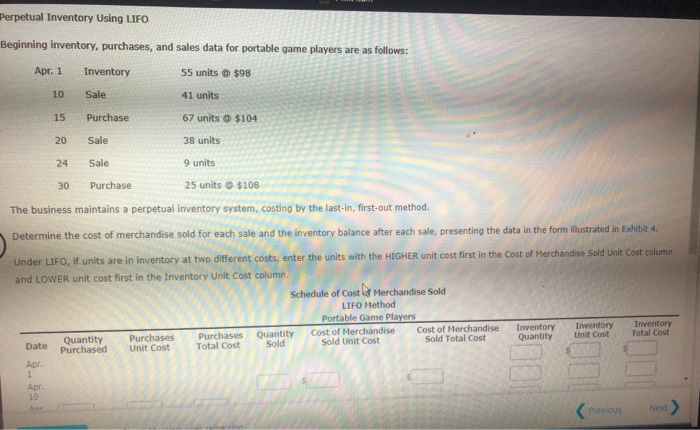

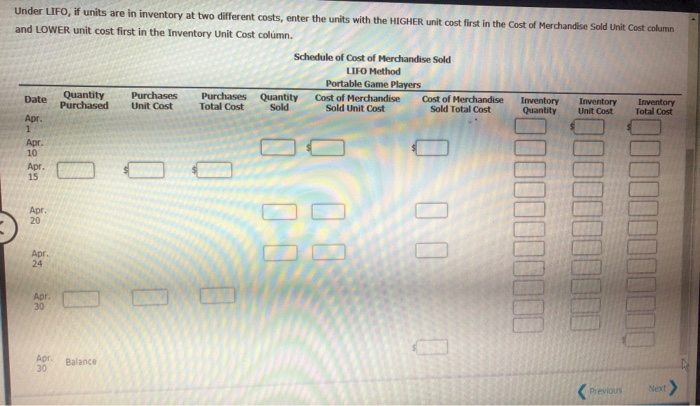

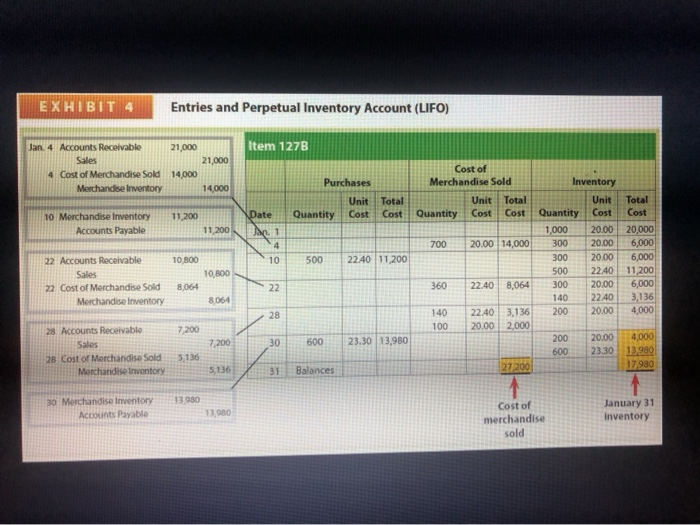

Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for portable game players are Apr. 1 Inventory 55 units $98 Sale 41 units Purchase 67 units $104 Sale 38 units 10 20 24 Sale 9 units Purchase 25 units $108 The business maintains a perpetual inventory system, costing by the last-In, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4 Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Merchandise Sold LIFO Method Portable Game Players Quantity Purchases Purchases Quantity Cost of Merchandise Cost of Merchandise Triventory Inventory Inventory Date Purchased Unit Cost Total Cost Sold Sold Unit Cost Sold Total Cost Quantity Unit Cost Total Cast (Previous Next Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Merchandise Sold LIFO Method Portable Game Players Quantity Purchases Purchases Quantity Cost of Merchandise Cost of Merchandise Inventory Inventory Inventory Purchased Unit Cost Total Cost Sold Sold Unit Cost Sold Total Cost Quantity Unit Cost Total Cost 1100100010011 Balance (nerous Next EXHIBIT 4 Entries and Perpetual Inventory Account (LIFO) Item 127B Jan. 4 Accounts Receivable Sales 4 Cost of Merchandise Sold Merchandise Inventory 21,000 21,000 14000 14,000 Inventory Purchases Unit Quantity Cost Cost of Merchandise Sold Unit Total Quantity Cost Cost Total Cost 11.200 Date 10 Merchandise Inventory Accounts Payable 11.200 Quantity 1,000 300 300 Unit Cost 20.00 20.00 20.00 22.40 Total Cost 20,000 6,000 6,000 11,200 700 20.00 14,000 10 800 10 500 2240 11,200 10,800 500 22 Accounts Receivable Sales 22 Cost of Merchandise Sold Merchandise Inventory 8064 360 22.40 8,064 8.064 300 140 200 2240 20.00 3,136 4,000 140 100 22.40 20.00 3,136 2,000 7 200 7,200 30 600 23.30 13,950 200 28 Accounts Receivable Sales 28 Cost of Merchandise Sold Merchandise Inventory 20.00 23.30 600 4,000 13980 17980 5,136 5,136 31 Balances 27200 30 Merchandise Inventory Accounts Payable 13980 1300 Cost of merchandise sold January 31 Inventory