Answered step by step

Verified Expert Solution

Question

1 Approved Answer

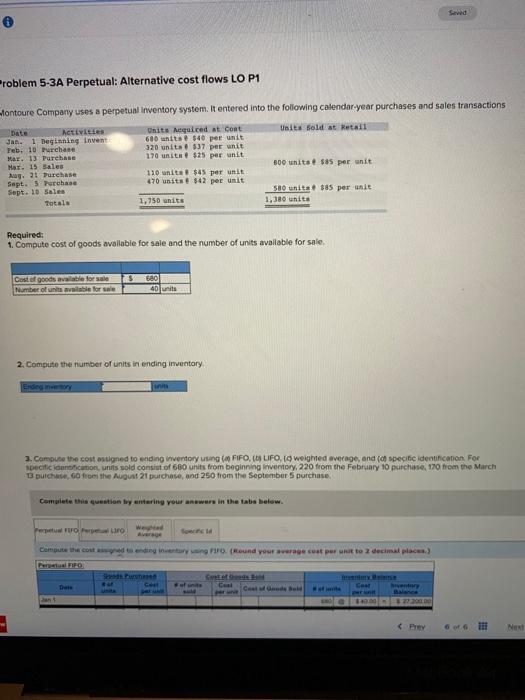

perpetual alternative cost flows help please:) som 6 Problem 5-3A Perpetual: Alternative cost flows LO P1 fontoure Company uses a perpetual Inventory system. It entered

