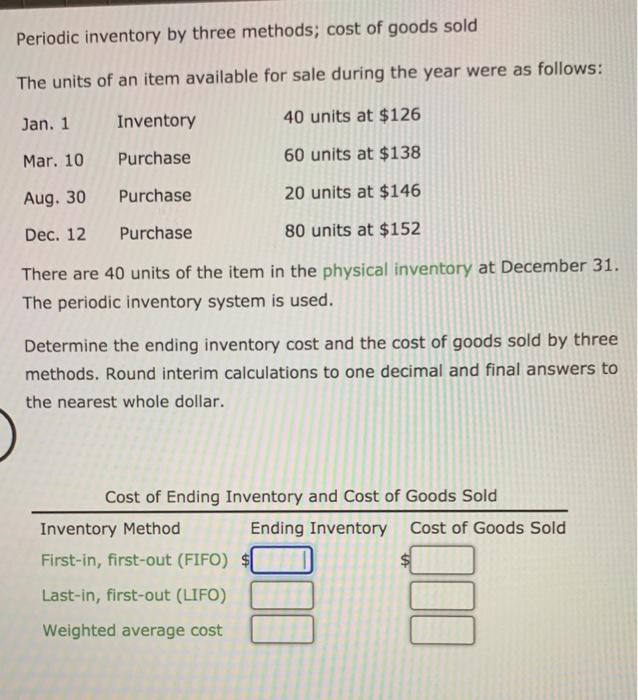

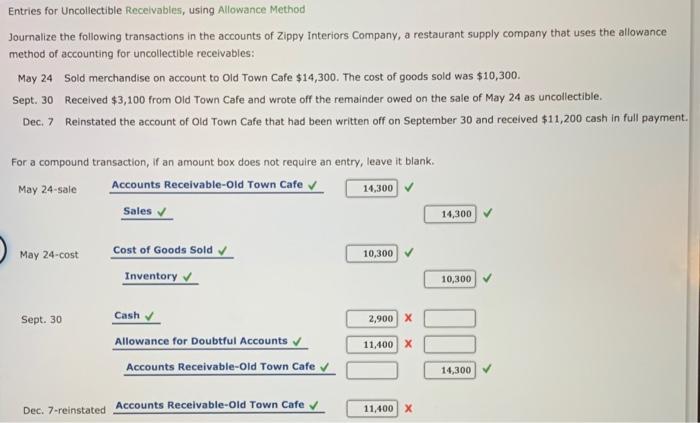

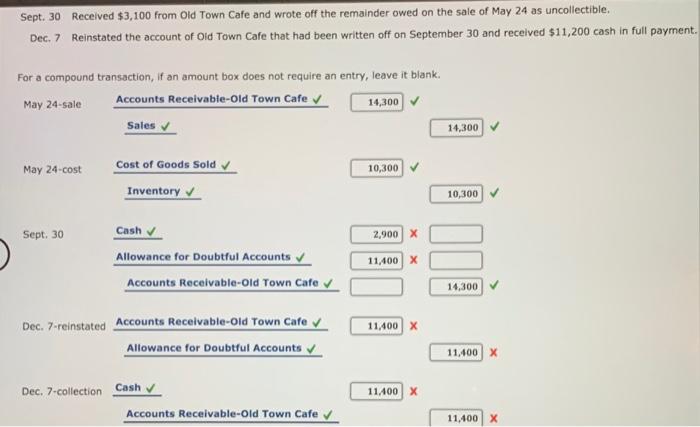

Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory 40 units at $126 Mar. 10 Purchase 60 units at $138 Aug. 30 Purchase 20 units at $146 Dec. 12 Purchase 80 units at $152 There are 40 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by three methods. Round interim calculations to one decimal and final answers to the nearest whole dollar. Cost of Ending Inventory and Cost of Goods Sold Inventory Method Ending Inventory Cost of Goods Sold First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost Entries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Zippy interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: May 24 Sold merchandise on account to Old Town Cafe $14,300. The cost of goods sold was $10,300. Sept. 30 Received $3,100 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $11,200 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. May 24-sale Accounts Receivable-Old Town Cafe 14,300 Sales 14,300 May 24-cost 10,300 Cost of Goods Sold Inventory 10,300 Sept. 30 2,900 X Cash Allowance for Doubtful Accounts Accounts Receivable-Old Town Cafe 11.400 X 14,300 Dec. 7-reinstated Accounts Receivable-Old Town Cafe 11.400 X Sept. 30 Received $3,100 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible, Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $11,200 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. May 24-sale Accounts Receivable-Old Town Cafe 14,300 Sales 14,300 May 24-cost 10,300 Cost of Goods Sold Inventory 10,300 Sept. 30 2,900 X Cash Allowance for Doubtful Accounts Accounts Receivable-Old Town Cafe 11.400 X 14,300 11,400 Dec. 7-reinstated Accounts Receivable-Old Town Cafe Allowance for Doubtful Accounts 11,400 x Dec. 7-collection Cash 11.400 X Accounts Receivable-Old Town Cafe 11,400 x