Perform the calculation in excel worksheets and prepare a short report in word version explaining how the ratio is computed (the formula) and what the ratio indicates. Also, a comparison of ratios for the two consecutive years should be stated in order for you to judge how the company has performed from year to year. (Example: Calculate Debt ratio 2018= Total Liabilities/ Total Assets & Debt ratio 2019= Total Liabilities/ Total Assets and explain what they indicate, before comparing the leverage situation of the company).

Focus your calculations and analysis on the below ratios:

PPE efficiency

Fixed asset turnover

Leverage Ratios:

Debt-to-equity ratio

Debt Ratio

Other ratios:

Times interest earned

Cash flow to Net Income

PE ratio

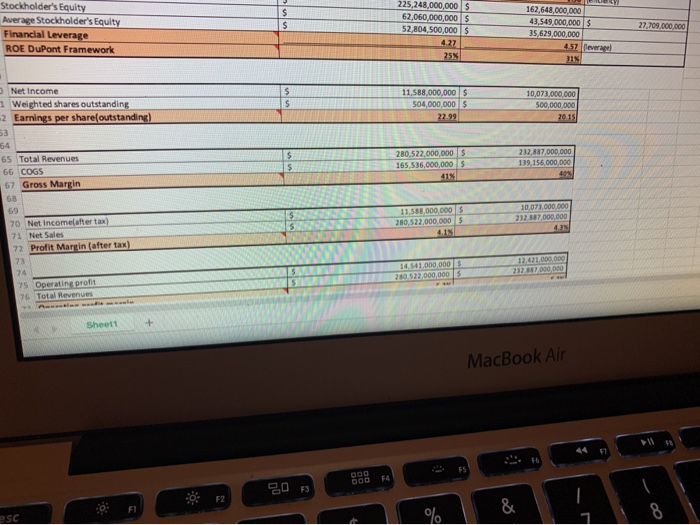

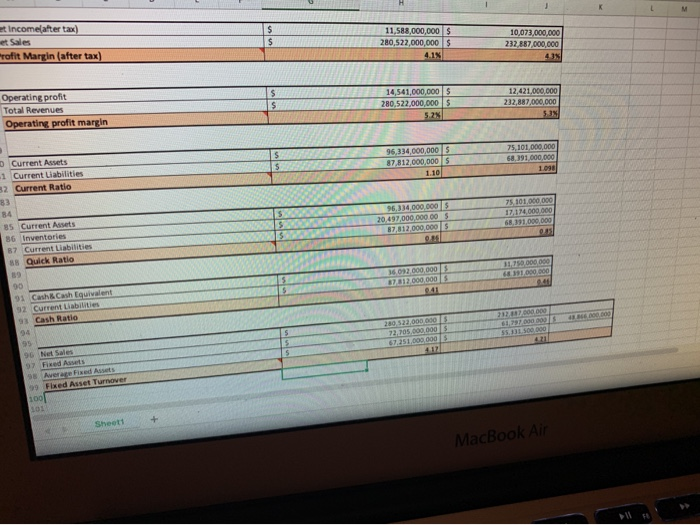

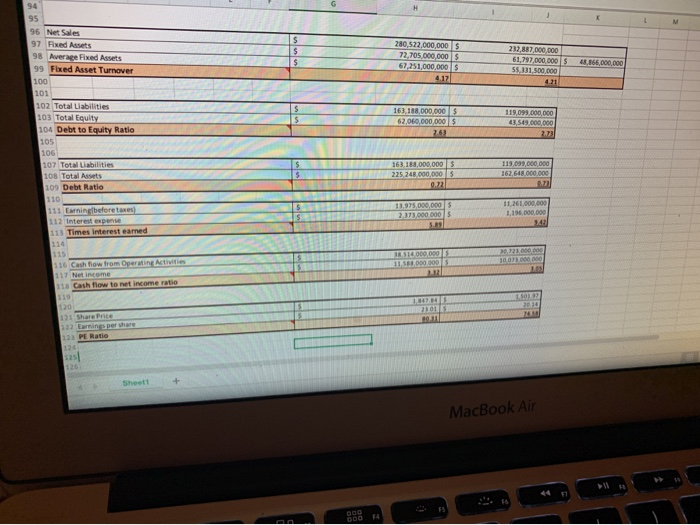

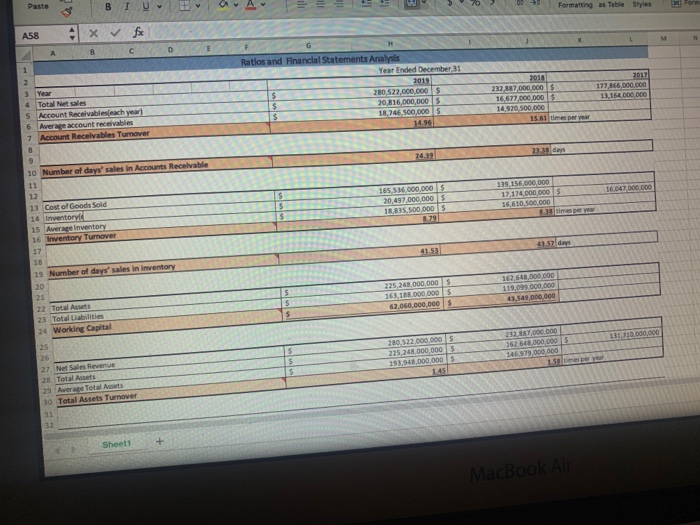

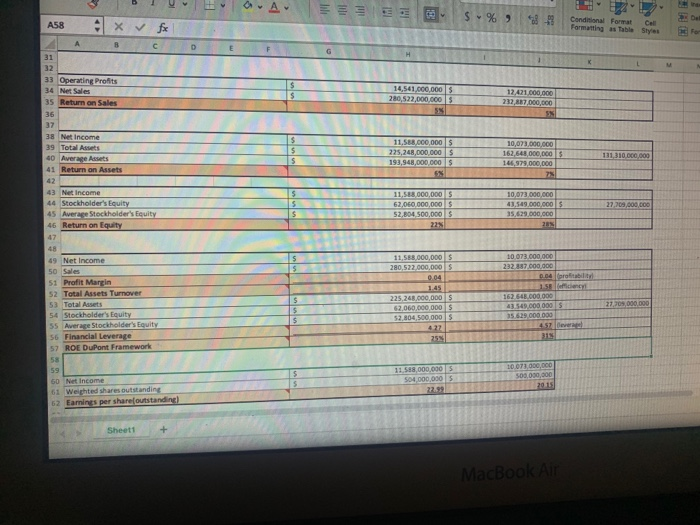

Stockholder's Equity Average Stockholder's Equity Financial Leverage ROE DuPont Framework $ $ 225,248,000,000 62,060,000,000 $ 52,804,500,000 $ 4.27 25% 27,709,000,000 162,648,000,000 43,549,000,000 $ 35,629,000,000 457 reverse 318 $ $ 11,588,000,000 $ 504,000,000 22.99 10,073,000,000 500,000,000 20.15 $ 280,522,000,000 $ 165,536,000,000 $ 232,887,000,000 139,156,000,000 $ 40 Net Income 1 Weighted shares outstanding -2 Earnings per share outstanding) 53 64 65 Total Revenues 66 COGS 67 Gross Margin 68 69 70 Net Income after ta 71 Net Sales 72 Profit Margin (after tax) 73 74 75 Operating profit 76 Total Revenues 11,588,000,000 280,522,000,000 S 10.073.000.000 212 887000.000 43N 16 541 000 000 200 522.000.000 212 387.000.000 Sheet1 MacBook Air FA 203 8 & esc % 8 M et Income after tax) et Sales rofit Margin (after tax) $ $ 11,588,000,000 $ 280,522,000,000 $ 4.18 10,073,000,000 232.887,000,000 43 $ $ Operating profit Total Revenues Operating profit margin 14,541,000,000 280,522,000,000 $ 5.2% 12,421,000,000 232,887,000,000 53 $ 5 75,101,000,000 68,191.000.000 Current Assets 1 Current Liabilities 32 Current Ratio 96,334,000,000 87.812,000,000 1.10 $ 5 96,134,000,000 $ 20.497,000,000.00 5 87,812.000.000 75 101 000 000 17,174.000.000 6.391.000.000 84 85 Current Assets 86 Inventories B7 Current Liabilities Quick Ratio 11 750 000 000 6111 000 000 36027.000.000 17.312.000.000 90 91 Cash Cash Equivalent 52 Current Liabilities 93 Cash Ratio 3 000 000 5 3 500.000 280 522 000 000 22.305 000 000 67.251.000.000 417 5 96 Net Sales 97 Fixed Assets 1 Average Fixed Assets Fixed Asset Turnover 100 + MacBook Air 94 95 $ $ $ 280 522,000,000 S 72,705.000.000 