perpetual alternative cost flows

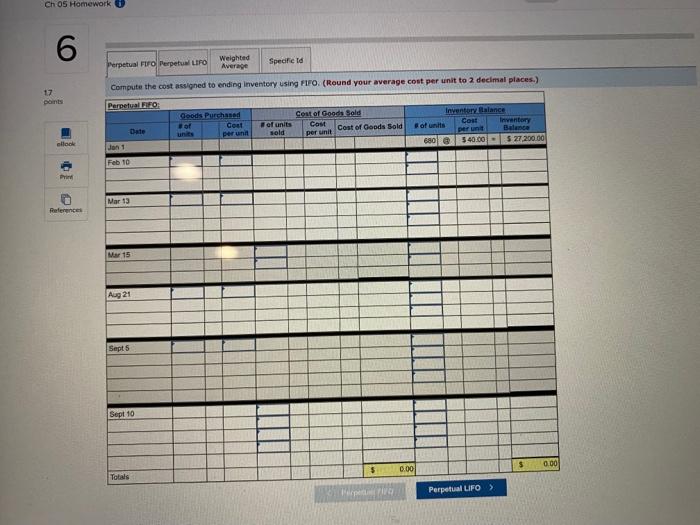

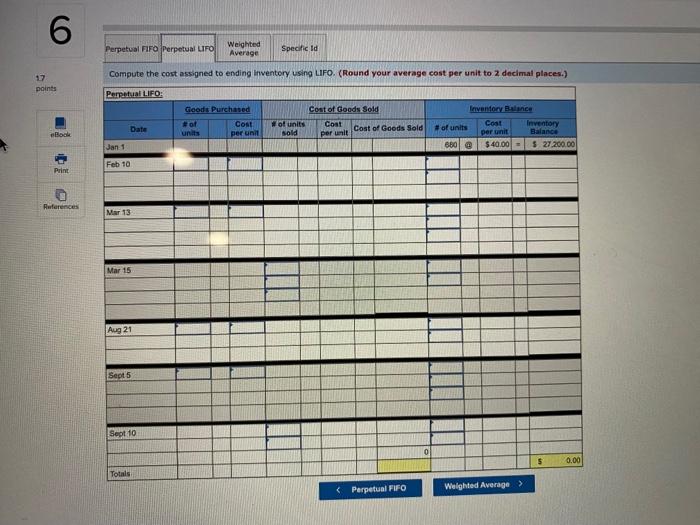

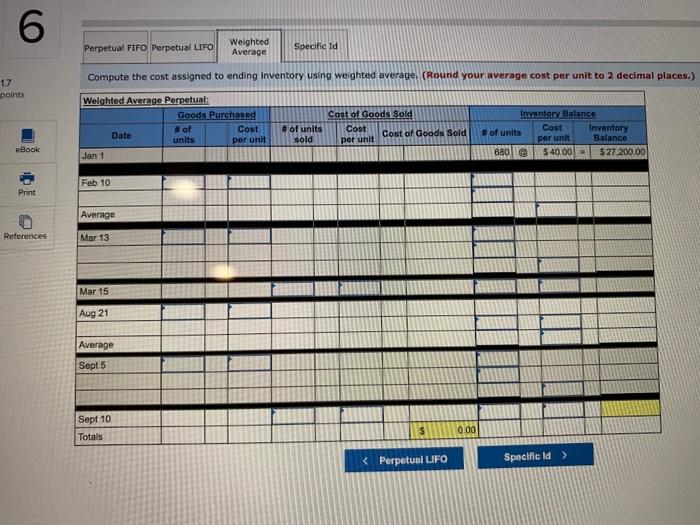

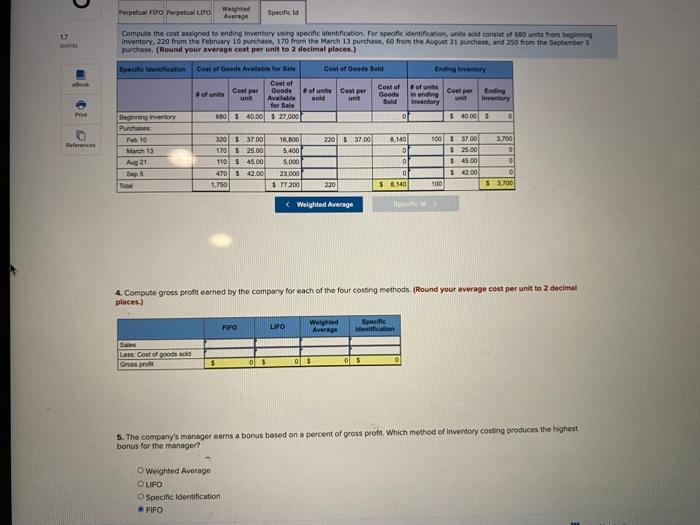

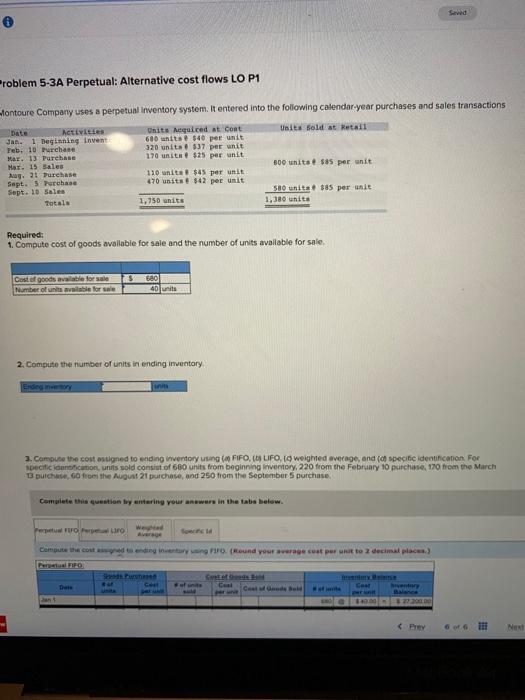

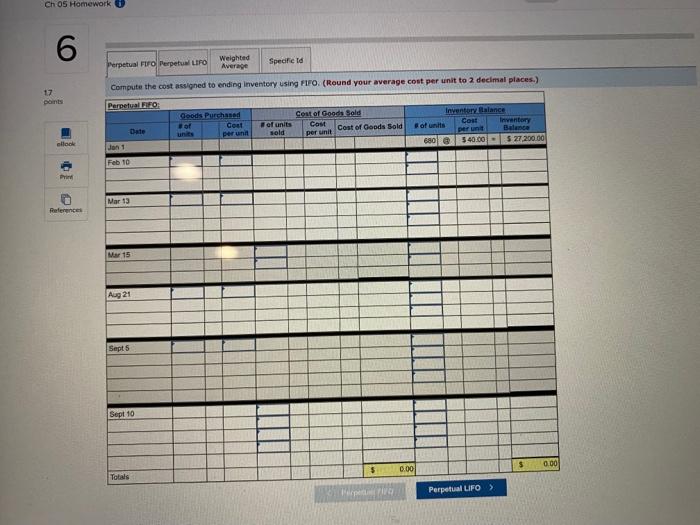

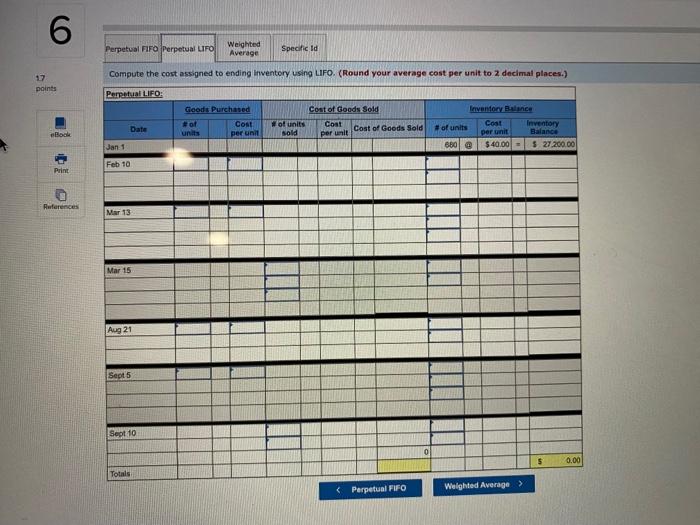

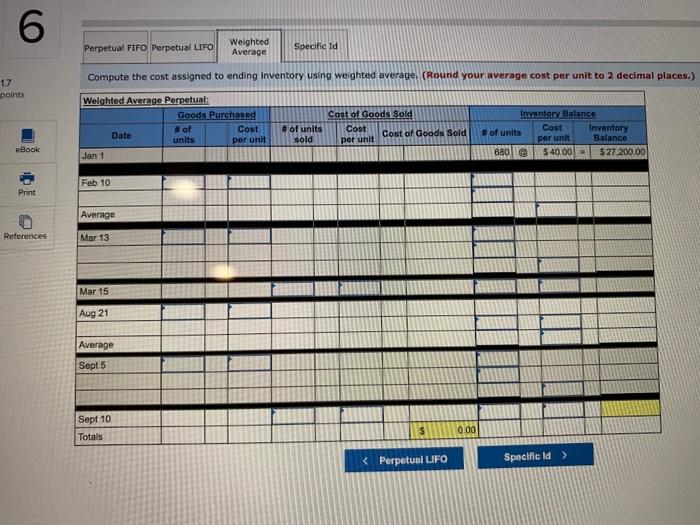

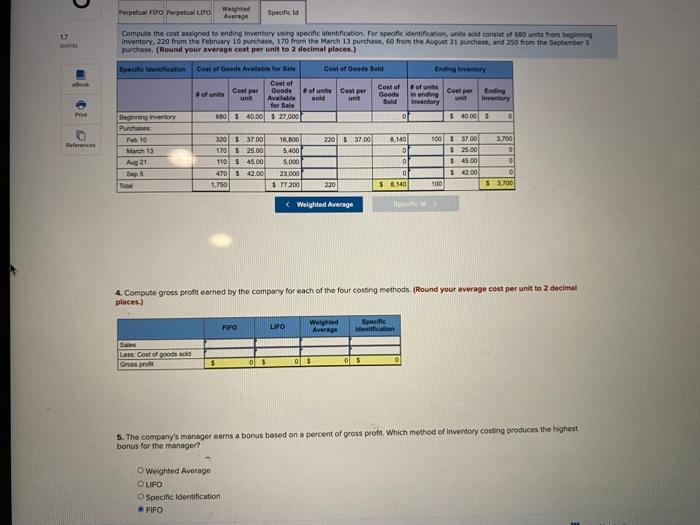

som 6 Problem 5-3A Perpetual: Alternative cost flows LO P1 fontoure Company uses a perpetual Inventory system. It entered into the following calendar-year purchases and sales transactions Units sold at Retail Date Activities JAR. 1 Beginning invent Feb. 10 Purchase Mar. 13 Purchase Mar. 15. Sales A. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Zetals Units Agained at Coat 680 units $40 per unit 320 unitat 537 per unit 170 units $25 per unit 110 units $45 per unit 470 units $42 per unit 800 units + $per unit 580 units $85 per unit 1.380 unita 1.750 units Required: 1. Compute cost of goods available for sale and the number of units available for sale $ Cost of goods available for sale Number of units available for sale 40 units 2. Compute the number of units in ending inventory 3. Campuse the cost ossigned to ending inventory using (FIFO, LIFO. 1 weighted average, and specific identification For specific identification units sold consist of 680 units from beginning inventory. 