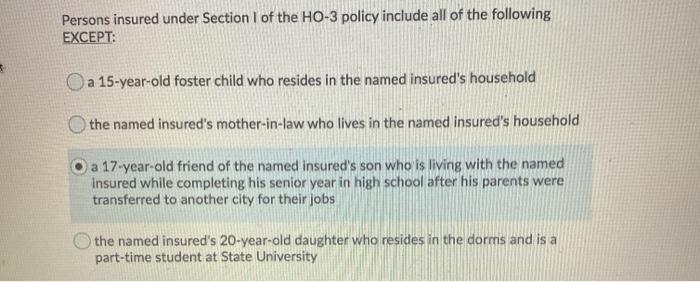

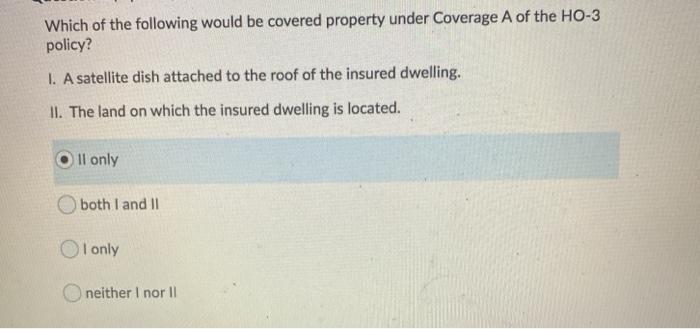

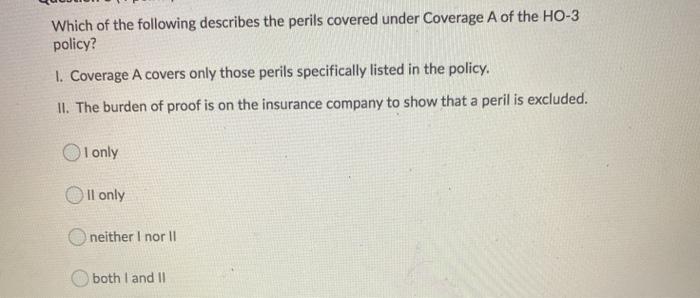

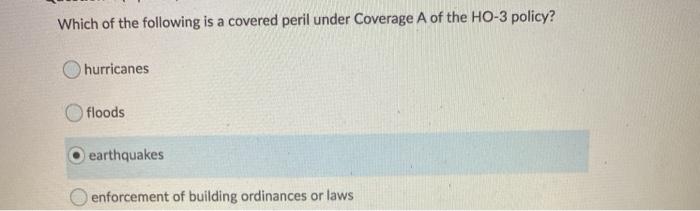

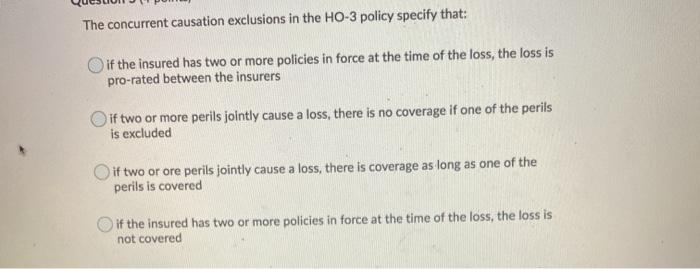

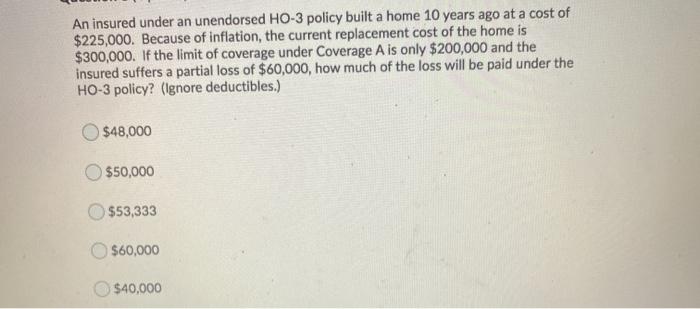

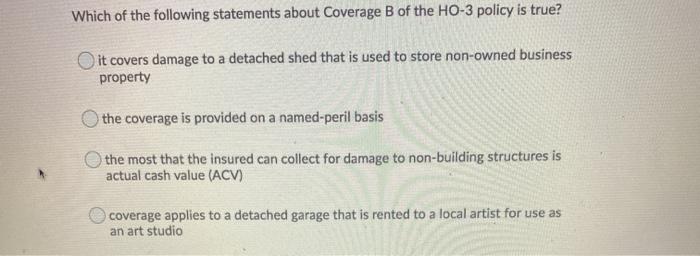

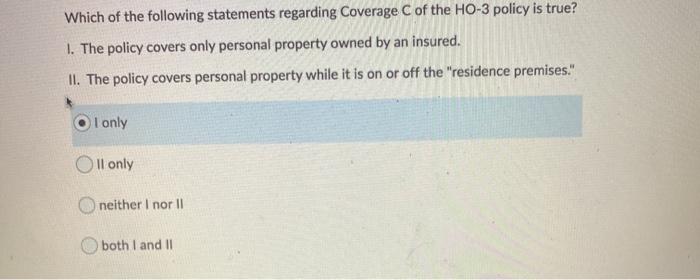

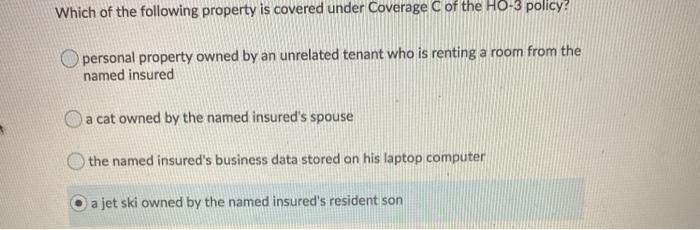

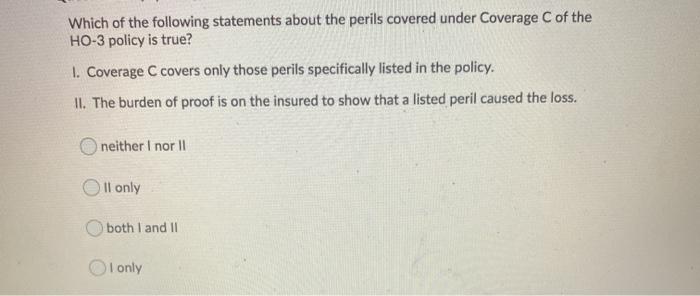

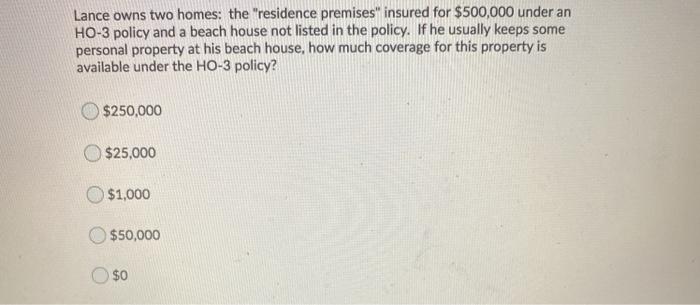

Persons insured under Section 1 of the HO-3 policy include all of the following EXCEPT: a 15-year-old foster child who resides in the named insured's household the named insured's mother-in-law who lives in the named insured's household O a 17-year-old friend of the named insured's son who is living with the named Insured while completing his senior year in high school after his parents were transferred to another city for their jobs the named insured's 20-year-old daughter who resides in the dorms and is a part-time student at State University Which of the following would be covered property under Coverage A of the HO-3 policy? I. A satellite dish attached to the roof of the insured dwelling. II. The land on which the insured dwelling is located. Il only both I and II I only neither I nor 11 Which of the following describes the perils covered under Coverage A of the HO-3 policy? 1. Coverage A covers only those perils specifically listed in the policy. II. The burden of proof is on the insurance company to show that a peril is excluded. I only Il only neither I nor 11 both I and II Which of the following is a covered peril under Coverage A of the HO-3 policy? hurricanes floods earthquakes enforcement of building ordinances or laws The concurrent causation exclusions in the HO-3 policy specify that: if the insured has two or more policies in force at the time of the loss, the loss is pro-rated between the insurers if two or more perils jointly cause a loss, there is no coverage if one of the perils is excluded if two or ore perils jointly cause a loss, there is coverage as long as one of the perils is covered if the insured has