67,251,000,000 4.17 237,887,000,000 61,797.000.000 55,111,500,000 4.21 166 000 000 163,188,000,000 $ 62.060,000,000 $ 2.63 96 Net Sales 97 Fixed Assets 98 Average Fixed Assets 99 Fixed Asset Turnover 100 101 102 Total Liabilities 103 Total Equity 104 Debt to Equity Ratio 105 106 107 Total Liabilities 108 Total Assets 109 Debt Ratio 110 111 Earning before taxes) 112 Interest expense 11 Times interest earned 114 119,093,000,000 43,549,000,000 2.73 163.183,000,000 225.248.000.000 0.22 119,099,000,000 162,648.000.000 13.925,000,000 2,373,000 000 11 261.000.000 1.196.000.000 18518 000.000 11 000 000 300 000 000 116 Cash flow from Operating Activities 117 Net income Cash flow to net income ratio 10 2015 120 Share Price 122 Earnines per share 13 PE Ratio MacBook Air F4 Paste AC BIU Formatting as Table Styles A58 X M B D 1 2017 177.166.000.000 13164 000 000 2 3 Year 4 Total Netales 5 Account Receivables each year) 6 Average account receivables 7 Account Receivables Turnover Ratlos and Financial Statements Analysis Year Ended December 31 2019 $ 280,522,000,000 $ 20,816,000,000 $ 18,746 500,000 14.96 2018 232,387,000,000 16,677,000,000 14,920, 500,000 15.61 times per year 23.30 days 24:39 9 16.047.000.000 139,156 000 000 17174 000 000 $ 16,610,500,000 8.3 times per year 165536.000.000 $ 20,497,000,000 16.835.500.000 8.79 $ 10 Number of days' sales in Accounts Receivable 11 12 13 Cost of Goods Sold 14 Inventory 15 Average Inventory 16 Inventory Turnover 17 18 19 Number of days' sales In Inventory 20 11.57 days 5 5 225.243.000.000 S 163,11 000 000 $ 62.060.000.000 162,648,000,000 119.099,000,000 01.549,000,000 22 Total Assets 23 Total Liabilities 24 Working Capital 25 000 000 5 212.887.000.000 362.648.000.000 146.379.000.000 150esper your 280 522.000.000 225.248.000.000 193.948.000.000 145 $ S 27 Net Sales Revenue 28 Total Assets 29 Average Total Assets 30 Total Assets Turnover 31 32 + Sheet1 MacBook Air 11 a. Av IH $ % 9 A58 8-23 x fx Conditional Format Call Formatting Table Slyes 14,541,000,000 280,522,000,000 12,421.000.000 232,387,000,000 B c 31 32 33 Operating Profits 34 Net Sales 35 Return on Sales 36 37 38 Net Income 39 Total Assets 40 Average Assets 41 Return on Assets 42 43 Net Income 44 Stockholder's Equity 45 Average Stockholder's Equity 46 Return on Equity 11.SERCOO 000 $ 225,248,000,000 $ 193,948,000,000 $ 10,073.000.000 162,648,000,000 $ 146,979,000,000 7 131,310.000.000 $ $ 10,073.000.000 43.549.000.000 35,629.000.000 27,209,000,000 11.588.000.000 62.060,000,000 52,804,500,000 $ 22 $ 11,588,000,000 $ 280,522.000.000 0.04 1.45 225.248.000,000 $ 62.060.000.000 $ 