Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Periodic and Perpetual Systems-Recording Purchases and Sales, and Year-End Adjustments; Computing Gross Profit under Both Systems Diaz Inc. uses the gross method to record purchases.

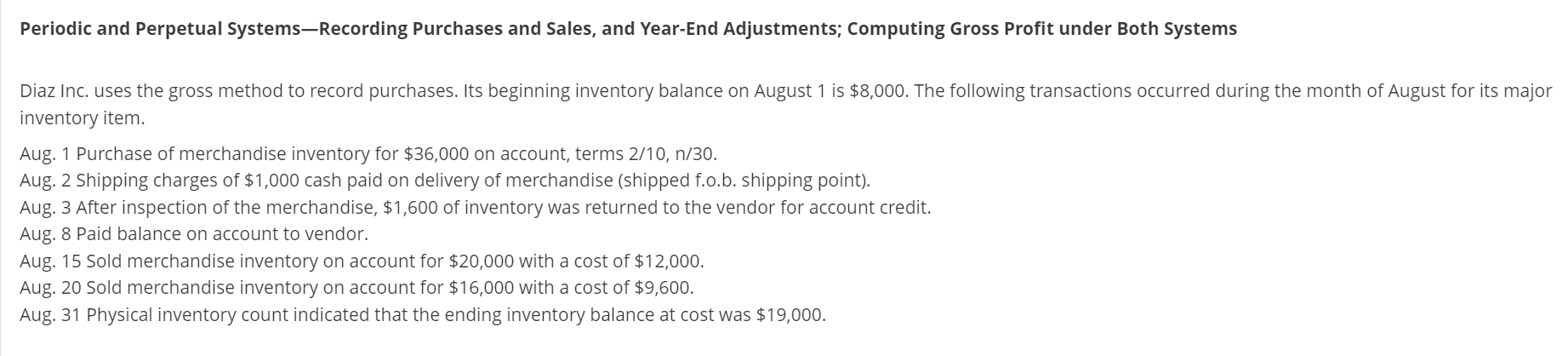

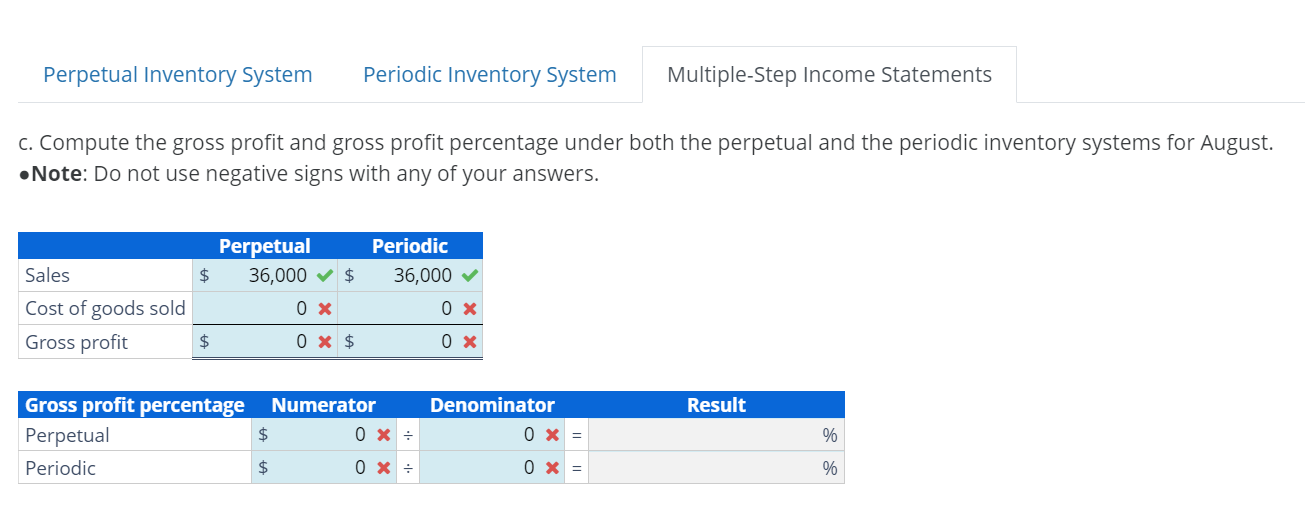

Periodic and Perpetual Systems-Recording Purchases and Sales, and Year-End Adjustments; Computing Gross Profit under Both Systems Diaz Inc. uses the gross method to record purchases. Its beginning inventory balance on August 1 is $8,000. The following transactions occurred during the month of August for its major inventory item. Aug. 1 Purchase of merchandise inventory for $36,000 on account, terms 2/10,n/30. Aug. 2 Shipping charges of $1,000 cash paid on delivery of merchandise (shipped f.o.b. shipping point). Aug. 3 After inspection of the merchandise, $1,600 of inventory was returned to the vendor for account credit. Aug. 8 Paid balance on account to vendor. Aug. 15 Sold merchandise inventory on account for $20,000 with a cost of $12,000. Aug. 20 Sold merchandise inventory on account for $16,000 with a cost of $9,600. Aug. 31 Physical inventory count indicated that the ending inventory balance at cost was $19,000. c. Compute the gross profit and gross profit percentage under both the perpetual and the periodic inventory systems for August. - Note: Do not use negative signs with any of your answers

Periodic and Perpetual Systems-Recording Purchases and Sales, and Year-End Adjustments; Computing Gross Profit under Both Systems Diaz Inc. uses the gross method to record purchases. Its beginning inventory balance on August 1 is $8,000. The following transactions occurred during the month of August for its major inventory item. Aug. 1 Purchase of merchandise inventory for $36,000 on account, terms 2/10,n/30. Aug. 2 Shipping charges of $1,000 cash paid on delivery of merchandise (shipped f.o.b. shipping point). Aug. 3 After inspection of the merchandise, $1,600 of inventory was returned to the vendor for account credit. Aug. 8 Paid balance on account to vendor. Aug. 15 Sold merchandise inventory on account for $20,000 with a cost of $12,000. Aug. 20 Sold merchandise inventory on account for $16,000 with a cost of $9,600. Aug. 31 Physical inventory count indicated that the ending inventory balance at cost was $19,000. c. Compute the gross profit and gross profit percentage under both the perpetual and the periodic inventory systems for August. - Note: Do not use negative signs with any of your answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started