Question

Hamid prepares his business financial statements to 31 May each year. Because he attended an accounting course at college he knows how to prepare income

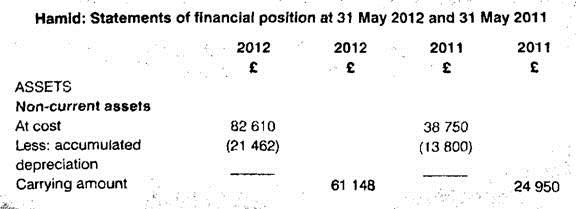

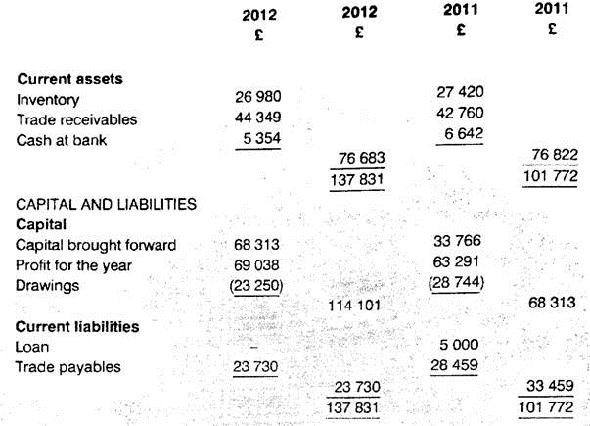

Hamid prepares his business financial statements to 31 May each year. Because he attended an accounting course at college he knows how to prepare income statements and statements of financial position. However, the course did not include the preparation statements of cash flow and Hamid asks you to prepare a statement of cash flows for his business for the year ending 31 May 2012. He supplies you with the following information:

1 There were no disposals of non-current assets during the year.

2 Following your request Hamid supplies the following information relating to cash receipts and payments during the year:

![]()

Required: prepare Hamid’s statement of cash flows for the year ending 31 May 2012 using a) the indirect method; and b) the direct method.

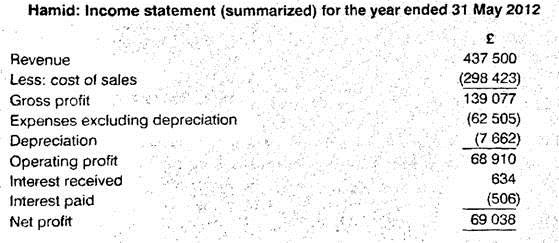

Hamid: Income statement (summarized) for the year ended 31 May 2012 Revenue 437 500 Less: cost of sales (298 423) 139 077 Gross profit Expenses excluding depreciation Depreciation Operating profit Interest received (62 505) (7 662) 68 910 634 Interest paid (506) Net profit 69 038

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started