Perpetual LIFO ^

Perpetual LIFO ^

2. Weighted Average

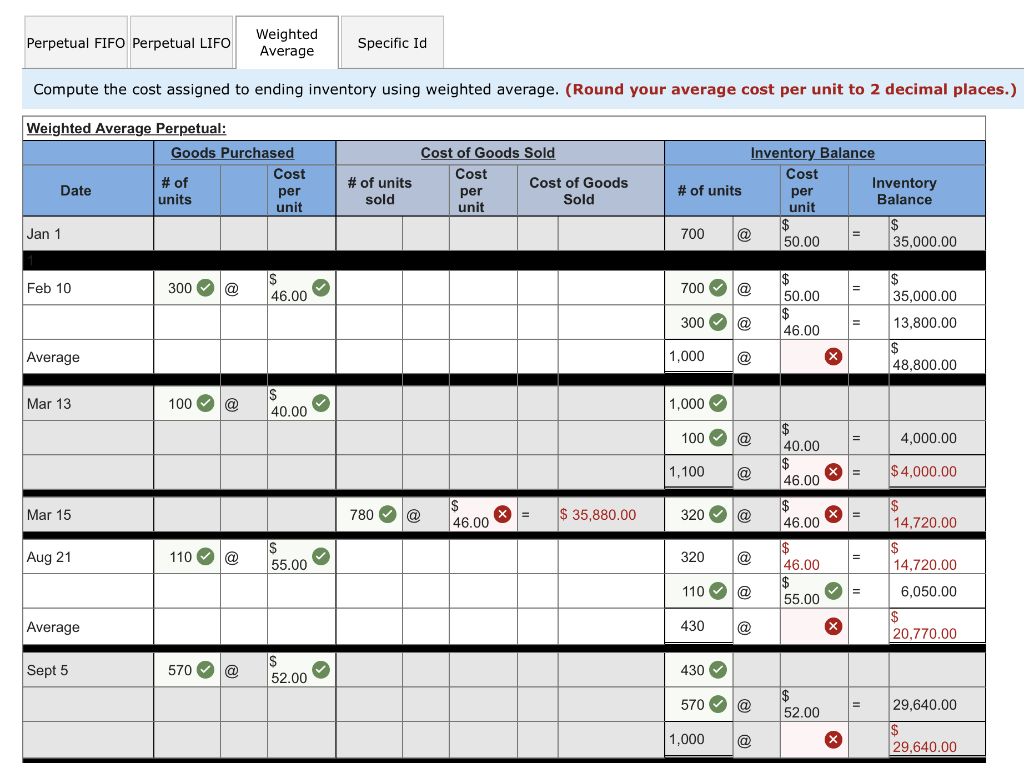

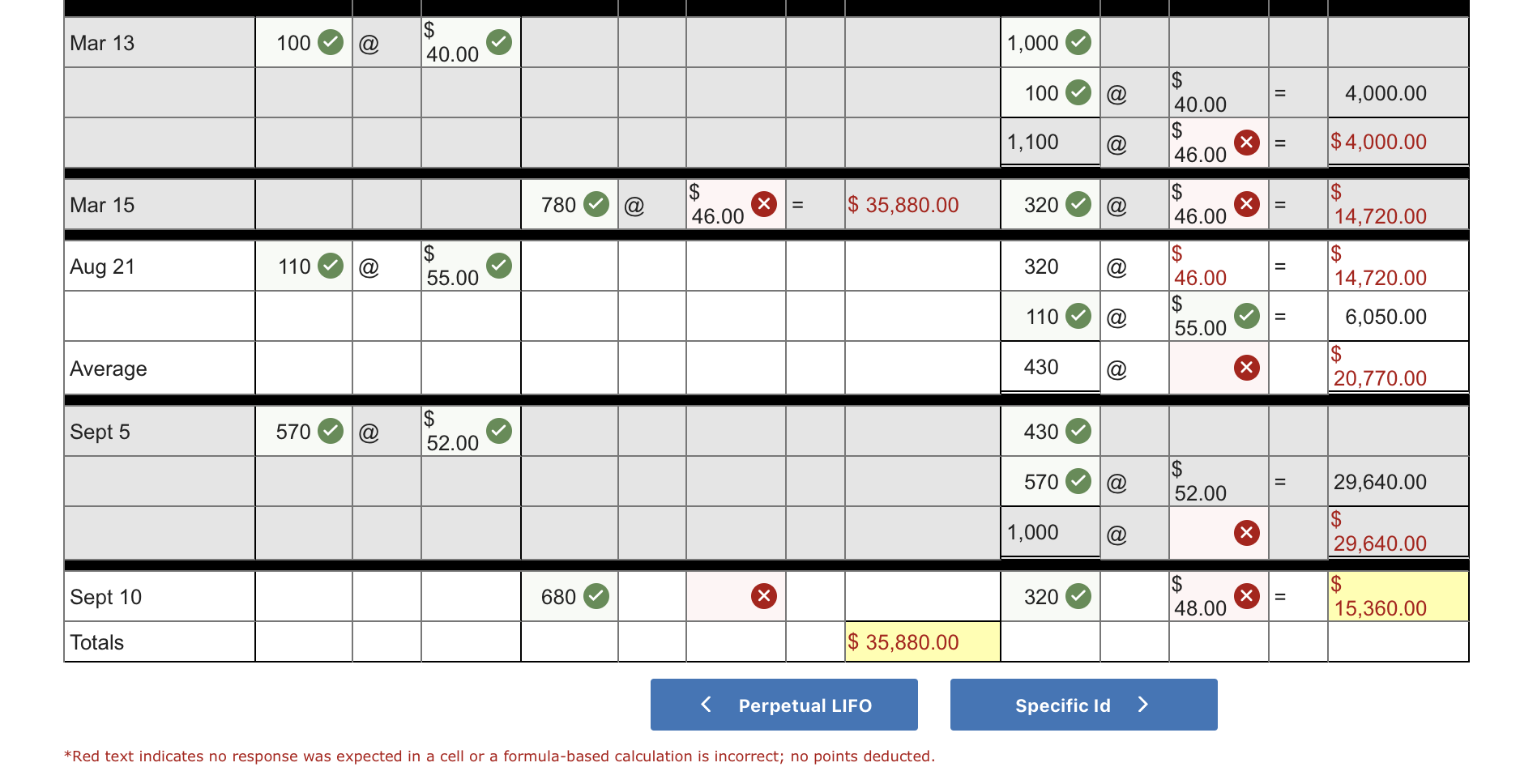

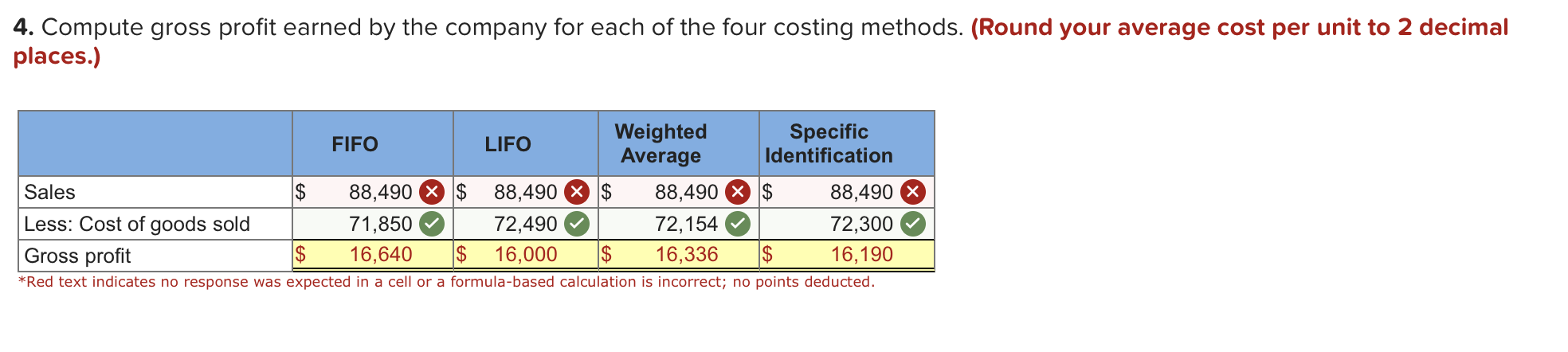

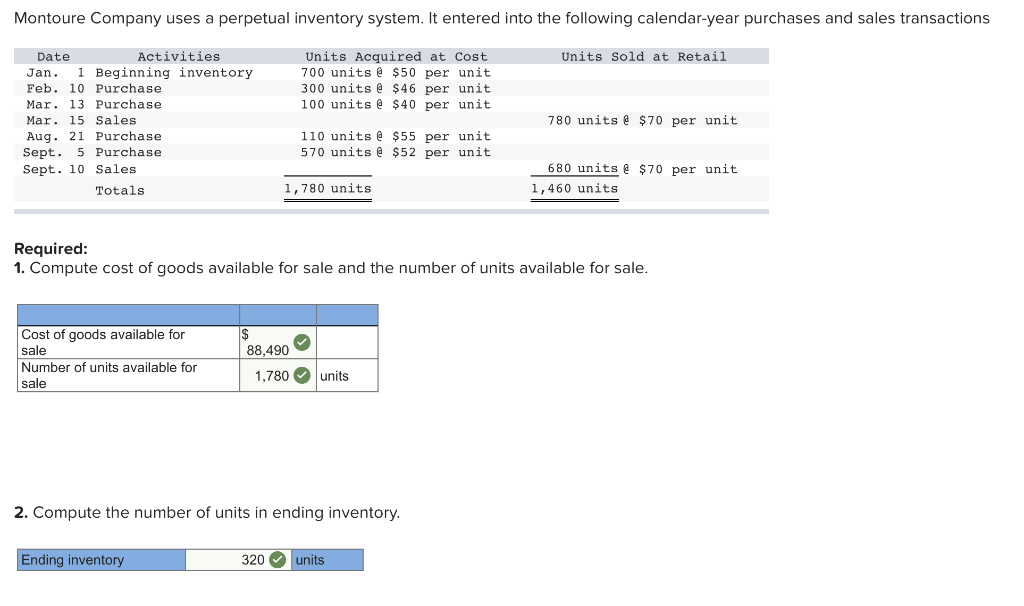

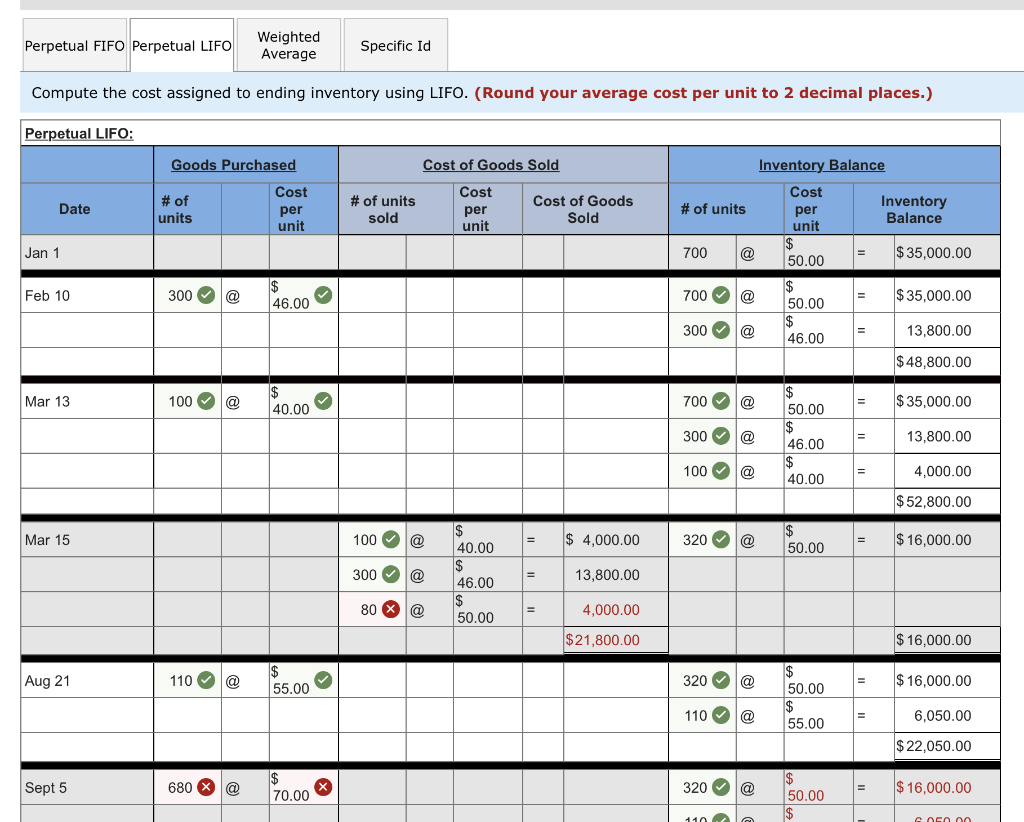

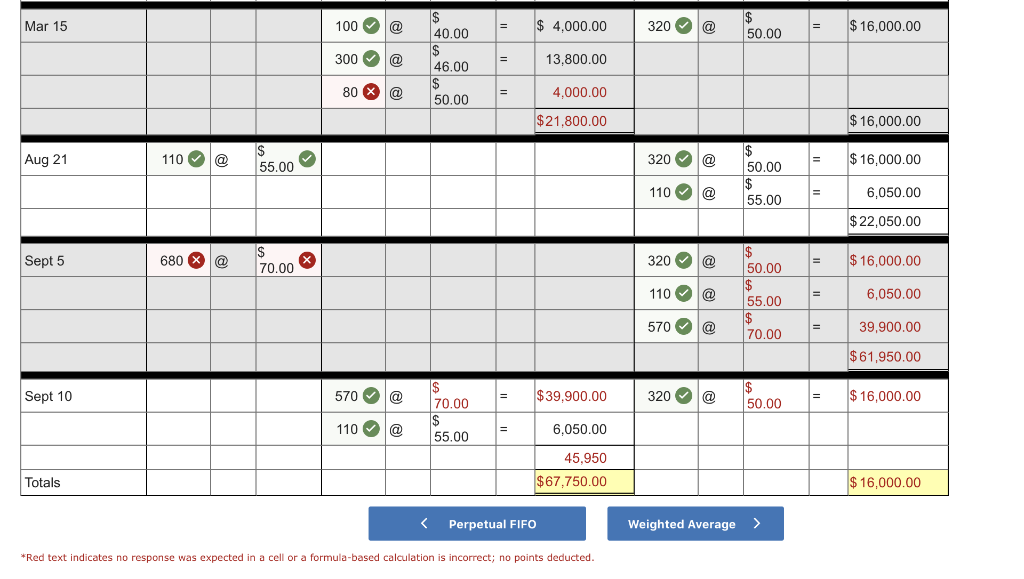

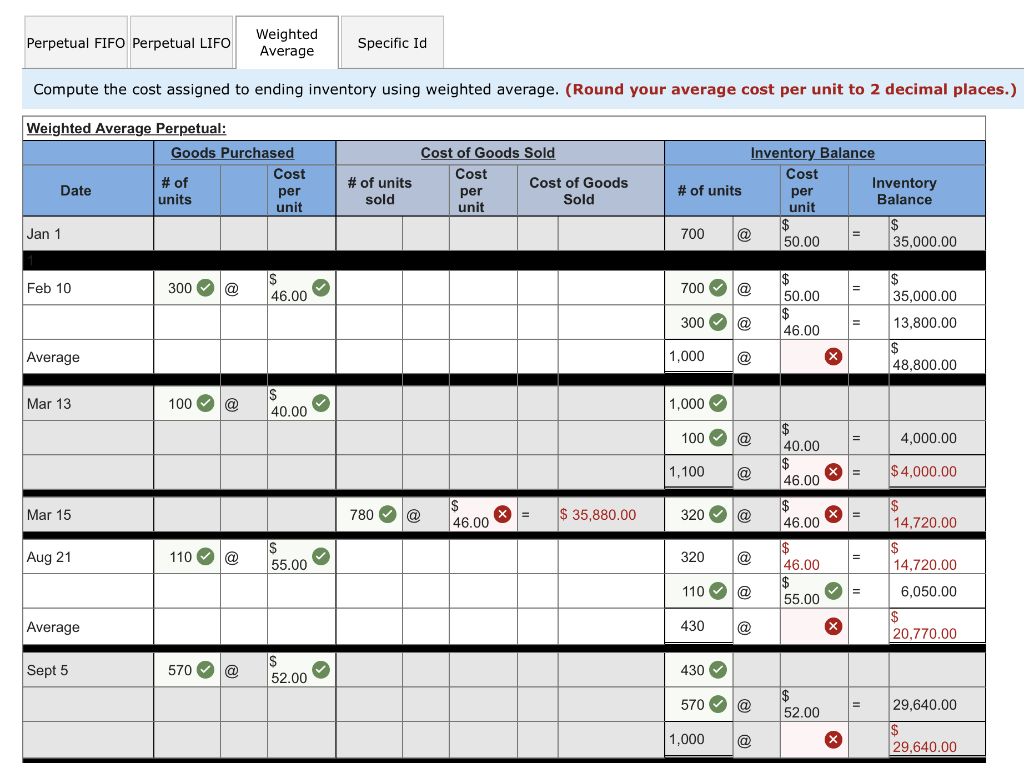

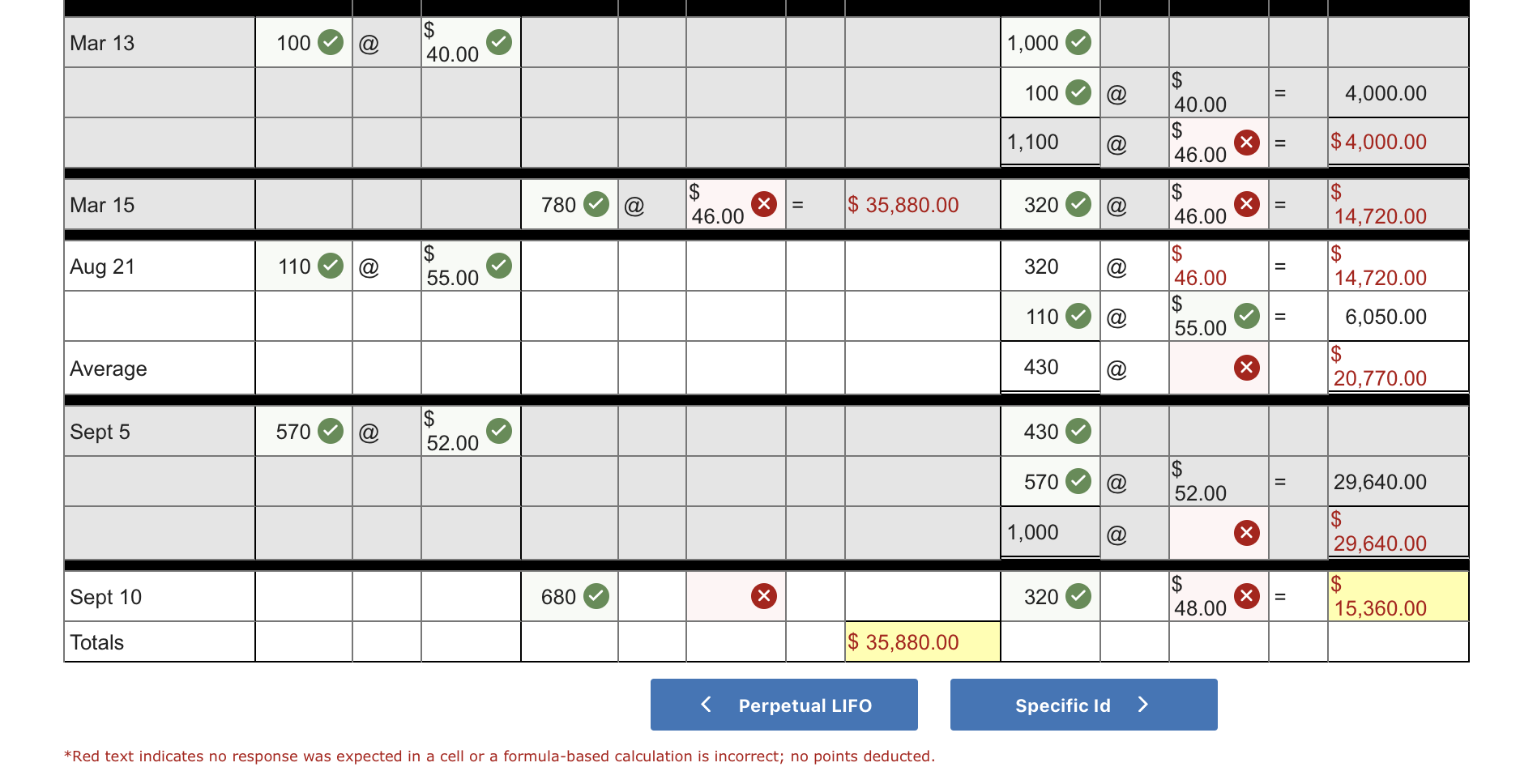

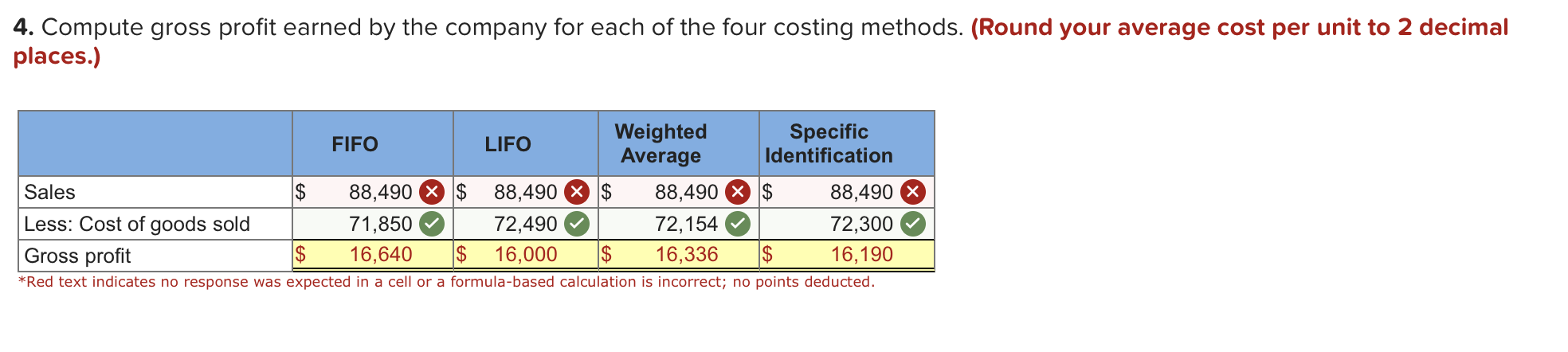

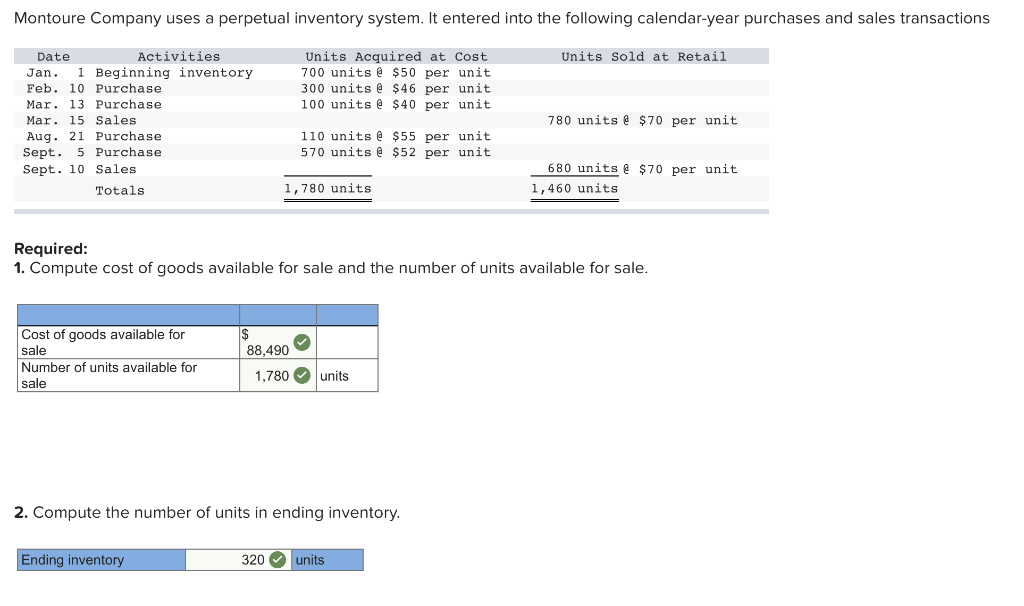