52,804,500,000 48 49 Net Income 50 Sales 51 Profit Margin 52 Total Assets Turnover 53 Total Assets 54 Stockholder's Equity 55 Average Stockholder's Equity 56 Financial Leverage 57 ROE DuPont Framework 58 59 50 Net Income 61 Weighted shares outstanding 62 Earnings per share outstanding) 10.073.000.000 232.887.000.000 0.04 taraftability 15 1625.000000 43.549.000.000 35.629 000 000 4.57Deve 27.03.000.000 11.588.000.000 504,000,000 5 10073.000.000 500,000,000 2015 Sheet1 MacBook Air Stockholder's Equity Average Stockholder's Equity Financial Leverage ROE DuPont Framework $ $ 225,248,000,000 62,060,000,000 $ 52,804,500,000 $ 4.27 25% 27,709,000,000 162,648,000,000 43,549,000,000 $ 35,629,000,000 457 reverse 318 $ $ 11,588,000,000 $ 504,000,000 22.99 10,073,000,000 500,000,000 20.15 $ 280,522,000,000 $ 165,536,000,000 $ 232,887,000,000 139,156,000,000 $ 40 Net Income 1 Weighted shares outstanding -2 Earnings per share outstanding) 53 64 65 Total Revenues 66 COGS 67 Gross Margin 68 69 70 Net Income after ta 71 Net Sales 72 Profit Margin (after tax) 73 74 75 Operating profit 76 Total Revenues 11,588,000,000 280,522,000,000 S 10.073.000.000 212 887000.000 43N 16 541 000 000 200 522.000.000 212 387.000.000 Sheet1 MacBook Air FA 203 8 & esc % 8 M et Income after tax) et Sales rofit Margin (after tax) $ $ 11,588,000,000 $ 280,522,000,000 $ 4.18 10,073,000,000 232.887,000,000 43 $ $ Operating profit Total Revenues Operating profit margin 14,541,000,000 280,522,000,000 $ 5.2% 12,421,000,000 232,887,000,000 53 $ 5 75,101,000,000 68,191.000.000 Current Assets 1 Current Liabilities 32 Current Ratio 96,334,000,000 87.812,000,000 1.10 $ 5 96,134,000,000 $ 20.497,000,000.00 5 87,812.000.000 75 101 000 000 17,174.000.000 6.391.000.000 84 85 Current Assets 86 Inventories B7 Current Liabilities Quick Ratio 11 750 000 000 6111 000 000 36027.000.000 17.312.000.000 90 91 Cash Cash Equivalent 52 Current Liabilities 93 Cash Ratio 3 000 000 5 3 500.000 280 522 000 000 22.305 000 000 67.251.000.000 417 5 96 Net Sales 97 Fixed Assets 1 Average Fixed Assets Fixed Asset Turnover 100 + MacBook Air 94 95 $ $ $ 280 522,000,000 S 72,705.000.000 67,251,000,000 4.17 237,887,000,000 61,797.000.000 55,111,500,000 4.21 166 000 000 163,188,000,000 $ 62.060,000,000 $ 2.63 96 Net Sales 97 Fixed Assets 98 Average Fixed Assets 99 Fixed Asset Turnover 100 101 102 Total Liabilities 103 Total Equity 104 Debt to Equity Ratio 105 106 107 Total Liabilities 108 Total Assets 109 Debt Ratio 110 111 Earning before taxes) 112 Interest expense 11 Times interest earned 114 119,093,000,000 43,549,000,000 2.73 163.183,000,000 225.248.000.000 