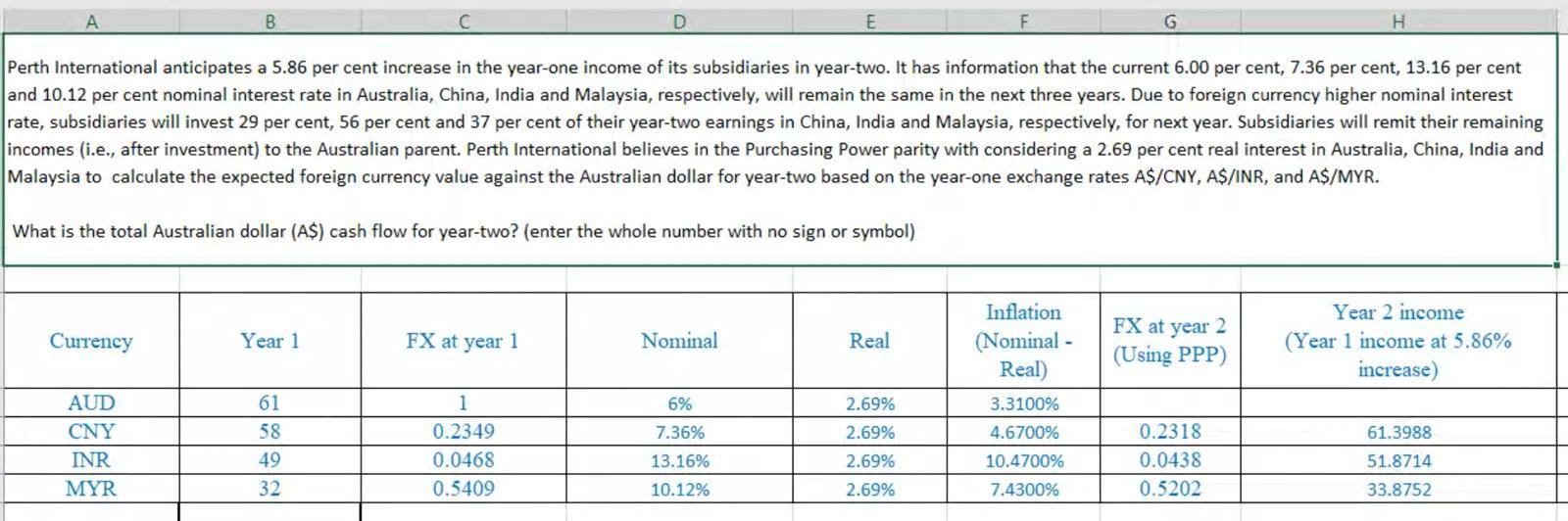

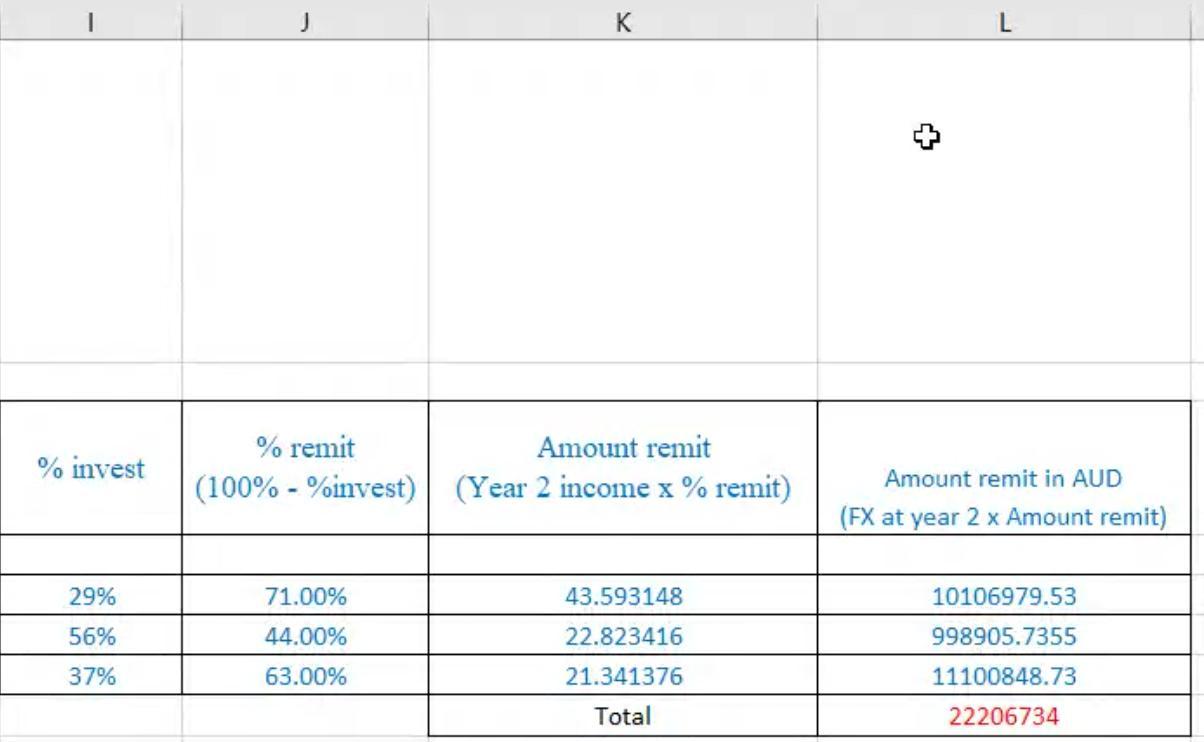

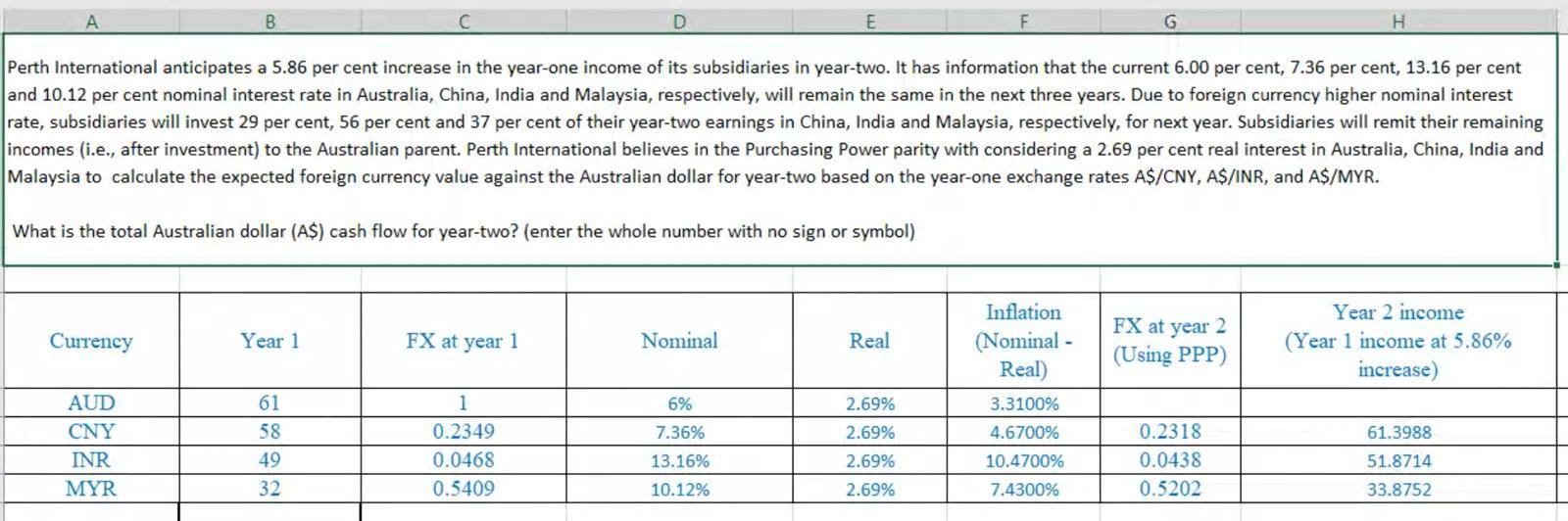

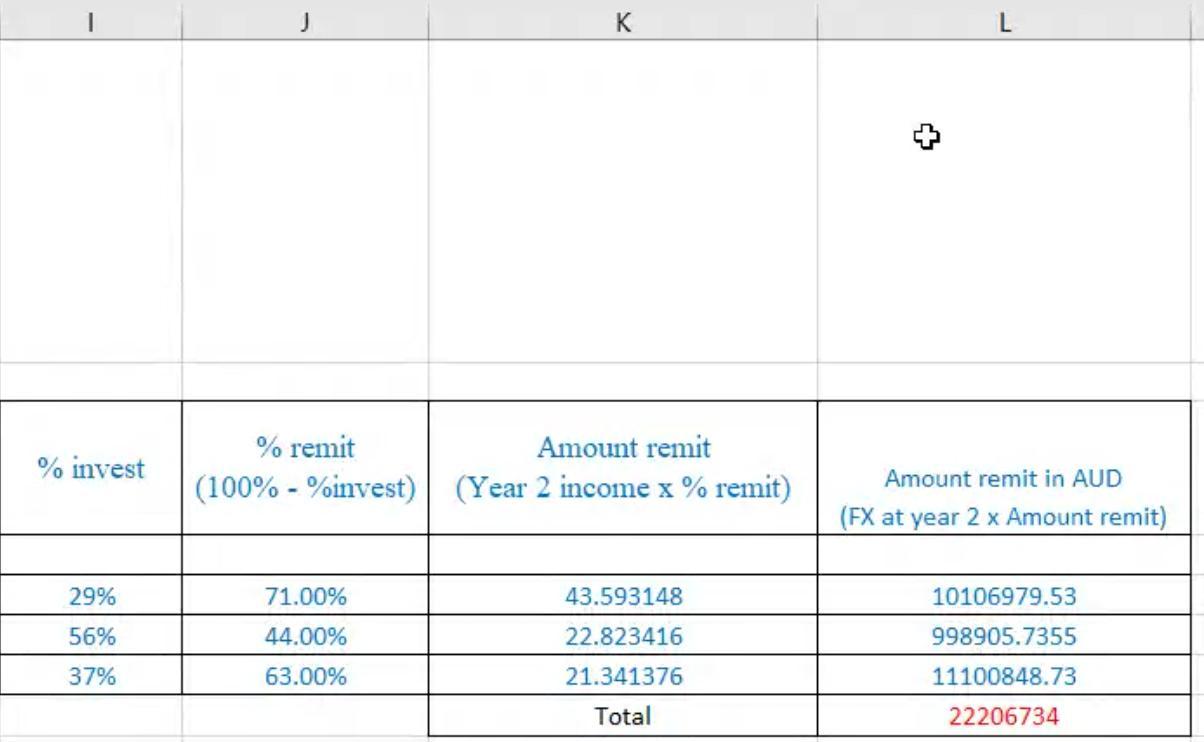

Perth International anticipates a 5.86 per cent increase in the year-one income of its subsidiaries in year-two. It has information that the current 6.00 per cent, 7.36 per cent, 13.16 per cent and 10.12 per cent nominal interest rate in Australia, China, India and Malaysia, respectively, will remain the same in the next three years. Due to foreign currency higher nominal interest rate, subsidiaries will invest 29 per cent, 56 per cent and 37 per cent of their year-two earnings in China, India and Malaysia, respectively, for next year. Subsidiaries will remit their remaining incomes (i.e., after investment) to the Australian parent. Perth International believes in the Purchasing Power parity with considering a 2.69 per cent real interest in Australia, China, India and Malaysia to calculate the expected foreign currency value against the Australian dollar for year-two based on the year-one exchange rates A$/CNY, AS/INR, and AS/MYR. What is the total Australian dollar (AS) cash flow for year-two? (enter the whole number with no sign or symbol)

I already posted the answer too. I cant understand the table. i dont know where the Year 1 amount come from. And I dont understand where the FX at year 1 come from. Can you pls help me explain the table to me. thanks. you can contact me via telegram @gianna007 if you wanna help my study as study guide we can talk about money there. if not, pls just answer the questions i posted.

