method. (24 marks) 1.3) With reference to the Investment in SW Traders Limited, discuss the nature of SendIT Limited's investment in SW Traders Limited in accordance with the requirements of IFRS 11. (10 marks) 1.4) 1.5) 1.6) With reference to the Tax liability, formulate the substantive procedures you would perform to substantiate the amount of income tax owed to the South Af- rican Revenue Service while conducting the audit for the 2022 financial year. (10 marks) With reference to the Courier vehicle, calculate the normal tax consequences of SendIT Limited for the 2022 year of assessment, relating to the sale of the courier vehicle. (7 marks) With reference to the Courier vehicle, discuss ALL the tax consequences in respect of the courier vehicle returned and cancellation of the instalment sale agreement on 15 February 2022. (8 marks) 1.7) With reference to the Audit differences, briefly discuss whether the audit differences in your opinion, individually or cumulatively, would have a material effect on the fair presentation of the financial statements. Show your workings clearly. Assume that the final materiality figure is R250 000. (15 marks) 1.8) With reference to the House sale, discuss the normal tax implications for Dillon Ceasar regarding the proposed disposal of the house in Stellenbosch. You may assume that the house was sold to SendIT Limited for R6 500 000 on 1 February 2022 and that this was the only disposal by Dillon Ceasar during the 2022 year of assessment. (13 marks) SendIT Limited is a courier company that delivers parcels for various clients. The com- pany has a 28 February year-end. The following is an extract from the asset register of SendIT Limited as at 28 February 2022: Land Building Computer equipment Courier vehicles Cost R700 000 R3 000 000 R250 000 R5 200 000 Carrying amount R700 000 R2 100 000 R125 000 R480 000 Depreciation rate n/a 10% p.a. 20% p.a. 20% p.a. Land and Building The Land and Building constitute the property used by SendIT Limited to operate its business. The building was new when SendIT Limited bought the property on 1 March 2019. An independent valuer determined the net replacement cost of the building to be R2 550 000 and the market value of the land to be R775 000 on 28 February 2022. Computer equipment The directors of SendIT Limited are considering an upgrade to the company's current computer equipment. The new computer equipment will cost R500 000. The useful life of the new computer equipment is estimated at five years, and the residual value is estimated at R120 000. The current computer equipment has an average operating cost of R55 000 per year. The new computer equipment will require an average oper- ating cost of R30 000 per year and increase SendIT Limited's productivity by an esti- mated value of R50 000 per year. The current computer equipment's market value is R130 000, and the tax value is R93 750. Management estimated that the existing com- puter equipment has a remaining useful life of 5 years and a residual value of Rnil in 5 years. All computer equipment is written off over 4 years for tax purposes. Investment in SW Traders Limited During the 2022 financial year, SendIT Limited and Wheels Limited incorporated SW Traders Limited. SW Traders Limited will be a tyre dealer. SendIT Limited acquired 60% of SW Traders Limited's share capital for R300 000, and Wheels Limited acquired 40% of the share capital for R200 000. In terms of the agreement that governs the operations of SW Traders Limited, all decisions relating to the operations of SW Trad- ers Limited need to be taken by both SendIT Limited and Wheels Limited. Neither party can make decisions without each other's consent. SW Traders Limited does not have any administrative staff and is 100% administered by a combination of SendIT Limited and Wheels Limited staff, which includes the company's finance function. More than half of SW Traders Limited's sales are channelled to SendIT Limited and Wheels Limited. SW Traders Limited will always give preference to the needs of SendIT Lim- ited and Wheels Limited over that of any third party who wishes to buy tyres from SW Traders Limited. Courier vehicle SendIT Limited sold a courier vehicle to Mr. Adams, a natural person and not related to the company, at an open market value of R350 000 (including VAT) on 1 December 2021. The sale was made in terms of an instalment sale agreement. No deposit was paid, but he is liable for instalments of R18 000 per month (including VAT), which is payable from 1 January 2022. SendIT Limited acquired this courier vehicle for R869 000 (including VAT) from an unrelated VAT vendor on 1 March 2018. This cou- rier vehicle was brought into use immediately. Courier vehicles are written off over four years for tax purposes. However, at the beginning of February 2022, Mr. Adams called SendIT Limited and complained about a serious problem being experienced with the courier vehicle. He was furious and threatened to report the matter to a newspaper. SendIT Limited agreed to cancel the agreement, effective 15 February 2022, to avoid bad publicity. Mr. Adams returned the courier vehicle and was fully refunded for the two instalments he had already paid, and all further