220 from the February 10 purchase, 170 from the March B purchase of the August 21 purchase, and 250 from the September 5 purchase Complete this question by entering your answers in the tabs below. etw. vero no w Average Compute the couted to ending ustry Profound your average cost per un to 2 decimal places) w Cat AN 00320 ant CEW TE Ne Ch 05 Homework 6 Perpetual Fr Perpetual LIFO Weighted Average Specified Compute the cost assigned to ending inventory using FIFO. (Round your average cost per unit to 2 decimal places.) 17 points Perpetual Goods Purchased of Cout units per un Cost of Goods Sold of units Bold Cost of Goods Sold per unit Cost Inventory Ilalance of units Cost Inventory per unit Balance 340.00 $ 27,200.00 Date ell 630 Jan 1 Feb 10 Print Mar 13 References Mar 15 Aug 21 Sept5 Sept 10 $ 0.00 $ 0.001 Totals Pepe Perpetual LIFO > 0 Perpetual FIFO Perpetual UFO Weighted Average Specific Id Compute the cost assigned to ending inventory using LIFO. (Round your average cost per unit to 2 decimal places.) 17 points Perpetual LIFO Goods Purchased Cost units per unit Cost of Goods Sold of units Cost Sold Cost of Goods Sold per unit Date Inventory Balance Cost Inventory #of units per unit Balance 680 $ 40,00 - $ 27.200.00 Block Jan 1 Feb 10 Print Rwferences Mar 13 Mar 15 Aug 21 Sept5 Sept 10 5 0.00 Totals Perpetual FIFO Weighted Average > 6 Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using weighted average. (Round your average cost per unit to 2 decimal places.) 