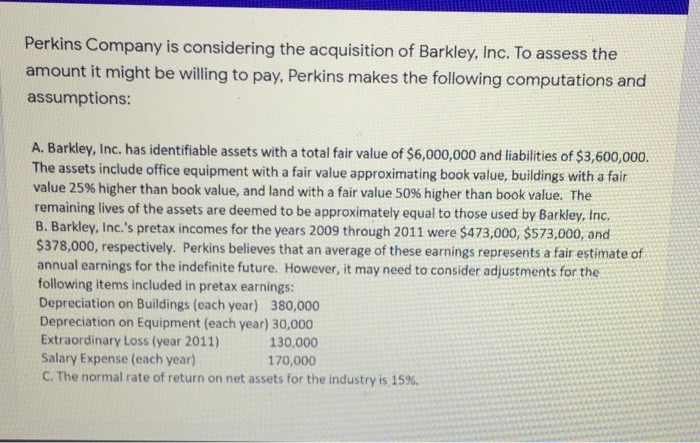

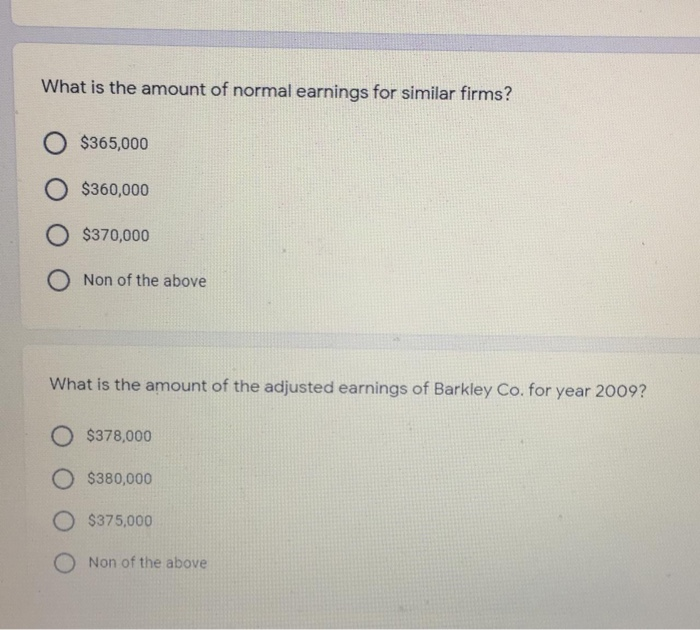

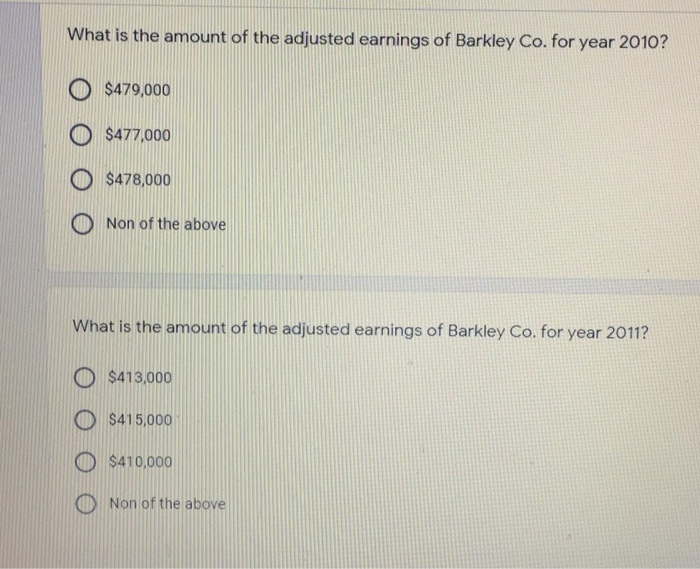

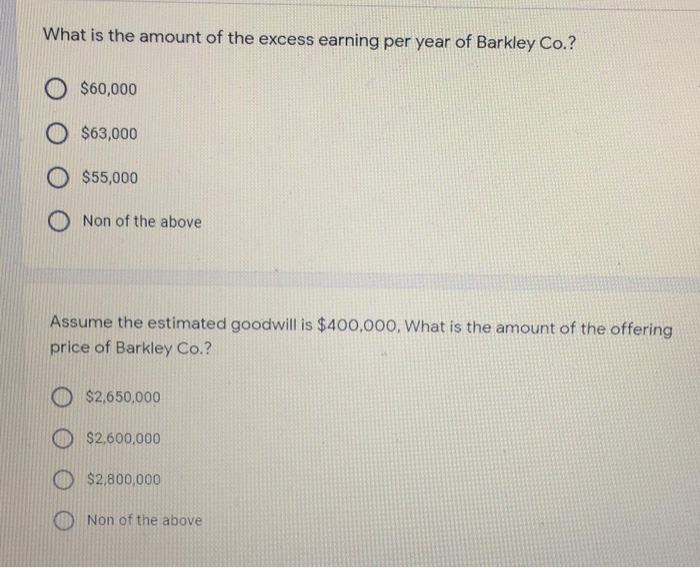

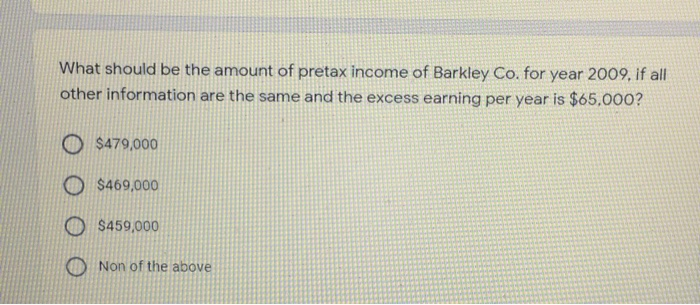

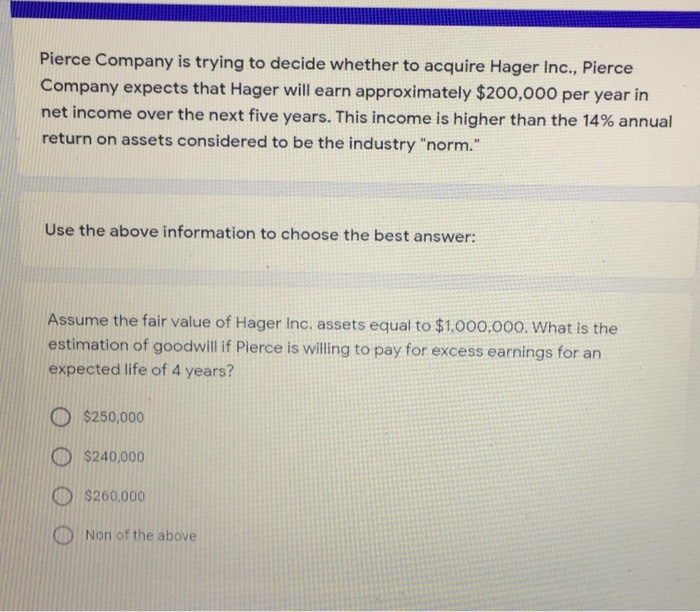

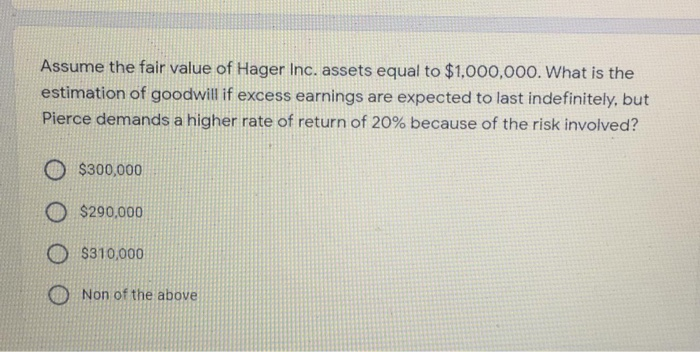

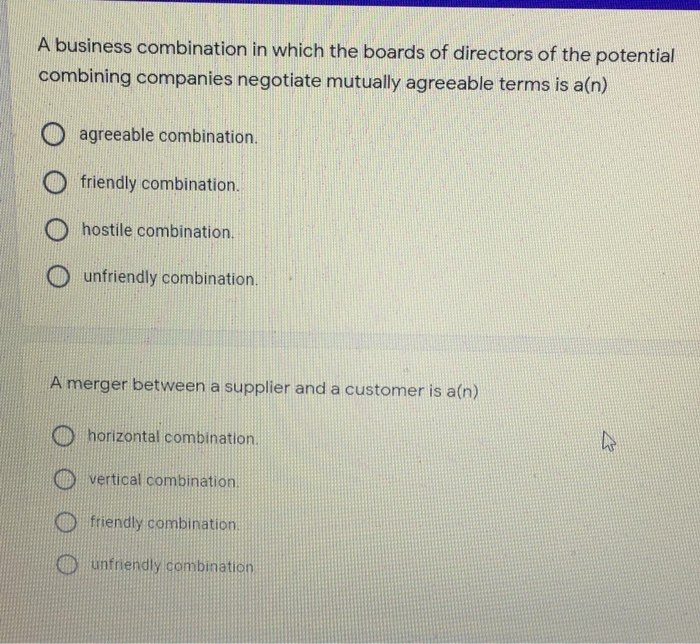

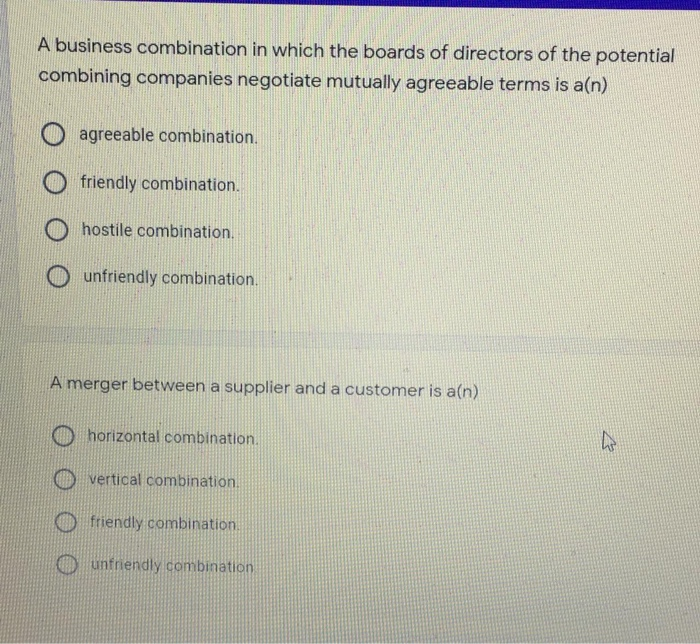

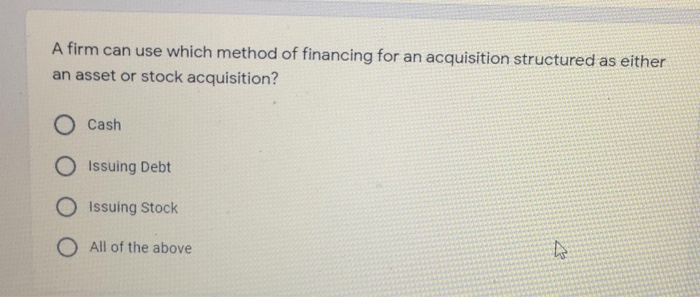

Perkins Company is considering the acquisition of Barkley, Inc. To assess the amount it might be willing to pay, Perkins makes the following computations and assumptions: A. Barkley, Inc. has identifiable assets with a total fair value of $6,000,000 and liabilities of $3,600,000. The assets include office equipment with a fair value approximating book value, buildings with a fair value 25% higher than book value, and land with a fair value 50% higher than book value. The remaining lives of the assets are deemed to be approximately equal to those used by Barkley, Inc. B. Barkley, Inc.'s pretax incomes for the years 2009 through 2011 were $473,000, $573,000, and $378,000, respectively. Perkins believes that an average of these earnings represents a fair estimate of annual earnings for the indefinite future. However, it may need to consider adjustments for the following items included in pretax earnings: Depreciation on Buildings (each year) 380,000 Depreciation on Equipment (each year) 30,000 Extraordinary Loss (year 2011) 130,000 Salary Expense (each year) 170,000 C. The normal rate of return on net assets for the industry is 15%. What is the amount of normal earnings for similar firms? 