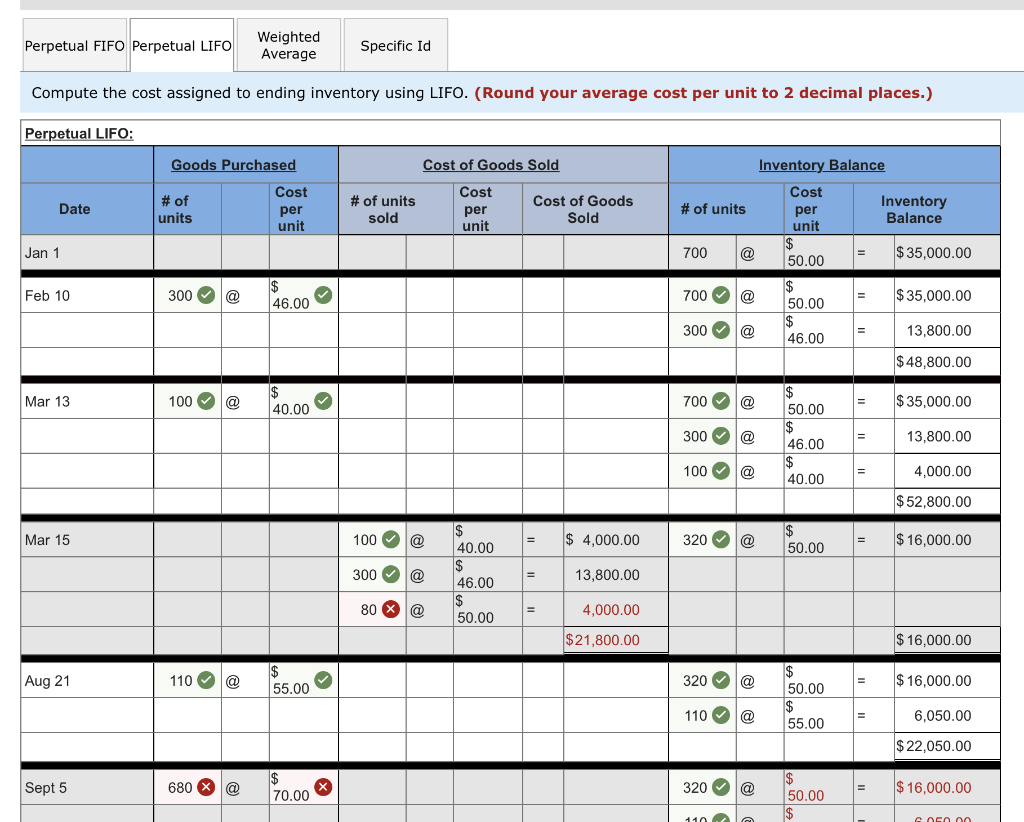

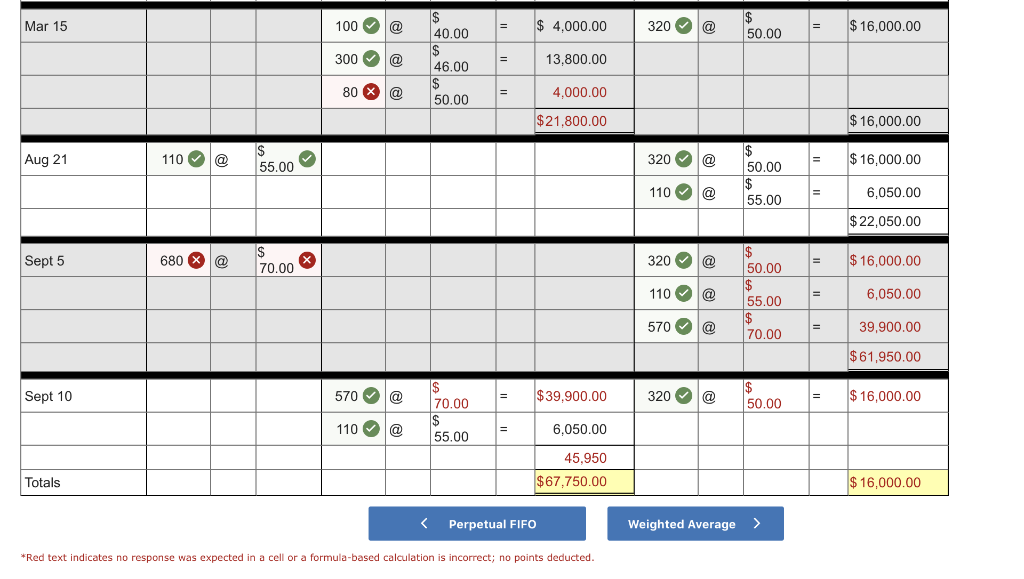

Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Units Sold at Retail Units Acquired at Cost 700 units @ $50 per unit 300 units @ $46 per unit 100 units @ $40 per unit Date Activities Jan. 1 Beginning inventory Feb. 10 Purchase Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Totals 780 units @ $70 per unit 110 units @ $55 per unit 570 units @ $52 per unit 680 units @ $70 per unit 1,460 units 1,780 