Question

Performance Corporation was organized on January 1, 2015. At the end of 2015, the company had not yet employed an accountant; however, an employee who

Performance Corporation was organized on January 1, 2015. At the end of 2015, the company had not yet employed an accountant; however, an employee who was good with numbers prepared the following statements at that date:

| PERFORMANCE CORPORATION | |||

| December 31, 2015 | |||

| Income from sales of merchandise | $ | 180,000 | |

| Total amount paid for goods sold during 2015 | (90,000 | ) | |

| Selling costs | (25,000 | ) | |

| Depreciation (on service vehicles used) | (12,000 | ) | |

| Income from services rendered | 52,000 | ||

| Salaries and wages paid | (62,000 | ) | |

| PERFORMANCE CORPORATION | |||||

| December 31, 2015 | |||||

| Resources | |||||

| Cash | $ | 32,000 | |||

| Merchandise inventory (held for resale) | 42,000 | ||||

| Service vehicles | 50,000 | ||||

| Retained earnings (profit earned in 2015) | 32,250 | ||||

| Grand total | $ | 156,250 | |||

| Debts | |||||

| Payables to suppliers | 17,750 | ||||

| Note owed to bank | 25,000 | ||||

| Due from customers | 13,000 | ||||

| Total | $ | 55,750 | |||

| Supplies on hand (to be used in rendering services) | $ | 15,000 | |||

| Accumulated depreciation (on service vehicles)* | 12,000 | ||||

| Common stock, 6,500 shares | 65,000 | ||||

| Total | 92,000 | ||||

| Grand total | $ | 147,750 | |||

* Accumulated depreciation represents the used portion of the asset and should be subtracted from the asset's balance.

Required:

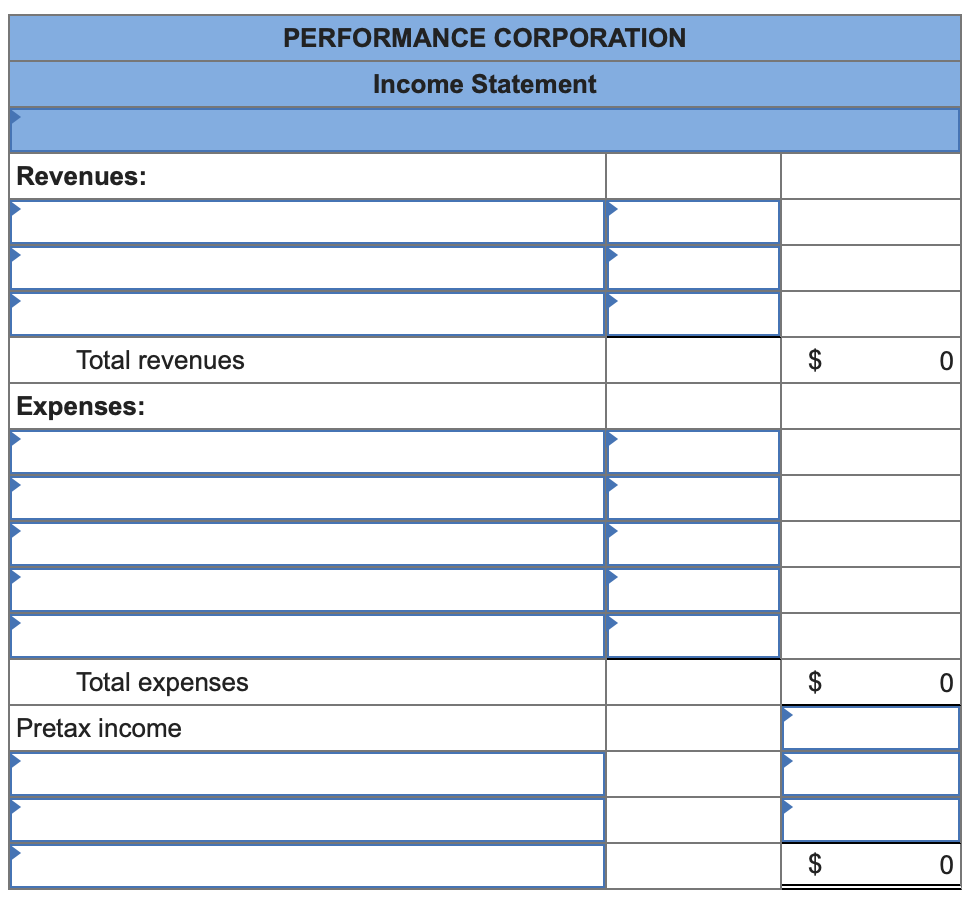

2-a. Prepare a proper income statement (correct net income is $32,250 and income tax expense is $10,750).

