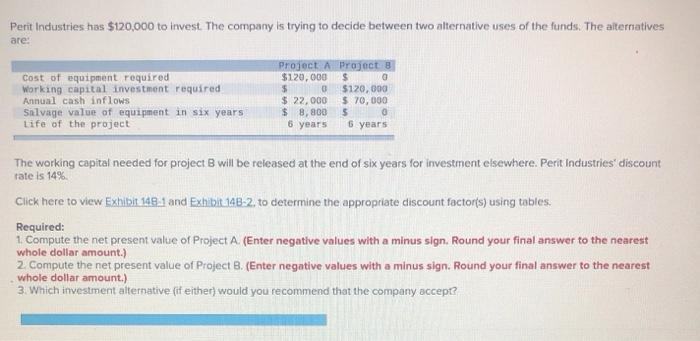

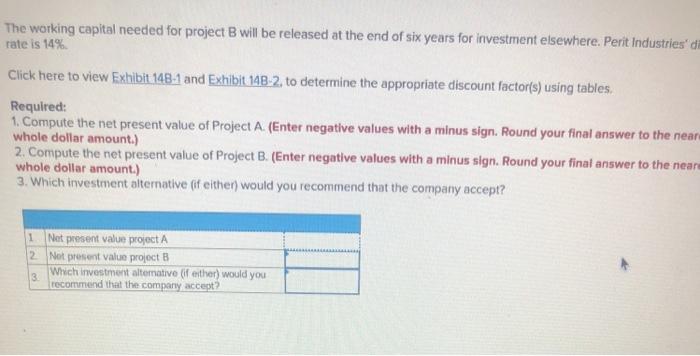

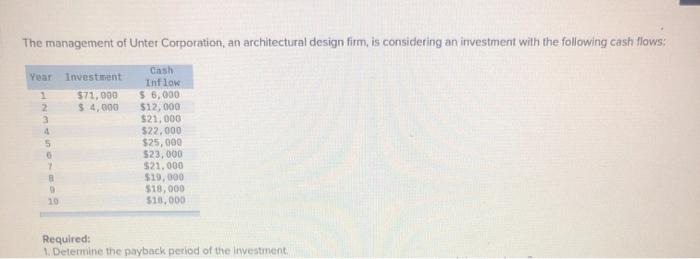

Perit Industries has $120,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project Project Projects $120,000 $ $ 0 $120,000 $ 22,000 $ 70,000 $8,800 $ 6 years 6 years The working capital needed for project will be released at the end of six years for investment elsewhere. Perit Industries discount rate is 14% Click here to view Exhibit 148.1 and Exhibit:14B-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. Compute the net present value of Project B. (Enter negative values with a minus sign. Round your final answer to the nearest 3. Which investment alternative fif either) would you recommend that the company accep? The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' di rate is 14% Click here to view Exhibit 148-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using tables Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the near whole dollar amount.) 2. Compute the net present value of Project B. (Enter negative values with a minus sign. Round your final answer to the near whole dollar amount.) 3. Which investment alternative (if either) would you recommend that the company accept? 1 Net present value project A 2 Not present value project B Which investment alternative of either) would you 3 recommend that the company accept? The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment 1 $71,000 2 $ 4,000 3 Cash Inflow $ 6,000 $12,000 $21,000 $22,000 $25,000 523,000 $21,000 $19,000 $18,000 $10.000 5 5 7 9 10 Required: 1. Determine the payback period of the investment