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. $ 88,490 Cost of goods available for sale Number of units available for sale 1,780 units 2. Compute the number of units in ending inventory. Ending inventory 320 units Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using LIFO. (Round your average cost per unit to 2 decimal places.) Perpetual LIFO: Goods Purchased Cost of Goods Sold Date # of units Cost per unit # of units sold Cost per unit Cost of Goods Sold Inventory Balance Cost # of units Inventory per Balance unit $ 700 @ 50.00 $ 35,000.00 $ 700 @ 50.00 $ 35,000.00 Jan 1 Feb 10 300 @ $ 46.00 300 @ = 13,800.00 46.00 $ 48,800.00 Mar 13 100 @ 700 @ 40.00 $ 50.00 $ 35,000.00 300 @ = 46.00 13,800.00 100 @ = 40.00 4,000.00 $ 52,800.00 Mar 15 100 $ 4,000.00 320 @ $ 50.00 $ 16,000.00 300 @ $ 40.00 $ 46.00 $ 50.00 13,800.00 80 X @ 4,000.00 $21,800.00 $ 16,000.00 Aug 21 110 @ $ 55.00 320 @ $ 50.00 = $ 16,000.00 110 @ 55.00 6,050.00 $ 22,050.00 Sept 5 680 X @ 70.00 320 @ 50.00 $ 16,000.00 110 Connn Mar 15 100 @ $ 4,000.00 320 a $ 50.00 $ 16,000.00 300 @ $ 40.00 $ 46.00 $ 50.00 13,800.00 80 X @ 4,000.00 $21,800.00 $ 16,000.00 Aug 21 110 @ $ 55.00 320 $ 16,000.00 . $ 50.00 $ 55.00 110 = 6,050.00 $ 22,050.00 Sept 5 680 X @ S 70.00 320 @ $ 16,000.00 110 @ 50.00 $ 55.00 $ 70.00 6,050.00 570 @ 39,900.00 $61,950.00 Sept 10 570 @ $39.900.00 320 @ $ 50.00 $ 16,000.00 $ 70.00 $ 55.00 110 @ 6,050.00 45,950 $67,750.00 Totals $ 16,000.00 