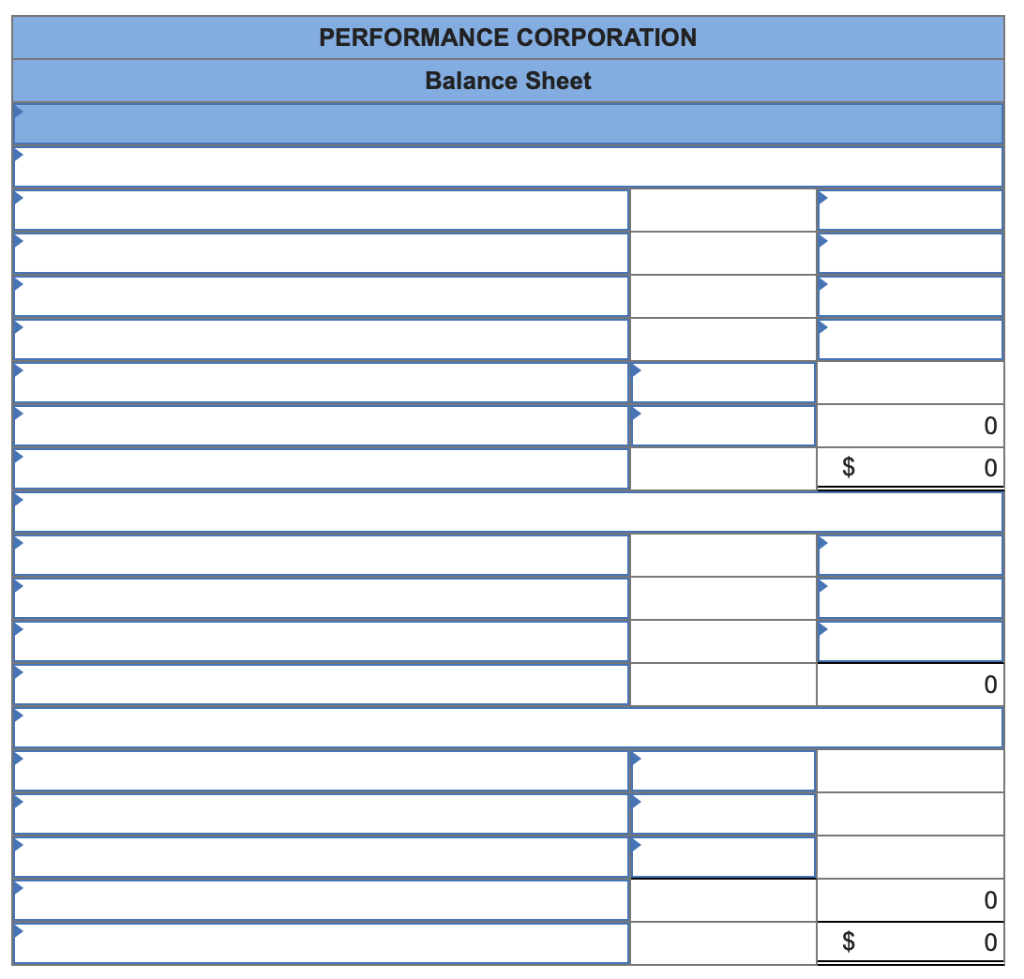

2-b. Balance sheet (correct total assets are $140,000). (Amounts to be deducted should be indicated by a minus sign.)

Thank you so much in advance!!

PERFORMANCE CORPORATION Income Statement Revenues: Total revenues $ 0 Expenses: Total expenses $ 0 Pretax income $ 0 PERFORMANCE CORPORATION Balance Sheet 0 $ 0 0 0 $ 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started