0.22 119,099,000,000 162,648.000.000 13.925,000,000 2,373,000 000 11 261.000.000 1.196.000.000 18518 000.000 11 000 000 300 000 000 116 Cash flow from Operating Activities 117 Net income Cash flow to net income ratio 10 2015 120 Share Price 122 Earnines per share 13 PE Ratio MacBook Air F4 Paste AC BIU Formatting as Table Styles A58 X M B D 1 2017 177.166.000.000 13164 000 000 2 3 Year 4 Total Netales 5 Account Receivables each year) 6 Average account receivables 7 Account Receivables Turnover Ratlos and Financial Statements Analysis Year Ended December 31 2019 $ 280,522,000,000 $ 20,816,000,000 $ 18,746 500,000 14.96 2018 232,387,000,000 16,677,000,000 14,920, 500,000 15.61 times per year 23.30 days 24:39 9 16.047.000.000 139,156 000 000 17174 000 000 $ 16,610,500,000 8.3 times per year 165536.000.000 $ 20,497,000,000 16.835.500.000 8.79 $ 10 Number of days' sales in Accounts Receivable 11 12 13 Cost of Goods Sold 14 Inventory 15 Average Inventory 16 Inventory Turnover 17 18 19 Number of days' sales In Inventory 20 11.57 days 5 5 225.243.000.000 S 163,11 000 000 $ 62.060.000.000 162,648,000,000 119.099,000,000 01.549,000,000 22 Total Assets 23 Total Liabilities 24 Working Capital 25 000 000 5 212.887.000.000 362.648.000.000 146.379.000.000 150esper your 280 522.000.000 225.248.000.000 193.948.000.000 145 $ S 27 Net Sales Revenue 28 Total Assets 29 Average Total Assets 30 Total Assets Turnover 31 32 + Sheet1 MacBook Air 11 a. Av IH $ % 9 A58 8-23 x fx Conditional Format Call Formatting Table Slyes 14,541,000,000 280,522,000,000 12,421.000.000 232,387,000,000 B c 31 32 33 Operating Profits 34 Net Sales 35 Return on Sales 36 37 38 Net Income 39 Total Assets 40 Average Assets 41 Return on Assets 42 43 Net Income 44 Stockholder's Equity 45 Average Stockholder's Equity 46 Return on Equity 11.SERCOO 000 $ 225,248,000,000 $ 193,948,000,000 $ 10,073.000.000 162,648,000,000 $ 146,979,000,000 7 131,310.000.000 $ $ 10,073.000.000 43.549.000.000 35,629.000.000 27,209,000,000 11.588.000.000 62.060,000,000 52,804,500,000 $ 22 $ 11,588,000,000 $ 280,522.000.000 0.04 1.45 225.248.000,000 $ 62.060.000.000 $ 52,804,500,000 48 49 Net Income 50 Sales 51 Profit Margin 52 Total Assets Turnover 53 Total Assets 54 Stockholder's Equity 55 Average Stockholder's Equity 56 Financial Leverage 57 ROE DuPont Framework 58 59 50 Net Income 61 Weighted shares outstanding 62 Earnings per share outstanding) 10.073.000.000 232.887.000.000 0.04 taraftability 15 1625.000000 43.549.000.000 35.629 000 000 4.57Deve 27.03.000.000 11.588.000.000 504,000,000 5 10073.000.000 500,000,000 2015 Sheet1 MacBook Air