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using weighted average. (Round your average cost per unit to 2 decimal places.) Weighted Average Perpetual: Goods Purchased Cost # of Date units per unit Jan 1 # of units sold Cost of Goods Sold Cost Cost of Goods per Sold unit Inventory Balance Cost Inventory per Balance unit # of units 700 @ 50.00 35,000.00 s Feb 10 300 @ > 46.00 700 @ $ 50.00 = $ 35,000.00 300 @ 46.00 13,800.00 Average 1,000 @ X $ 48,800.00 Mar 13 100 @ 40.00 1,000 100 @ 4,000.00 1,100 @ $ 40.00 $ 46.00 $ 46.00 x = $ 4,000.00 Mar 15 780 @ $ 46.00 $ 35,880.00 320 @ x = $ 14,720.00 Aug 21 110 @ S 55.00 320 @ 46.00 $ 14,720.00 110 @ = 6,050.00 55.00 > > Average 430 @ $ 20,770.00 Sept 5 570 @ 430 52.00 570 @ 29,640.00 52.00 1,000 $ 29,640.00 Mar 13 100 a $ 40.00 1,000 100 a 11 4,000.00 40.00 1,100 @ = $ 4,000.00 46.00 Mar 15 780 @ $ 46.00 x = $ 35,880.00 320 @ 46.00 $ 14,720.00 $ 14,720.00 110 Aug 21 $ 55.00 320 Il @ 46.00 110 = 6,050.00 55.00 Average 430 $ 20,770.00 Sept 5 570 $ 52.00 430 570 - 52.00 29,640.00 $ 29,640.00 1,000 Sept 10 680 320 $ 15,360.00 48.00 Totals $ 35,880.00 Perpetual LIFO Specific Id *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) Weighted Specific FIFO LIFO Average Identification Sales $ 88,490 X $ 88,490 $ 88,490 X $ 88,490 Less: Cost of goods sold 71,850 72,490 72,154 72,300 Gross profit 16,640 $ 16,000 16,336 $ 16,190 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. CA

Perpetual LIFO ^

Perpetual LIFO ^