Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perivatives: Options on a Binomial Tree 1. This question asks you to price and describe the replicating portfolio for options on a non-dividend-paying stock whose

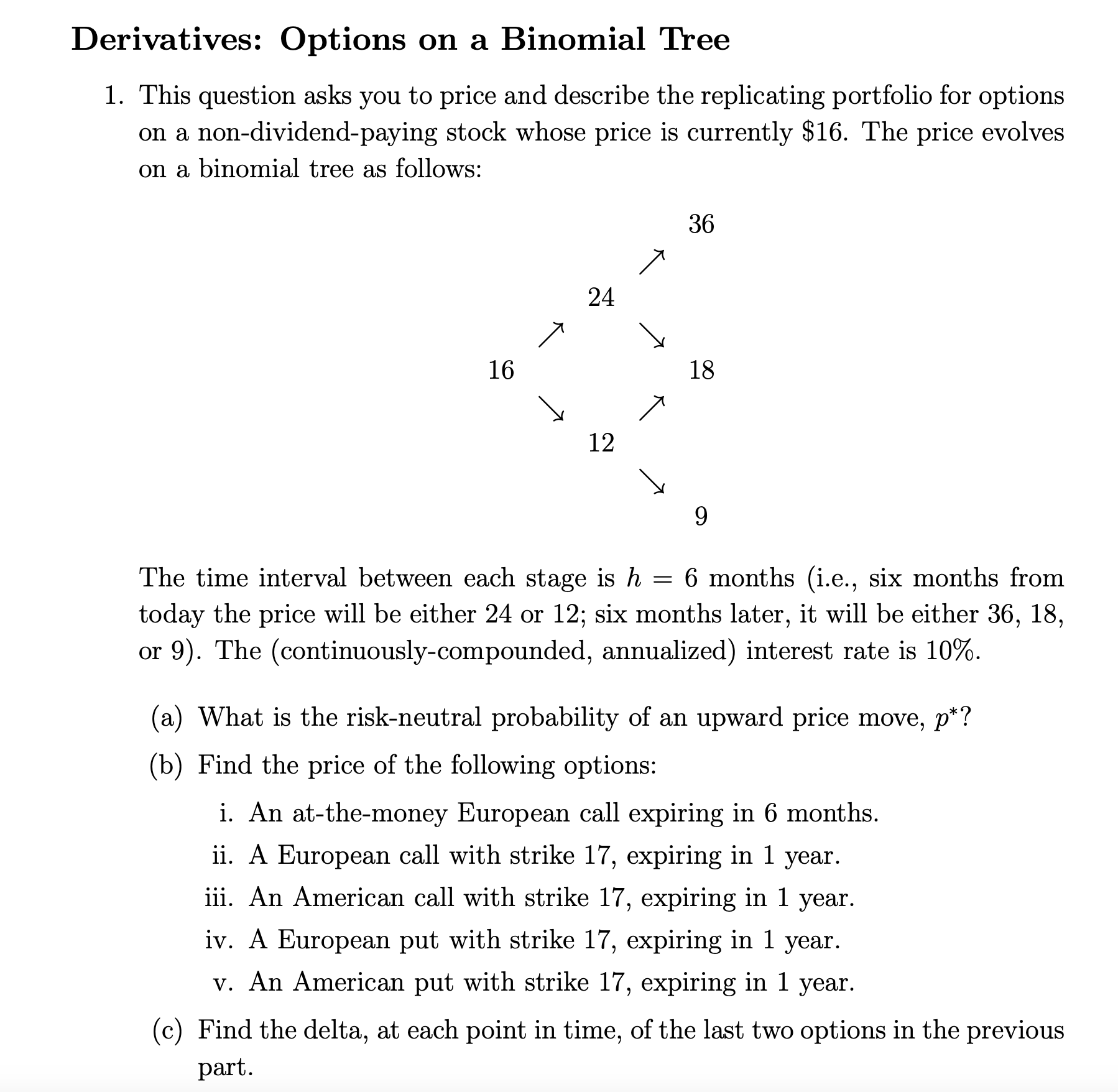

Perivatives: Options on a Binomial Tree 1. This question asks you to price and describe the replicating portfolio for options on a non-dividend-paying stock whose price is currently $16. The price evolves on a binomial tree as follows: The time interval between each stage is h=6 months (i.e., six months from today the price will be either 24 or 12 ; six months later, it will be either 36,18 , or 9 ). The (continuously-compounded, annualized) interest rate is 10%. (a) What is the risk-neutral probability of an upward price move, p ? (b) Find the price of the following options: i. An at-the-money European call expiring in 6 months. ii. A European call with strike 17, expiring in 1 year. iii. An American call with strike 17, expiring in 1 year. iv. A European put with strike 17, expiring in 1 year. v. An American put with strike 17, expiring in 1 year. (c) Find the delta, at each point in time, of the last two options in the previous part

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started