B D E G H Perth International anticipates a 5.86 per cent increase in the year-one income of its subsidiaries in year-two. It has information that the current 6.00 per cent, 7.36 per cent, 13.16 per cent and 10.12 per cent nominal interest rate in Australia, China, India and Malaysia, respectively, will remain the same in the next three years. Due to foreign currency higher nominal interest rate, subsidiaries will invest 29 per cent, 56 per cent and 37 per cent of their year-two earnings in China, India and Malaysia, respectively, for next year. Subsidiaries will remit their remaining incomes (i.e., after investment) to the Australian parent. Perth International believes in the Purchasing Power parity with considering a 2.69 per cent real interest in Australia, China, India and Malaysia to calculate the expected foreign currency value against the Australian dollar for year-two based on the year-one exchange rates A$/CNY, AS/INR, and A$/MYR. What is the total Australian dollar (A$) cash flow for year-two? (enter the whole number with no sign or symbol) Currency Year 1 FX at year 1 Nominal Real FX at year 2 (Using PPP) Inflation (Nominal - Real) 3.3100% 4.6700% Year 2 income (Year 1 income at 5.86% increase) 6% 7.36% AUD CNY INR MYR 61 58 49 32 1 0.2349 0.0468 0.5409 2.69% 2.69% 2.69% 61.3988 51.8714 13.16% 0.2318 0.0438 0.5202 10.4700% 10.12% 2.69% 7.4300% 33.8752 J L % invest % remit Amount remit (100% -%invest) (Year 2 income x % remit) Amount remit in AUD (FX at year 2 x Amount remit) 29% 56% 37% 71.00% 44.00% 63.00% 43.593148 22.823416 21.341376 Total 10106979.53 998905.7355 11100848.73 22206734 B D E G H Perth International anticipates a 5.86 per cent increase in the year-one income of its subsidiaries in year-two. It has information that the current 6.00 per cent, 7.36 per cent, 13.16 per cent and 10.12 per cent nominal interest rate in Australia, China, India and Malaysia, respectively, will remain the same in the next three years. Due to foreign currency higher nominal interest rate, subsidiaries will invest 29 per cent, 56 per cent and 37 per cent of their year-two earnings in China, India and Malaysia, respectively, for next year. Subsidiaries will remit their remaining incomes (i.e., after investment) to the Australian parent. Perth International believes in the Purchasing Power parity with considering a 2.69 per cent real interest in Australia, China, India and Malaysia to calculate the expected foreign currency value against the Australian dollar for year-two based on the year-one exchange rates A$/CNY, AS/INR, and A$/MYR. What is the total Australian dollar (A$) cash flow for year-two? (enter the whole number with no sign or symbol) Currency Year 1 FX at year 1 Nominal Real FX at year 2 (Using PPP) Inflation (Nominal - Real) 3.3100% 4.6700% Year 2 income (Year 1 income at 5.86% increase) 6% 7.36% AUD CNY INR MYR 61 58 49 32 1 0.2349 0.0468 0.5409 2.69% 2.69% 2.69% 61.3988 51.8714 13.16% 0.2318 0.0438 0.5202 10.4700% 10.12% 2.69% 7.4300% 33.8752 J L % invest % remit Amount remit (100% -%invest) (Year 2 income x % remit) Amount remit in AUD (FX at year 2 x Amount remit) 29% 56% 37% 71.00% 44.00% 63.00% 43.593148 22.823416 21.341376 Total 10106979.53 998905.7355 11100848.73 22206734