0 $365,000 O $360,000 $370,000 O Non of the above What is the amount of the adjusted earnings of Barkley Co. for year 2009? O $378,000 O O $380,000 $375,000 O Non of the above What is the amount of the adjusted earnings of Barkley Co. for year 2010? O $479,000 O $477,000 O $478,000 O Non of the above What is the amount of the adjusted earnings of Barkley Co. for year 2011? O $413,000 $415,000 0 $410,000 Non of the above What is the amount of the excess earning per year of Barkley Co.? O O $60,000 $63,000 O $55,000 O Non of the above Assume the estimated goodwill is $400,000, What is the amount of the offering price of Barkley Co.? O $2,650,000 O $2,600,000 O $2,800,000 O Non of the above What should be the amount of pretax income of Barkley Co. for year 2009, if all other information are the same and the excess earning per year is $65,000? O $479,000 O $469,000 O $459,000 Non of the above Pierce Company is trying to decide whether to acquire Hager Inc., Pierce Company expects that Hager will earn approximately $200,000 per year in net income over the next five years. This income is higher than the 14% annual return on assets considered to be the industry "norm." Use the above information to choose the best answer: Assume the fair value of Hager Inc, assets equal to $1,000,000. What is the estimation of goodwill if Pierce is willing to pay for excess earnings for an expected life of 4 years? O $250,000 O $240,000 O $260,000 O Non of the above Assume the fair value of Hager Inc. assets equal to $1,000,000. What is the estimation of goodwill if excess earnings are expected to last indefinitely, but Pierce demands a higher rate of return of 20% because of the risk involved? O $300,000 O $290,000 O $310,000 Non of the above A business combination in which the boards of directors of the potential combining companies negotiate mutually agreeable terms is a(n) agreeable combination. O friendly combination. O hostile combination. O unfriendly combination. A merger between a supplier and a customer is a(n) O horizontal combination vertical combination friendly combination unfriendly combination A business combination in which the boards of directors of the potential combining companies negotiate mutually agreeable terms is a(n) agreeable combination. O friendly combination. O hostile combination. O unfriendly combination. A merger between a supplier and a customer is a(n) O horizontal combination vertical combination friendly combination unfriendly combination A firm can use which method of financing for an acquisition structured as either an asset or stock acquisition? O Cash Issuing Debt 0 Issuing Stock O All of the above