Question

Perkora Bains plc manufactures household fittings. The company uses a system of divisional management, with divisions split by product type. All divisions are treated as

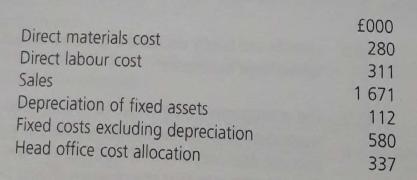

Perkora Bains plc manufactures household fittings. The company uses a system of divisional management, with divisions split by product type. All divisions are treated as profit centres. The accountant in the bathroom division (BD) has gathered the following data for production of the quarterly performance statement which is due for submission to head office:

Of the fixed costs, £37 000 is non-controllable at divisional level. The head office cost allocation relates to research and development and marketing expenditure.

a) Prepare a divisional Performance statement for BD

b) identify the amount of profit that should be used as an indicator of divisional performance.

Direct materials cost Direct labour cost Sales Depreciation of fixed assets Fixed costs excluding depreciation Head office cost allocation 000 280 311 1671 112 580 337

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Direct materials cost 280OOO Direct labour cost 311000 Sales 1 671000 Depreciation of f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started