Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Personal and Family finance. I already up load the question number 1 earlier. Personal and Family finance. Rest I post question 2 to 6. Question

Personal and Family finance.

I already up load the question number 1 earlier. Personal and Family finance. Rest I post question 2 to 6.

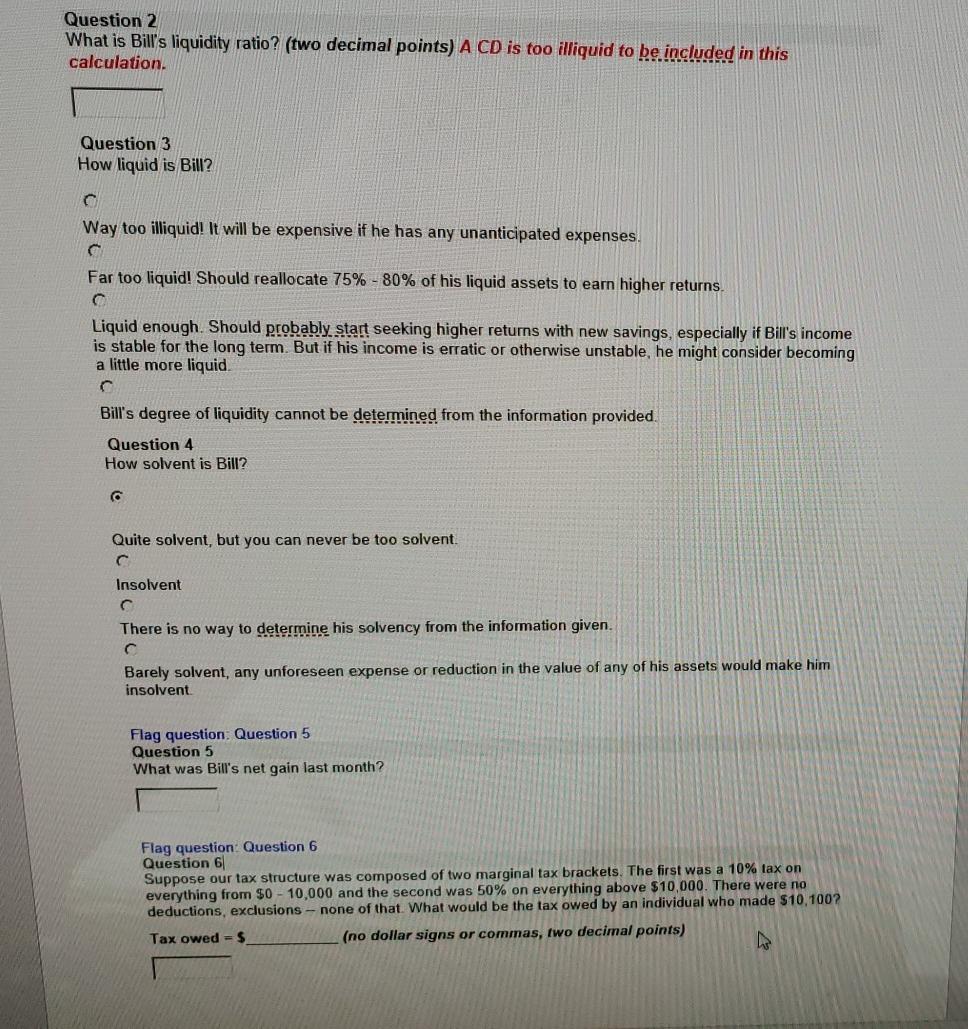

Question 2 What is Bill's liquidity ratio? (two decimal points) A CD is too illiquid to be included in this calculation. Question 3 How liquid is Bill? Way too illiquid! It will be expensive if he has any unanticipated expenses. Far too liquid! Should reallocate 75% - 80% of his liquid assets to earn higher returns Liquid enough. Should probably start seeking higher returns with new savings, especially if Bill's income is stable for the long term. But if his income is erratic or otherwise unstable, he might consider becoming a little more liquid. Bill's degree of liquidity cannot be determined from the information provided. Question 4 How solvent is Bill? Quite solvent, but you can never be too solvent. Insolvent There is no way to determine his solvency from the information given. Barely solvent, any unforeseen expense or reduction in the value of any of his assets would make him insolvent Flag question: Question 5 Question 5 What was Bill's net gain last month? Flag question: Question 6 Question 6 Suppose our tax structure was composed of two marginal tax brackets. The first was a 10% tax on everything from $0 - 10,000 and the second was 50% on everything above $10,000. There were no deductions, exclusions - none of that. What would be the tax owed by an individual who made $10,100? Tax owed - $ (no dollar signs or commas, two decimal points) Question 2 What is Bill's liquidity ratio? (two decimal points) A CD is too illiquid to be included in this calculation. Question 3 How liquid is Bill? Way too illiquid! It will be expensive if he has any unanticipated expenses. Far too liquid! Should reallocate 75% - 80% of his liquid assets to earn higher returns Liquid enough. Should probably start seeking higher returns with new savings, especially if Bill's income is stable for the long term. But if his income is erratic or otherwise unstable, he might consider becoming a little more liquid. Bill's degree of liquidity cannot be determined from the information provided. Question 4 How solvent is Bill? Quite solvent, but you can never be too solvent. Insolvent There is no way to determine his solvency from the information given. Barely solvent, any unforeseen expense or reduction in the value of any of his assets would make him insolvent Flag question: Question 5 Question 5 What was Bill's net gain last month? Flag question: Question 6 Question 6 Suppose our tax structure was composed of two marginal tax brackets. The first was a 10% tax on everything from $0 - 10,000 and the second was 50% on everything above $10,000. There were no deductions, exclusions - none of that. What would be the tax owed by an individual who made $10,100? Tax owed - $ (no dollar signs or commas, two decimal points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started