Answered step by step

Verified Expert Solution

Question

1 Approved Answer

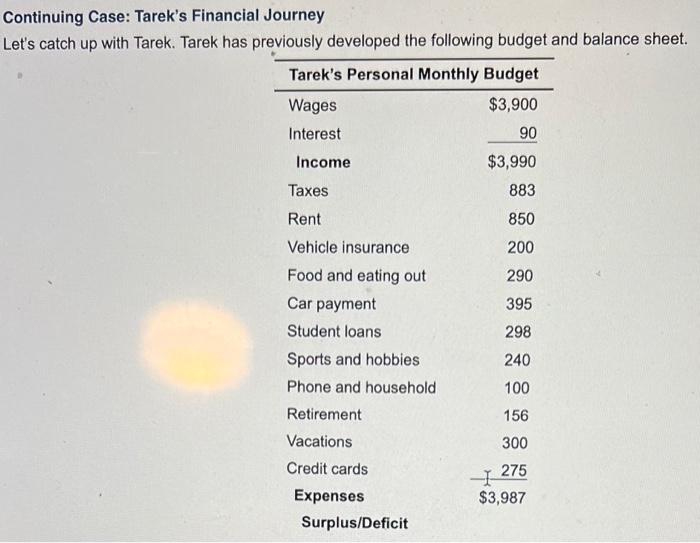

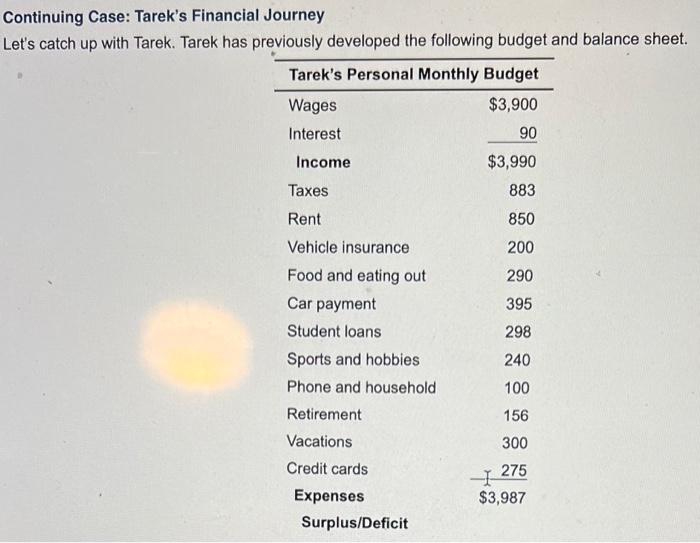

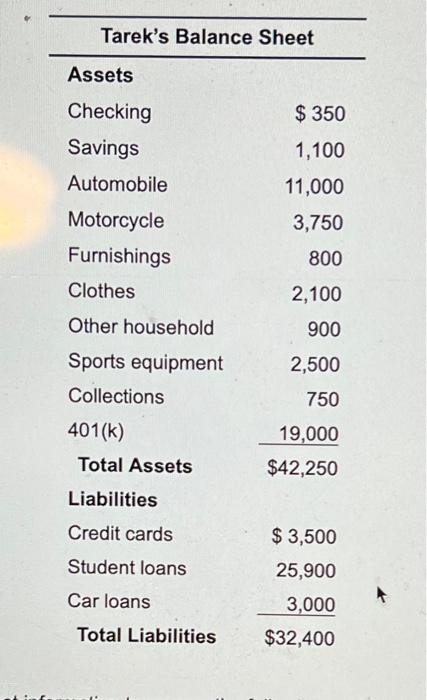

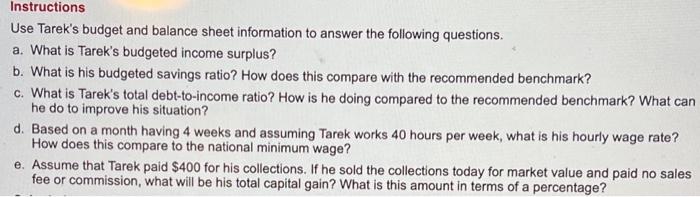

Personal finance class BTW Continuing Case: Tarek's Financial Journey Let's catch up with Tarek. Tarek has previously developed the following budget and balance sheet. Tarek's

Personal finance class BTW

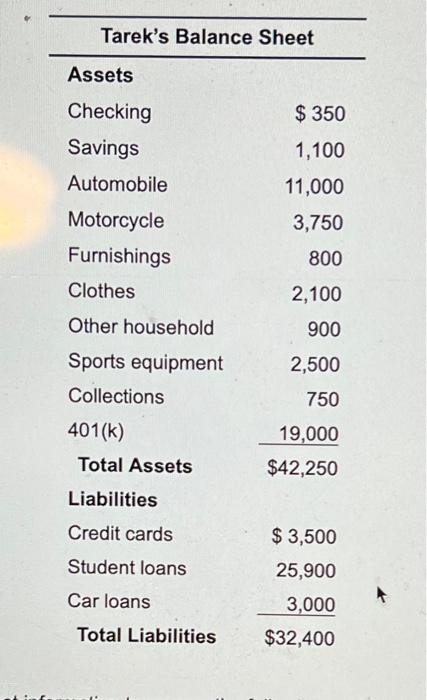

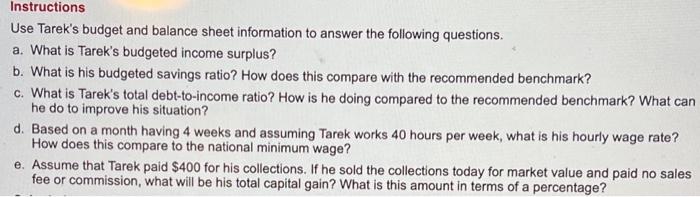

Continuing Case: Tarek's Financial Journey Let's catch up with Tarek. Tarek has previously developed the following budget and balance sheet. Tarek's Personal Monthly Budget Wages $3,900 Interest Income $3,990 Taxes 883 90 Rent 850 200 290 395 298 240 Vehicle insurance Food and eating out Car payment Student loans Sports and hobbies Phone and household Retirement Vacations Credit cards Expenses Surplus/Deficit 100 156 300 -1 275 $3,987 Tarek's Balance Sheet Assets $ 350 1,100 11,000 Checking Savings Automobile Motorcycle Furnishings Clothes 3,750 800 2,100 900 Other household 2,500 750 Sports equipment Collections 401(k) Total Assets 19,000 $42,250 Liabilities Credit cards $ 3,500 Student loans Car loans 25,900 3,000 $32,400 Total Liabilities Instructions Use Tarek's budget and balance sheet information to answer the following questions. a. What is Tarek's budgeted income surplus? b. What is his budgeted savings ratio? How does this compare with the recommended benchmark? c. What is Tarek's total debt-to-Income ratio? How is he doing compared to the recommended benchmark? What can he do to improve his situation? d. Based on a month having 4 weeks and assuming Tarek works 40 hours per week, what is his hourly wage rate? How does this compare to the national minimum wage? e. Assume that Tarek paid $400 for his collections. If he sold the collections today for market value and paid no sales fee or commission, what will be his total capital gain? What is this amount in terms of a percentage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started