Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Periodic Question 4: (20 marks: Hayward trading Corporation started business in 2019. The company applied a first-in, first-out (FIFO) basis of pricing inventories in 2019.

Periodic

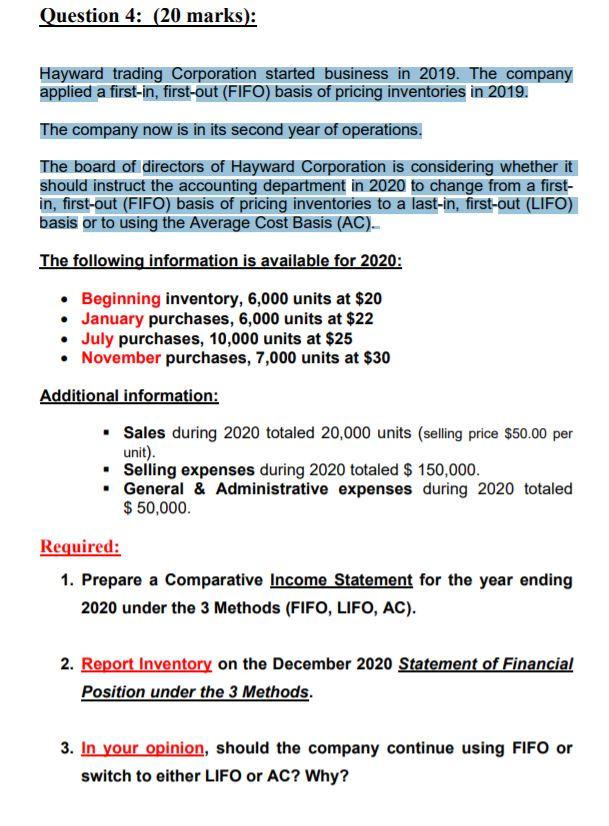

Question 4: (20 marks: Hayward trading Corporation started business in 2019. The company applied a first-in, first-out (FIFO) basis of pricing inventories in 2019. The company now is in its second year of operations. The board of directors of Hayward Corporation is considering whether it should instruct the accounting department in 2020 to change from a first- in, first-out (FIFO) basis of pricing inventories to a last-in, first-out (LIFO) basis or to using the Average Cost Basis (AC). The following information is available for 2020: Beginning inventory, 6,000 units at $20 January purchases, 6,000 units at $22 July purchases, 10,000 units at $25 November purchases, 7,000 units at $30 Additional information: Sales during 2020 totaled 20,000 units (selling price $50.00 per unit) . Selling expenses during 2020 totaled $ 150,000. . General & Administrative expenses during 2020 totaled $ 50,000 Required: 1. Prepare a Comparative Income Statement for the year ending 2020 under the 3 Methods (FIFO, LIFO, AC). 2. Report Inventory on the December 2020 Statement of Financial Position under the 3 Methods. 3. In your opinion, should the company continue using FIFO or switch to either LIFO or AC? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started