Answered step by step

Verified Expert Solution

Question

1 Approved Answer

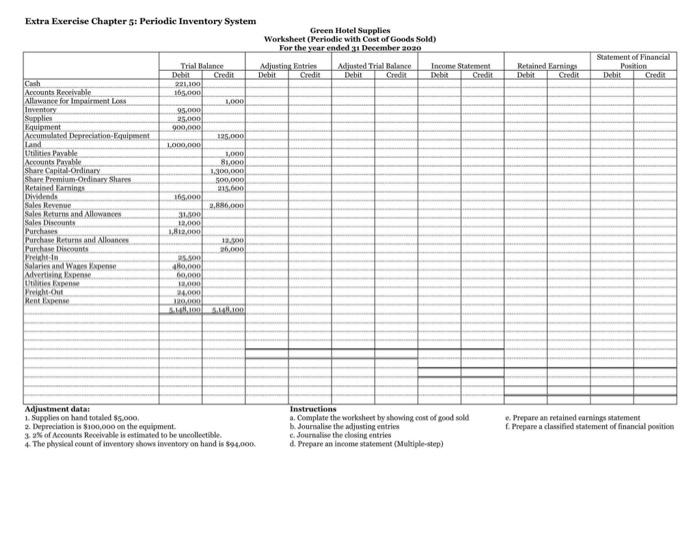

Periodic Inventory System Cash Accounts Receivable Allawance for Impairment Loss Inventory Supplies Equipment Accumulated Depreciation-Equipment Land Utilities Payable Accounts Payable Share Capital-Ordinary Share Premium-Ordinary Shares

Periodic Inventory System Cash Accounts Receivable Allawance for Impairment Loss Inventory Supplies Equipment Accumulated Depreciation-Equipment Land Utilities Payable Accounts Payable Share Capital-Ordinary Share Premium-Ordinary Shares Retained Earnings Dividends Sales Revenue Sales Returns and Allowances Sales Discounts Purchases Purchase Returns and Alloances Purchase Discounts Freight-In Salaries and Wages Expense Advertising Expense Utilities Expense Freight-Out Rent Expense Trial Balance Debit 221,100 165,000 95,000 25,000 900,000 1,000,000 165,000 31,500 12,000 1,812,000 Credit 1,000 125,000 1,000 81,000 1,300,000 500,000 215,600 2,886,000 12,500 26,000 25,500 480,000 60,000 12,000 24,000 120,000 5,148,100 5,148,100 Adjustment data: 1. Supplies on hand totaled $5,000. 2. Depreciation is $100,000 on the equipment. 3.2% of Accounts Receivable is estimated to be uncollectible. 4. The physical count of inventory shows inventory on hand is $94,000. Green Hotel Supplies Worksheet (Periodic with Cost of Goods Sold) For the year ended 31 December 2020 Adjusting Entries Debit Credit Adjusted Trial Balance Debit Credit Income Statement Debit Credit Instructions a. Complate the worksheet by showing cost of good sold b. Journalise the adjusting entries c. Journalise the closing entries d. Prepare an income statement (Multiple-step) Retained Earnings Debit Credit Statement of Financial Position Debit Credit e. Prepare an retained earnings statement f. Prepare a classified statement of financial position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started