Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perform the quantitative financial analysis. Recommend and justify your decision. the China Synergy Group billed itself as our customers' China liaison to manage product

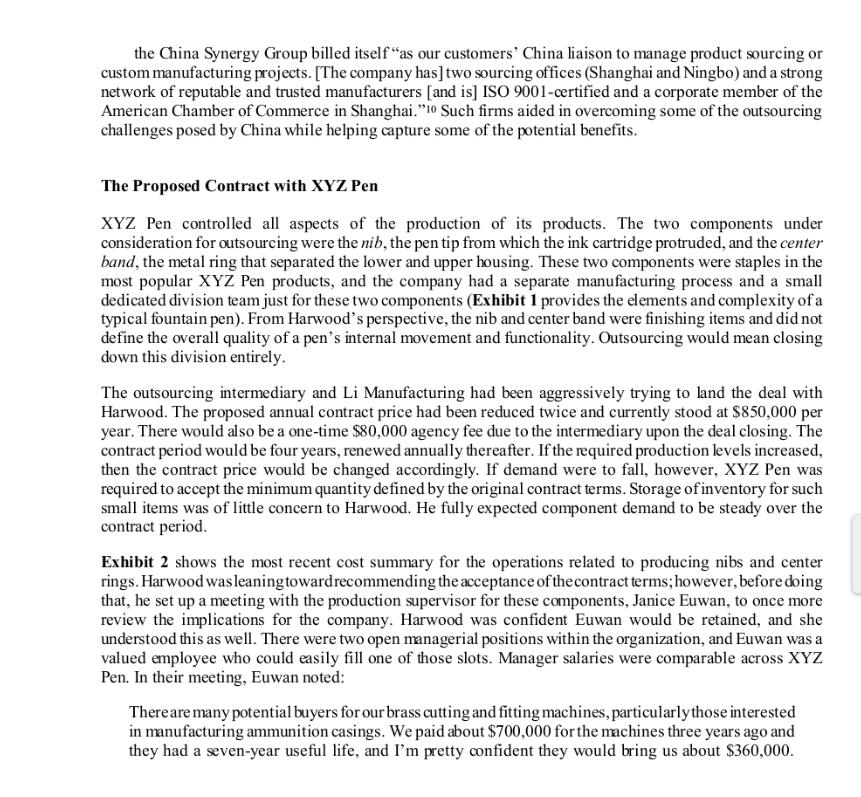

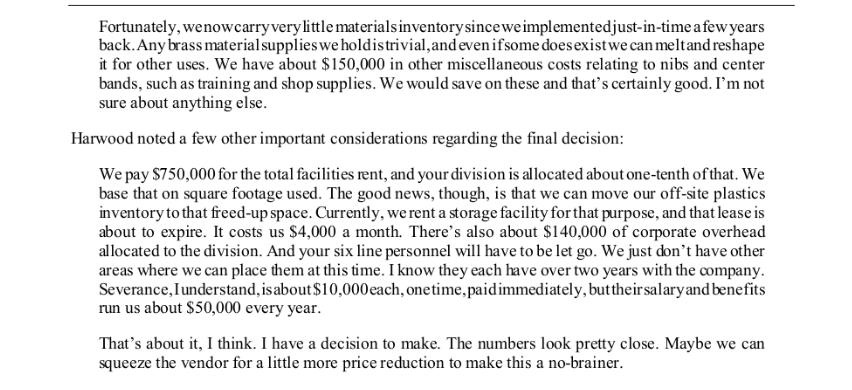

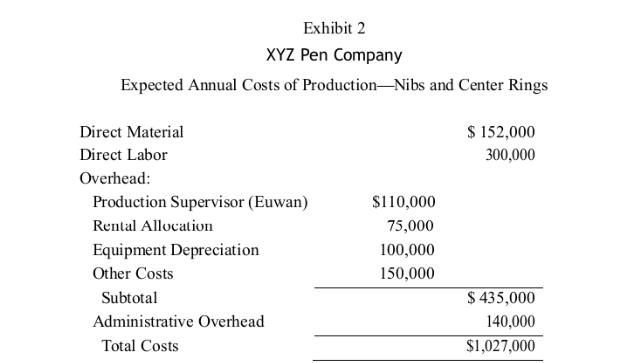

Perform the quantitative financial analysis. Recommend and justify your decision. the China Synergy Group billed itself "as our customers' China liaison to manage product sourcing or custom manufacturing projects. [The company has] two sourcing offices (Shanghai and Ningbo) and a strong network of reputable and trusted manufacturers [and is] ISO 9001-certified and a corporate member of the American Chamber of Commerce in Shanghai."10 Such firms aided in overcoming some of the outsourcing challenges posed by China while helping capture some of the potential benefits. The Proposed Contract with XYZ Pen XYZ Pen controlled all aspects of the production of its products. The two components under consideration for outsourcing were the nib, the pen tip from which the ink cartridge protruded, and the center band, the metal ring that separated the lower and upper housing. These two components were staples in the most popular XYZ Pen products, and the company had a separate manufacturing process and a small dedicated division team just for these two components (Exhibit 1 provides the elements and complexity of a typical fountain pen). From Harwood's perspective, the nib and center band were finishing items and did not define the overall quality of a pen's internal movement and functionality. Outsourcing would mean closing down this division entirely. The outsourcing intermediary and Li Manufacturing had been aggressively trying to land the deal with Harwood. The proposed annual contract price had been reduced twice and currently stood at $850,000 per year. There would also be a one-time $80,000 agency fee due to the intermediary upon the deal closing. The contract period would be four years, renewed annually thereafter. If the required production levels increased, then the contract price would be changed accordingly. If demand were to fall, however, XYZ Pen was required to accept the minimum quantity defined by the original contract terms. Storage of inventory for such small items was of little concern to Harwood. He fully expected component demand to be steady over the contract period. Exhibit 2 shows the most recent cost summary for the operations related to producing nibs and center rings. Harwood was leaning toward recommending the acceptance