17 points Weighted Average Perpetual: Goods Purchased of Cost Date units per unit Jan 1 of units sold Cost of Goods Sold Cost Cost of Goods Sold per unit Inventory Balance Cost #of units Inventory per unit Balance 680 @ $40.00 $ 27,200.00 Book Feb 10 Print Average References Mar 13 Mar 15 Aug 21 Average Sept5 Sept 10 Totals 0.00 Perpetual Fero Perpetual LIFO Weighted Average Specield 17 Compute the cost assigned to ending inventory wing specific identification. For specific dentification, unts told consist of GD units from beginning inventory, 220 from the February 10 pct. 170 from the March 13 purchase, from the August 21 purchase, and 256 from the September purchase. (Round your average cost per unit to 2 decimal places.) Specite identication Conte de Said Ending wory . Coupe Cost of Good Astor tale Cost of Goode unit Available for Sale 650 540.00 $ 27.000 of units Cost per sold Un Coster Goods Sold of units ning Inventory Coste unit Ending imento c $40.000 0 220 S 37,00 Reference Beginning inventory Purchases: Feb 10 March 13 Aug 21 Sep 5 3.700 0 320 33700 170 $ 25,00 110 $ 45.00 470 $42.00 1,750 16 500 5.400 5.000 23.000 2001 8.140 0 0 0 5 B.140 100 3700 $ 2.00 $45.00 $ 47.00 100 0 53.700 220 help please:)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started