two or more policies in force at the time of the loss, the loss is not covered An insured under an unendorsed HO-3 policy built a home 10 years ago at a cost of $225,000. Because of inflation, the current replacement cost of the home is $300,000. If the limit of coverage under Coverage A is only $200,000 and the insured suffers a partial loss of $60,000, how much of the loss will be paid under the HO-3 policy? (Ignore deductibles.) $48,000 $50,000 $53,333 $60,000 $40,000 Which of the following statements about Coverage B of the HO-3 policy is true? it covers damage to a detached shed that is used to store non-owned business property the coverage is provided on a named-peril basis the most that the insured can collect for damage to non-building structures is actual cash value (ACV) coverage applies to a detached garage that is rented to a local artist for use as an art studio Which of the following statements regarding Coverage C of the HO-3 policy is true? 1. The policy covers only personal property owned by an insured. II. The policy covers personal property while it is on or off the "residence premises." I only Oll only neither I nor 11 both I and II Which of the following property is covered under Coverage Cof the HO-s policy? personal property owned by an unrelated tenant who is renting a room from the named insured a cat owned by the named insured's spouse the named insured's business data stored on his laptop computer a jet ski owned by the named insured's resident son Which of the following statements about the perils covered under Coverage C of the HO-3 policy is true? 1. Coverage C covers only those perils specifically listed in the policy. II. The burden of proof is on the insured to show that a listed peril caused the loss. neither I nor 11 Oll only both I and II I only Lance owns two homes: the "residence premises" insured for $500,000 under an HO-3 policy and a beach house not listed in the policy. If he usually keeps some personal property at his beach house, how much coverage for this property is available under the HO-3 policy? $250,000 $25,000 $1,000 $50,000 $0