of the contract terms; however, before doing that, he set up a meeting with the production supervisor for these components, Janice Euwan, to once more review the implications for the company. Harwood was confident Euwan would be retained, and she understood this as well. There were two open managerial positions within the organization, and Euwan was a valued employee who could easily fill one of those slots. Manager salaries were comparable across XYZ Pen. In their meeting, Euwan noted: There are many potential buyers for our brass cutting and fitting machines, particularly those interested in manufacturing ammunition casings. We paid about $700,000 for the machines three years ago and they had a seven-year useful life, and I'm pretty confident they would bring us about $360,000. Fortunately, we nowcarry very little materials inventory since we implemented just-in-time a few years back. Any brass material supplies we holdis trivial, and even if some does exist we can melt and reshape it for other uses. We have about $150,000 in other miscellaneous costs relating to nibs and center bands, such as training and shop supplies. We would save on these and that's certainly good. I'm not sure about anything else. Harwood noted a few other important considerations regarding the final decision: We pay $750,000 for the total facilities rent, and your division is allocated about one-tenth of that. We base that on square footage used. The good news, though, is that we can move our off-site plastics inventory to that freed-up space. Currently, we rent a storage facility for that purpose, and that lease is about to expire. It costs us $4,000 a month. There's also about $140,000 of corporate overhead allocated to the division. And your six line personnel will have to be let go. We just don't have other areas where we can place them at this time. I know they each have over two years with the company. Severance, I understand, is about $10,000 each, one time, paid immediately, but their salary and benefits run us about $50,000 every year. That's about it, I think. I have a decision to make. The numbers look pretty close. Maybe we can squeeze the vendor for a little more price reduction to make this a no-brainer. Exhibit 2 XYZ Pen Company Expected Annual Costs of Production-Nibs and Center Rings Direct Material Direct Labor Overhead: Production Supervisor (Euwan) Rental Allocation Equipment Depreciation Other Costs Subtotal Administrative Overhead Total Costs $110,000 75,000 100,000 150,000 $ 152,000 300,000 $ 435,000 140,000 $1,027,000

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started