Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Permata Sdn Bhd manufactures and sells its single Product X through manufacturer agents. The agents are paid a commission of 20% of the selling

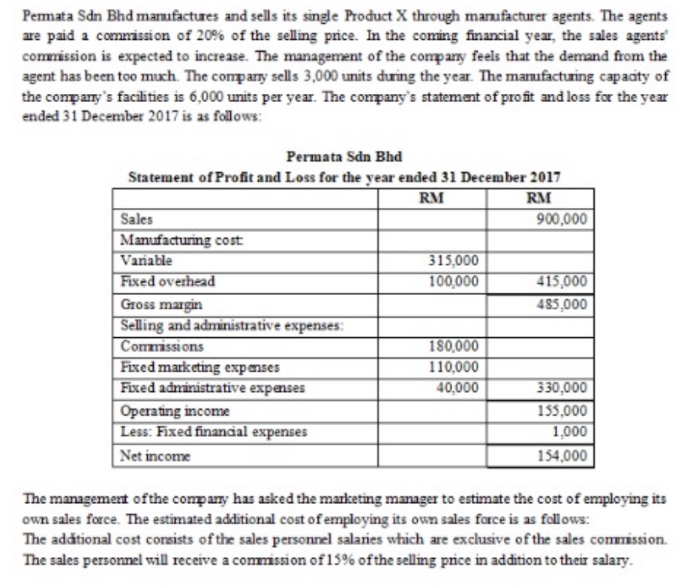

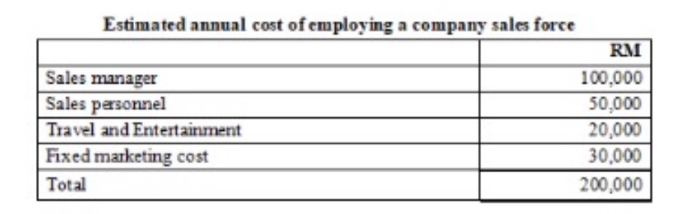

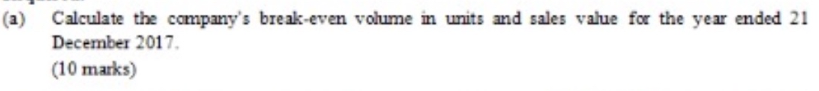

Permata Sdn Bhd manufactures and sells its single Product X through manufacturer agents. The agents are paid a commission of 20% of the selling price. In the coming financial year, the sales agents' commission is expected to increase. The management of the company feels that the demand from the agent has been too much. The company sells 3,000 units during the year. The manufacturing capacity of the company's facilities is 6,000 units per year. The company's statement of profit and loss for the year ended 31 December 2017 is as follows: Permata Sdn Bhd Statement of Profit and Loss for the year ended 31 December 2017 RM Sales RM 900,000 Manufacturing cost Variable 315,000 Fixed overhead 100,000 415,000 Gross margin 485,000 Selling and administrative expenses: Commissions 180,000 Fixed marketing expenses 110,000 Fixed administrative expenses 40,000 330,000 Operating income 155,000 Less: Fixed financial expenses 1,000 Net income 154,000 The management of the company has asked the marketing manager to estimate the cost of employing its own sales force. The estimated additional cost of employing its own sales force is as follows: The additional cost consists of the sales personnel salaries which are exclusive of the sales commission. The sales personnel will receive a commission of 15% of the selling price in addition to their salary. Estimated annual cost of employing a company sales force Sales manager Sales personnel Travel and Entertainment Fixed marketing cost Total RM 100,000 50,000 20,000 30,000 200,000 (a) Calculate the company's break-even volume in units and sales value for the year ended 21 December 2017. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps to estimate the cost of employing the companys own sales force vs continuing with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started