Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perform the following analyses options on Lotuss common stock that mature in February 1994 and that have an exercise price of $55 per share. 1.Compute

Perform the following analyses options on Lotus’s common stock that mature in February 1994 and that have an exercise price of $55 per share. 1.Compute net profits and losses per share at maturity for the following two investment strategies: 1.Writing a put option on Lotus’s common stock. 2.Buying a share of Lotus’s common stock at $55 per share and hold it until Feb. 19, 1994.

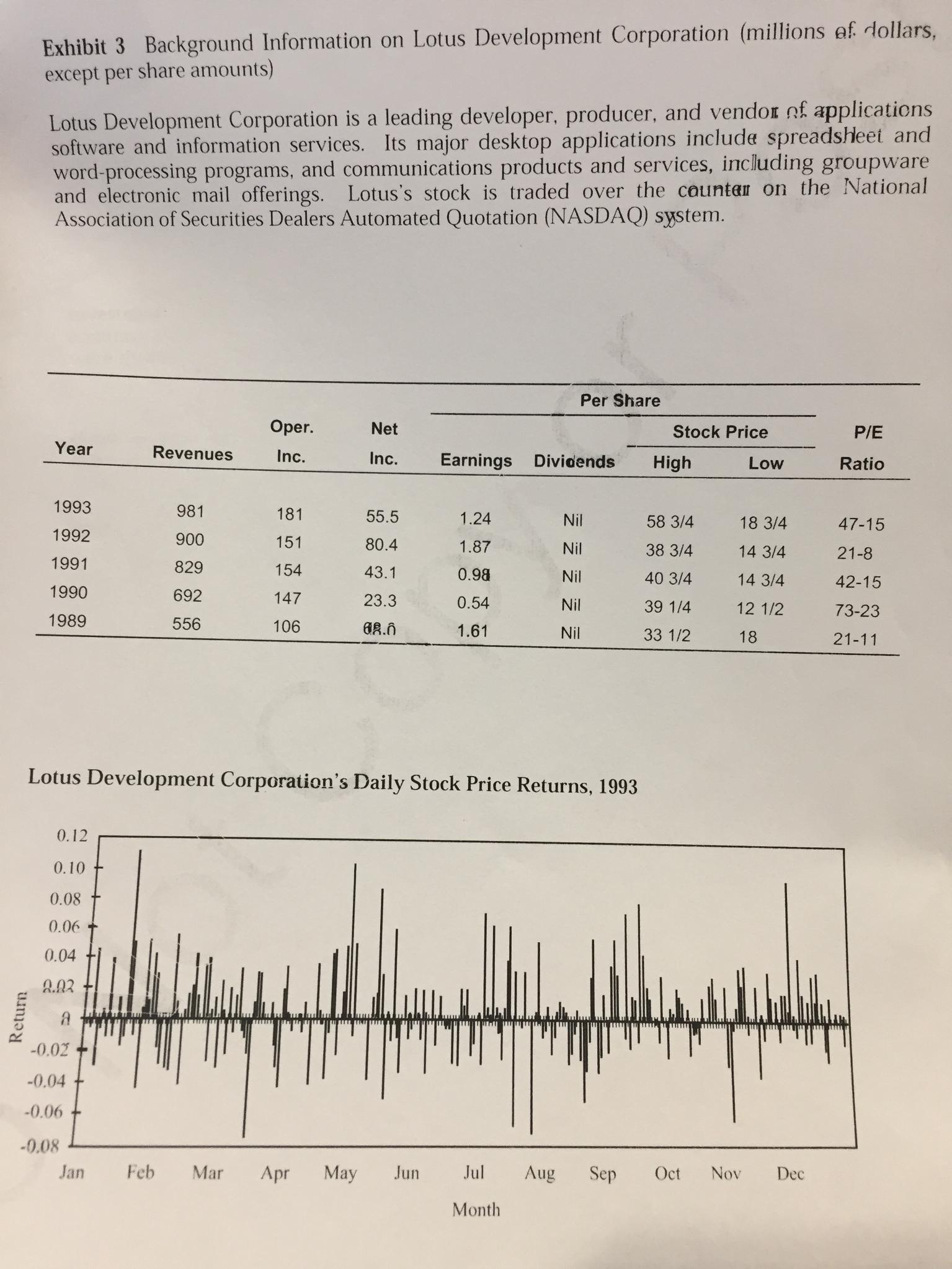

Exhibit 3 Background Information on Lotus Development Corporation (millions af dollars, except per share amounts) Lotus Development Corporation is a leading developer, producer, and vendor of applications software and information services. Its major desktop applications include spreadsheet and word-processing programs, and communications products and services, including groupware and electronic mail offerings. Lotus's stock is traded over the cauntar on the National Association of Securities Dealers Automated Quotation (NASDAQ) system. Per Share Oper. Net Stock Price P/E Year Revenues Inc. Inc. Earnings Dividends High Low Ratio 1993 981 181 55.5 1.24 Nil 58 3/4 18 3/4 47-15 1992 900 151 80.4 1.87 Nil 38 3/4 14 3/4 21-8 1991 829 154 43.1 0.98 Nil 40 3/4 14 3/4 42-15 1990 692 147 23.3 0.54 Nil 39 1/4 12 1/2 73-23 1989 556 106 1.61 Nil 33 1/2 18 21-11 Lotus Development Corporation's Daily Stock Price Returns, 1993 0.12 0.10 0.08 0.06 0.04 2.03 -0.02 -0.04 -0.06 -0.08 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Month Return

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

We assume that the selling and buying prices of all puts and calls are p which is small compared to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started