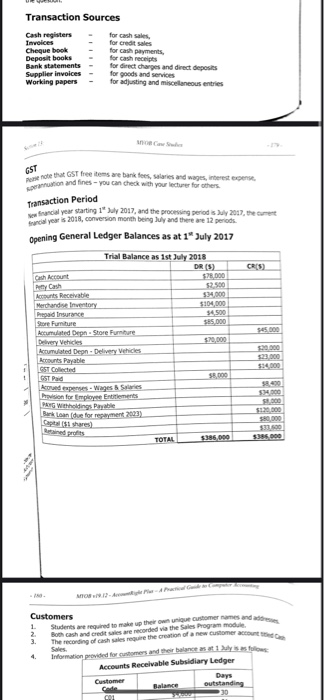

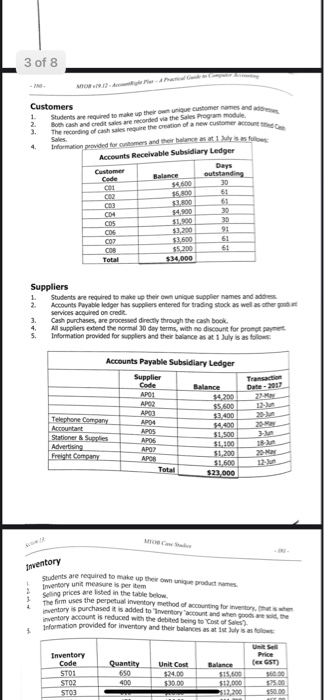

Pero that GST free items are bankes, and wages, ention and fines - you can check wh your before Transaction Sources Cash registers Invoices Cheque book Deposit books Bank statements Supplier invoices Working papers for credit sales for cash payments for direct charges and direct deposits for goods and services for adjusting and miscellaneous entries GST Transaction Period en financial year starting 1" Suy 2017, and the processing periods 2017, the current financial year is 2018, conversion month being Juy and there are 12 periods. Opening General Ledger Balances as at 15 July 2017 Trial Balance as 1st July 2018 DR (5) 528.000 2.500 5104.000 54500 SES.000 545.000 5.20,000 Cash Account heyah A Receivable Merchandise restory Prepaid force Store Furniture Accumulated Den Store Pumbre Delivery Vehicles Accumulated Depn. Delivery Vehicles Rounts Payable CST Collected GST Paid forudsperses Wages & Se Pision for employee Entitlements PAIG Wholdings Payable Bank Loan (due for repayment 2003) 52100 514.000 90400 300 5000 $150 $385.000 TOTAL 5386.00 Customers 1. Students are required to make up the consigue customer names and are 2 Both cash and credit were recorded via the Sales Program module 3. the recording of cash sales require the creation of a new customer account the core 4. Information provided for customers and their balance as a Sely safe Accounts Receivable Subsidiary Ledger Customer Days outstanding 3 of 8 Customers Students toured to make up ther own unique customer names and are 2 or cash and credit as we recorded via the Sales Program module 1 The recording of cash sales mure the creation of a new customer account 4 Information provided for stomers and their balance as aty salon Accounts Receivable Subsidiary Ledger Customer Days Code outstanding 30 53.800 CB3 CD4 COS COS COY 008 Total $1,900 $3,200 13500 $5.200 534,000 39 91 61 61 Suppliers 1 Students are required to make their own unique supplier names and are 2. Accounts Payable ledger has suppliers entered for trading stock as well as the 3. Cash purchases, are processed directly through the cash book 4. All suppliers extend the normal 30 day terms, with no discount for promot payment 5. Information provided for suppliers and their balance as at 1 July is as follows $5.500 Accounts Payable Subsidiary Ledger Supplier Code Balance APOI APOZ APO3 $3,400 Telephone Company APO4 Accountant 14.400 APOS Stationer Supplies $1.500 APOS Advertising APOT Freight Company $1,200 APOS $1,600 Total $23,000 Inventory students are required to make up thrown productes Selling prices are listed in the table below The firm uses the perpetua inventory method of accounting for the inventory account is reduced with the dutite being to Co of Ser? Information provided for inventory and their balances as at 1st Suly is as follows 5 United Unit Cost Balance Inventory Code STOI STO? STOS Quantity 650 400 (GST) 6000 $3000 350.00 Pero that GST free items are bankes, and wages, ention and fines - you can check wh your before Transaction Sources Cash registers Invoices Cheque book Deposit books Bank statements Supplier invoices Working papers for credit sales for cash payments for direct charges and direct deposits for goods and services for adjusting and miscellaneous entries GST Transaction Period en financial year starting 1" Suy 2017, and the processing periods 2017, the current financial year is 2018, conversion month being Juy and there are 12 periods. Opening General Ledger Balances as at 15 July 2017 Trial Balance as 1st July 2018 DR (5) 528.000 2.500 5104.000 54500 SES.000 545.000 5.20,000 Cash Account heyah A Receivable Merchandise restory Prepaid force Store Furniture Accumulated Den Store Pumbre Delivery Vehicles Accumulated Depn. Delivery Vehicles Rounts Payable CST Collected GST Paid forudsperses Wages & Se Pision for employee Entitlements PAIG Wholdings Payable Bank Loan (due for repayment 2003) 52100 514.000 90400 300 5000 $150 $385.000 TOTAL 5386.00 Customers 1. Students are required to make up the consigue customer names and are 2 Both cash and credit were recorded via the Sales Program module 3. the recording of cash sales require the creation of a new customer account the core 4. Information provided for customers and their balance as a Sely safe Accounts Receivable Subsidiary Ledger Customer Days outstanding 3 of 8 Customers Students toured to make up ther own unique customer names and are 2 or cash and credit as we recorded via the Sales Program module 1 The recording of cash sales mure the creation of a new customer account 4 Information provided for stomers and their balance as aty salon Accounts Receivable Subsidiary Ledger Customer Days Code outstanding 30 53.800 CB3 CD4 COS COS COY 008 Total $1,900 $3,200 13500 $5.200 534,000 39 91 61 61 Suppliers 1 Students are required to make their own unique supplier names and are 2. Accounts Payable ledger has suppliers entered for trading stock as well as the 3. Cash purchases, are processed directly through the cash book 4. All suppliers extend the normal 30 day terms, with no discount for promot payment 5. Information provided for suppliers and their balance as at 1 July is as follows $5.500 Accounts Payable Subsidiary Ledger Supplier Code Balance APOI APOZ APO3 $3,400 Telephone Company APO4 Accountant 14.400 APOS Stationer Supplies $1.500 APOS Advertising APOT Freight Company $1,200 APOS $1,600 Total $23,000 Inventory students are required to make up thrown productes Selling prices are listed in the table below The firm uses the perpetua inventory method of accounting for the inventory account is reduced with the dutite being to Co of Ser? Information provided for inventory and their balances as at 1st Suly is as follows 5 United Unit Cost Balance Inventory Code STOI STO? STOS Quantity 650 400 (GST) 6000 $3000 350.00