Answered step by step

Verified Expert Solution

Question

1 Approved Answer

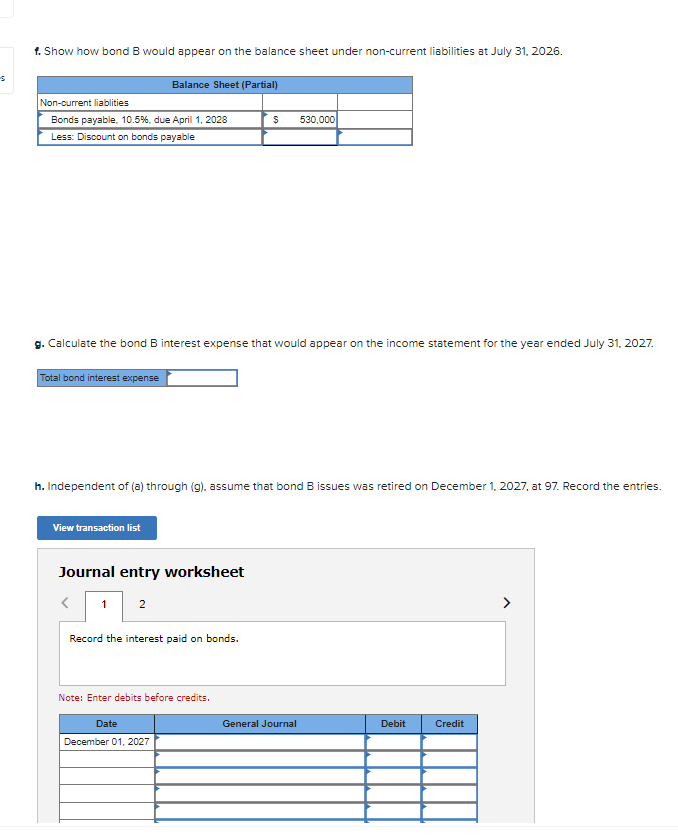

Period Ending (A) Cash Interest Paid $530,000.0 10.0% 3/12 (B) Period Interest Expense (E) 10.5% 3/12 (C) Amort. (A) (B) (D) Unamortized Balance (E) Carrying

| Period Ending | (A) Cash Interest Paid $530,000.0 10.0% 3/12 | (B) Period Interest Expense (E) 10.5% 3/12 | (C) Amort. (A) (B) | (D) Unamortized Balance | (E) Carrying Value $530,000 (D) | ||||||||||||||||||||

| Apr. 1/18 | $ | 16,286 | $ | 513,714 | |||||||||||||||||||||

| Jul. 1/18 | $ | 13,250 | $ | 13,485 | $ | 235 | 16,051 | 513,949 | |||||||||||||||||

| Apr. 1/26 | 13,250 | 13,775 | 525 | 4,726 | 525,274 | ||||||||||||||||||||

| Jul. 1/26 | 13,250 | 13,788 | 538 | 4,188 | 525,812 | ||||||||||||||||||||

| Oct. 1/26 | 13,250 | 13,803 | 553 | 3,635 | 526,365 | ||||||||||||||||||||

| Jan. 1/27 | 13,250 | 13,817 | 567 | 3,068 | 526,932 | ||||||||||||||||||||

| Apr. 1/27 | 13,250 | 13,832 | 582 | 2,486 | 527,514 | ||||||||||||||||||||

| Jul. 1/27 | 13,250 | 13,847 | 597 | 1,889 | 528,111 | ||||||||||||||||||||

| Oct. 1/27 | 13,250 | 13,863 | 613 | 1,276 | 528,724 | ||||||||||||||||||||

| Jan. 1/28 | 13,250 | 13,879 | 629 | 647 | 529,353 | ||||||||||||||||||||

| Apr. 1/28 | 13,250 | 13,897 | * | 647 | 0 | 530,000 | |||||||||||||||||||

| Totals | $ | 530,000 | $ | 546,286 | $ | 16,286 | |||||||||||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started