instalments were cancelled. At the time of cancelation of the agreement, the courier vehicle was valued at R260 000. The courier vehicle was not used by SendIT Limited or repaired since Mr. Adams returned it. Mr. Adams is not registered for VAT. Tax liability Included in the current liabilities balance in the statement of financial position for the 2022 financial year is an amount of R213 415, which represents income tax owed by SendIT Limited to the South African Revenue Service. Audit differences The following audit differences were noted while performing the audit for the 2022 financial year: a) The company's tax calculation was found to be incorrect because an inadmissible deduction of R280 534 was claimed. The net profit of the company is currently R241 998. b) The inventory in one of the warehouses was not included in the stocktake. The value of this inventory amounted to R336 223. This was not the first year that they experienced issues with the annual stocktake. c) No provision for credit losses was made for the current year. The accounting policy of SendIT Limited is to provide for 6,5% of the outstanding debtors as a provision for credit losses annually. The debtors' final figure was R659 678. House sale One of the directors of SendIT Limited, Dillon Ceasar, is considering emigrating from South Africa to Namibia. He currently lives in Stellenbosch with his wife, to whom he is married in community of property. Although they also own a house in Namibia, they always regarded their Stellenbosch house as their primary residence. The house was acquired through a donation from Dillon's grandfather on 1 October 2009 and formed part of the couple's joint estate. Donations tax amounted to R361 087 and was paid by Dillon's grandfather. The market values of the house amounted to R2 150 000 on 1 October 2009 and R6 500 000 on 1 February 2022. Dillon's wife, Nicole, operates a small business, selling second-hand books, from their house. A room of 35m is used exclusively in her trading operations. The house covers an area of 480m in total. Nicole has been utilising the space in her trade since Dillon acquired the house. SendIT Limited considers purchasing the house from Dillon. The house will then be provided to an employee of SendIT Limited as residential accommodation. General information: The straight-line depreciation method is used on all asset classes. Property (Land & Building) is recognised using the revaluation model and is reval- ued at the end of every third year. Accumulated depreciation is eliminated at each revaluation date, and the revaluation surplus is released only on the disposal of the asset. Courier vehicles and computer equipment is recognised according to the cost model. The residual value on all assets is insignificant unless herwise sta Assume the residual value and useful life estimates have been reviewed every year and have remained unchanged. The company's cost of capital is 11%. Assume an income tax rate of 28% and 80% of capital gains are taxable. REQUIRED: 1.1) With reference to the Land and Building, prepare the journal entries, including deferred tax, required in the records of SendIT Limited for the year ended 28 February 2022 to account for the revaluation of the property. (13 marks) 1.2) With reference to the Computer equipment, advise SendIT Limited on whether they should invest in the new computer equipment by using the net present value method. (24 marks) 1.3) With reference to the Investment in SW Traders Limited, discuss the nature of SendIT Limited's investment in SW Traders Limited in accordance with the requirements of IFRS 11. (10 marks) 1.4) 1.5) 1.6) With reference to the Tax liability, formulate the substantive procedures you would perform to substantiate the amount of income tax owed to the South Af- rican Revenue Service while conducting the audit for the 2022 financial year. (10 marks) With reference to the Courier vehicle, calculate the normal tax consequences of SendIT Limited for the 2022 year of assessment, relating to the sale of the courier vehicle. (7 marks) With reference to the Courier vehicle, discuss ALL the tax consequences in respect of the courier vehicle returned and cancellation of the instalment sale agreement on 15 February 2022. (8 marks) 1.7) With reference to the Audit differences, briefly discuss whether the audit differences in your opinion, individually or cumulatively, would have a material effect on the fair presentation of the financial statements. Show your workings clearly. Assume that the final materiality figure is R250 000. (15 marks) 1.8) With reference to the House sale, discuss the normal tax implications for Dillon Ceasar regarding the proposed disposal of the house in Stellenbosch. You may assume that the house was sold to SendIT Limited for R6 500 000 on 1 February 2022 and that this was the only disposal by Dillon Ceasar during the 2022 year of assessment. (13 marks)

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The answer has been provided and developed by step by step manner 11 Land and Building The Land and Building represent the property employed by SendIT restricted to work its business The building was ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started