Perpetuum Mobile Inc. is an all-equity firm that generates $6m in annual after-tax cash flows that are expected to remain constant forever. It's cost

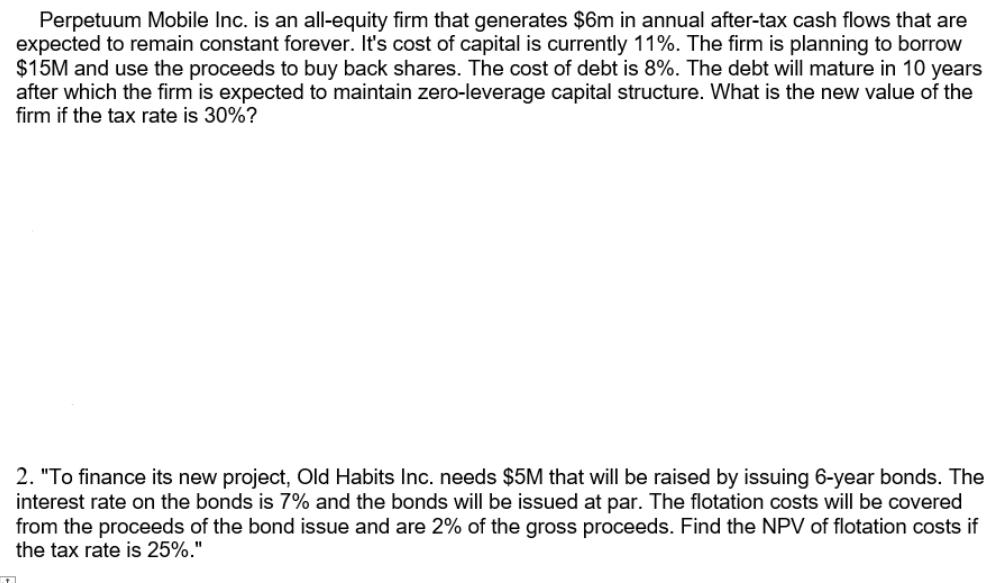

Perpetuum Mobile Inc. is an all-equity firm that generates $6m in annual after-tax cash flows that are expected to remain constant forever. It's cost of capital is currently 11%. The firm is planning to borrow $15M and use the proceeds to buy back shares. The cost of debt is 8%. The debt will mature in 10 years after which the firm is expected to maintain zero-leverage capital structure. What is the new value of the firm if the tax rate is 30%? 2. "To finance its new project, Old Habits Inc. needs $5M that will be raised by issuing 6-year bonds. The interest rate on the bonds is 7% and the bonds will be issued at par. The flotation costs will be covered from the proceeds of the bond issue and are 2% of the gross proceeds. Find the NPV of flotation costs if the tax rate is 25%."

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the new value of the firm after the share buyback and borrowing we need to calculate the present value of the aftertax cash flows and t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started