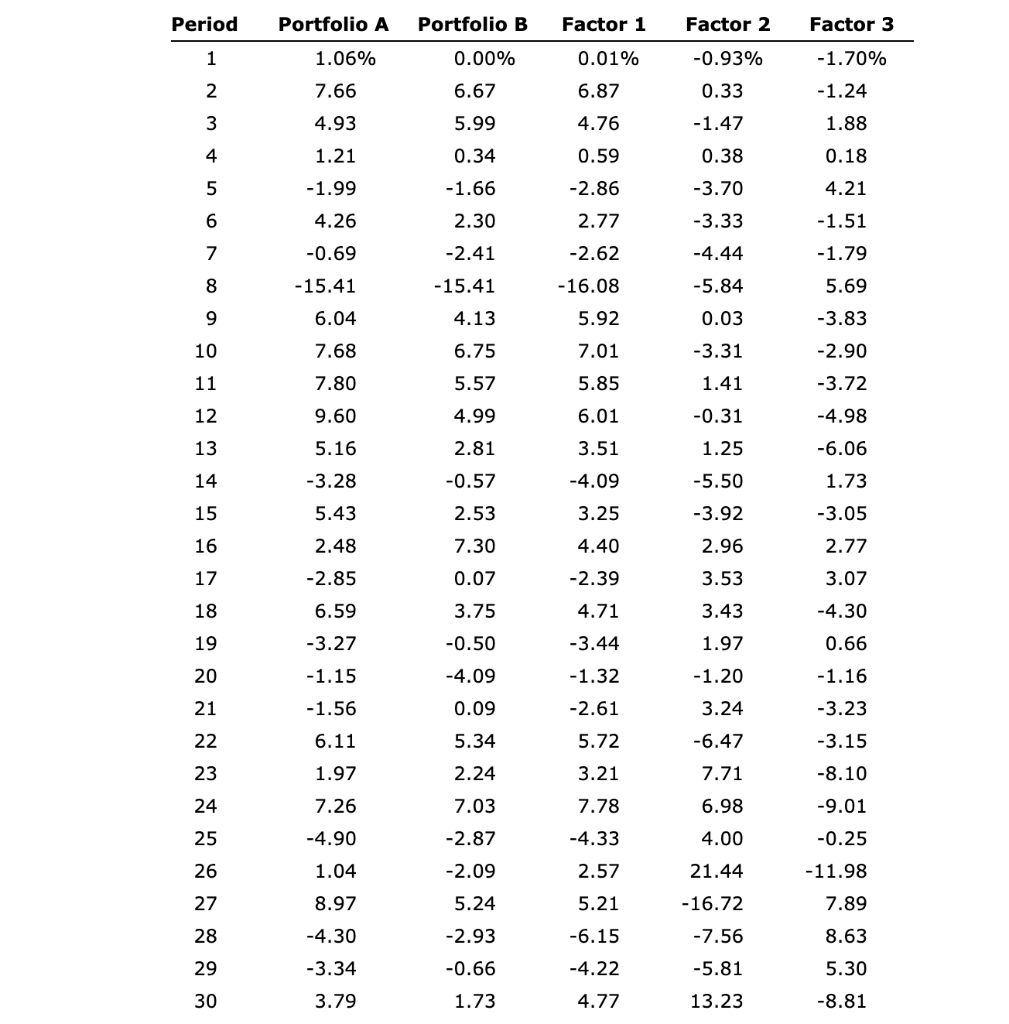

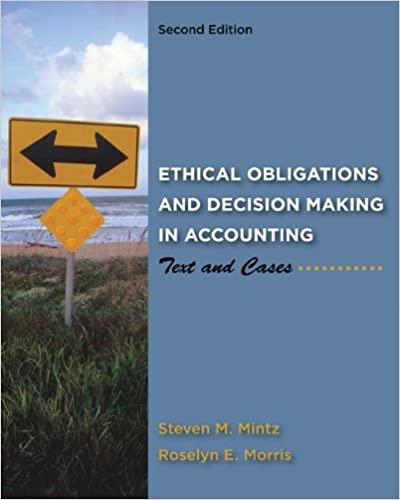

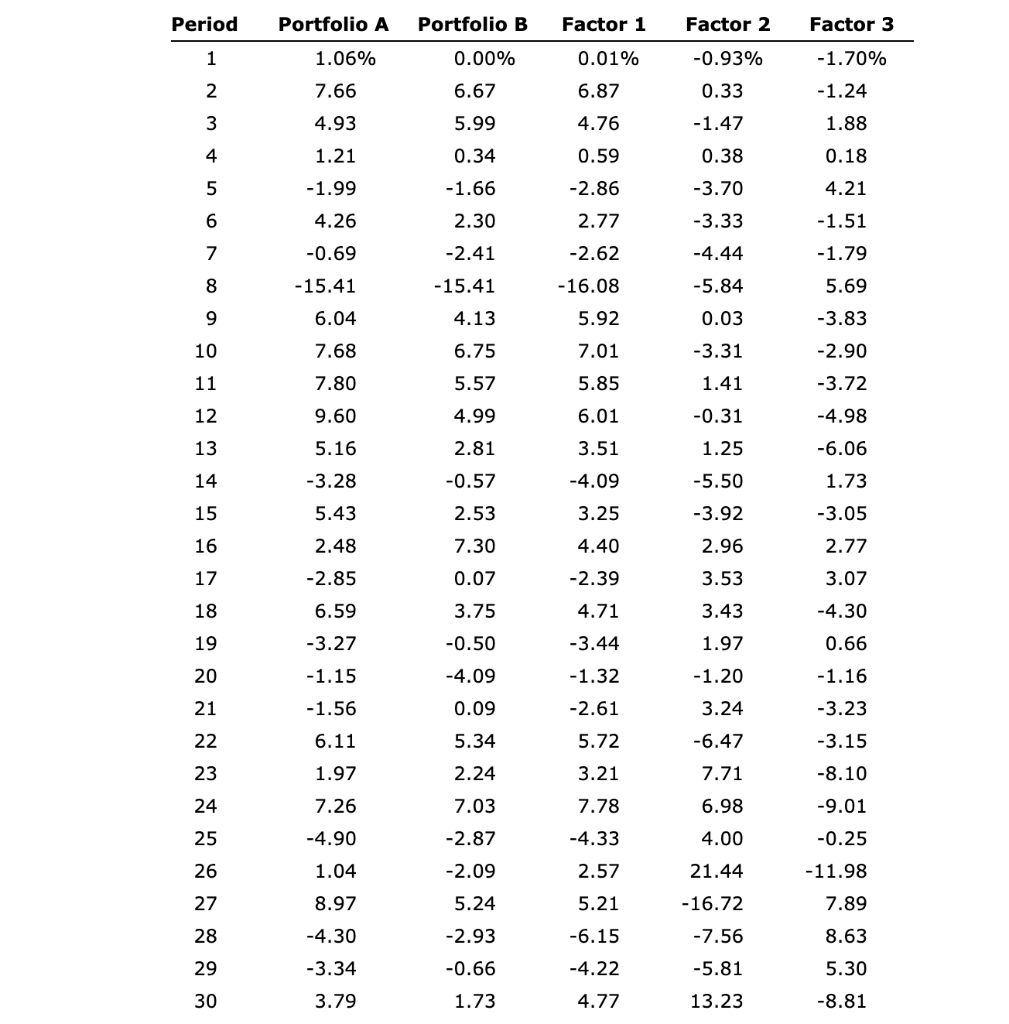

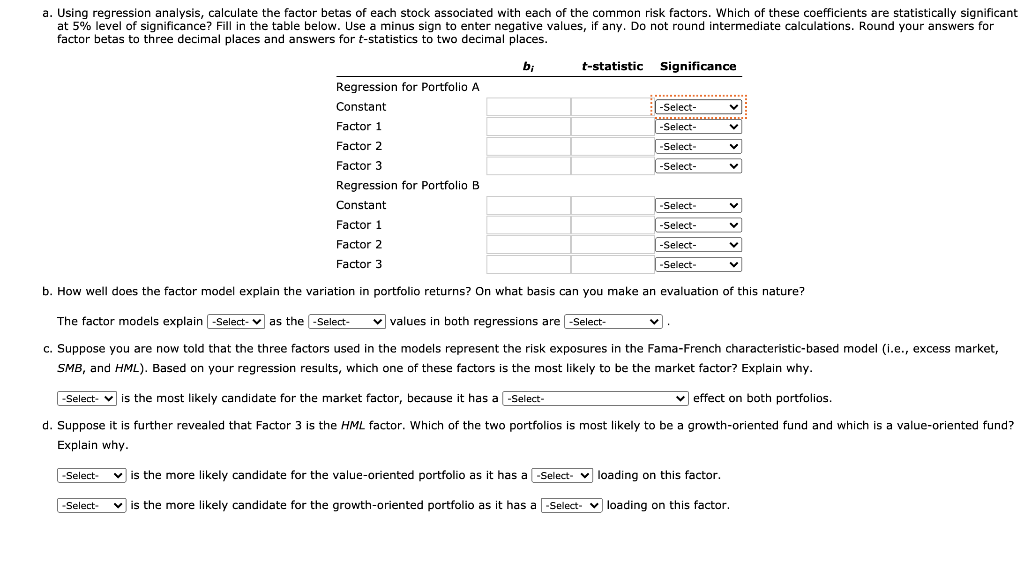

Period Portfolio A Portfolio B Factor 1 Factor 2 Factor 3 1 1.06% 0.00% 0.01% -0.93% -1.70% 2 7.66 6.67 6.87 0.33 -1.24 3 4.93 5.99 4.76 -1.47 1.88 4 1.21 0.34 0.59 0.38 0.18 5 -1.99 -1.66 -2.86 -3.70 4.21 6 4.26 2.30 2.77 -3.33 -1.51 7 -0.69 -2.41 -2.62 -4.44 -1.79 8 -15.41 -15.41 -16.08 -5.84 5.69 9 6.04 4.13 5.92 0.03 -3.83 10 7.68 6.75 7.01 -3.31 -2.90 11 7.80 5.57 1.41 -3.72 12 5.85 6.01 3.51 9.60 5.16 -0.31 -4.98 -6.06 1.25 4.99 2.81 -0.57 2.53 -3.28 -4.09 1.73 -5.50 -3.92 5.43 3.25 -3.05 2.48 7.30 4.40 2.96 2.77 17 -2.85 0.07 -2.39 3.53 3.07 2 3 4 5 9 1 2 : 6.59 3.75 4.71 3.43 -4.30 19 -3.27 -3.44 0.66 20 -1.15 -1.56 -0.50 -4.09 0.09 5.34 -1.32 -2.61 5.72 3.21 1.97 -1.20 3.24 -6.47 7.71 - 1.16 -3.23 -3.15 -8.10 6.11 1.97 2.24 23 24 7.26 7.03 7.78 6.98 -9.01 25 -4.90 -2.87 -4.33 4.00 -0.25 1.04 -2.09 2.57 21.44 -11.98 26 27 8.97 5.24 5.21 -16.72 7.89 28 -7.56 -4.30 -3.34 -2.93 -0.66 1.73 -6.15 -4.22 8.63 5.30 29 30 -5.81 3.79 4.77 13.23 -8.81 a. Using regression analysis, calculate the factor betas of each stock associated with each of the common risk factors. Which of these coefficients are statistically significant at 5% level of significance? Fill in the table below. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers for factor betas to three decimal places and answers for t-statistics to two decimal places. b; t-statistic Significance Regression for Portfolio A Constant -Select- Factor 1 -Select- Factor 2 -Select- Factor 3 -Select- Regression for Portfolio B Constant -Select- Factor 1 -Select- Factor 2 -Select- Factor 3 -Select- V b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain -Select- as the -Select values in both regressions are -Select- c. Suppose you are now told that the three factors used in the models represent the risk exposures in the Fama-French characteristic-based model (i.e., excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why. - Select is the most likely candidate for the market factor, because it has a -Select- effect on both portfolios. d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why. -Select- v is the more likely candidate for the value-oriented portfolio as it has a -Select- loading on this factor. -Select- V is the more likely candidate for the growth-oriented portfolio as it has a -Select- loading on this factor. Period Portfolio A Portfolio B Factor 1 Factor 2 Factor 3 1 1.06% 0.00% 0.01% -0.93% -1.70% 2 7.66 6.67 6.87 0.33 -1.24 3 4.93 5.99 4.76 -1.47 1.88 4 1.21 0.34 0.59 0.38 0.18 5 -1.99 -1.66 -2.86 -3.70 4.21 6 4.26 2.30 2.77 -3.33 -1.51 7 -0.69 -2.41 -2.62 -4.44 -1.79 8 -15.41 -15.41 -16.08 -5.84 5.69 9 6.04 4.13 5.92 0.03 -3.83 10 7.68 6.75 7.01 -3.31 -2.90 11 7.80 5.57 1.41 -3.72 12 5.85 6.01 3.51 9.60 5.16 -0.31 -4.98 -6.06 1.25 4.99 2.81 -0.57 2.53 -3.28 -4.09 1.73 -5.50 -3.92 5.43 3.25 -3.05 2.48 7.30 4.40 2.96 2.77 17 -2.85 0.07 -2.39 3.53 3.07 2 3 4 5 9 1 2 : 6.59 3.75 4.71 3.43 -4.30 19 -3.27 -3.44 0.66 20 -1.15 -1.56 -0.50 -4.09 0.09 5.34 -1.32 -2.61 5.72 3.21 1.97 -1.20 3.24 -6.47 7.71 - 1.16 -3.23 -3.15 -8.10 6.11 1.97 2.24 23 24 7.26 7.03 7.78 6.98 -9.01 25 -4.90 -2.87 -4.33 4.00 -0.25 1.04 -2.09 2.57 21.44 -11.98 26 27 8.97 5.24 5.21 -16.72 7.89 28 -7.56 -4.30 -3.34 -2.93 -0.66 1.73 -6.15 -4.22 8.63 5.30 29 30 -5.81 3.79 4.77 13.23 -8.81 a. Using regression analysis, calculate the factor betas of each stock associated with each of the common risk factors. Which of these coefficients are statistically significant at 5% level of significance? Fill in the table below. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers for factor betas to three decimal places and answers for t-statistics to two decimal places. b; t-statistic Significance Regression for Portfolio A Constant -Select- Factor 1 -Select- Factor 2 -Select- Factor 3 -Select- Regression for Portfolio B Constant -Select- Factor 1 -Select- Factor 2 -Select- Factor 3 -Select- V b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain -Select- as the -Select values in both regressions are -Select- c. Suppose you are now told that the three factors used in the models represent the risk exposures in the Fama-French characteristic-based model (i.e., excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why. - Select is the most likely candidate for the market factor, because it has a -Select- effect on both portfolios. d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why. -Select- v is the more likely candidate for the value-oriented portfolio as it has a -Select- loading on this factor. -Select- V is the more likely candidate for the growth-oriented portfolio as it has a -Select- loading on this factor