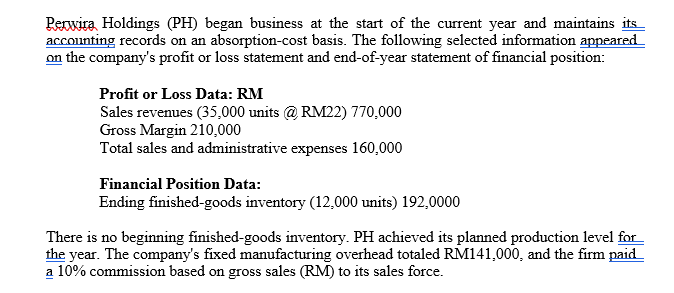

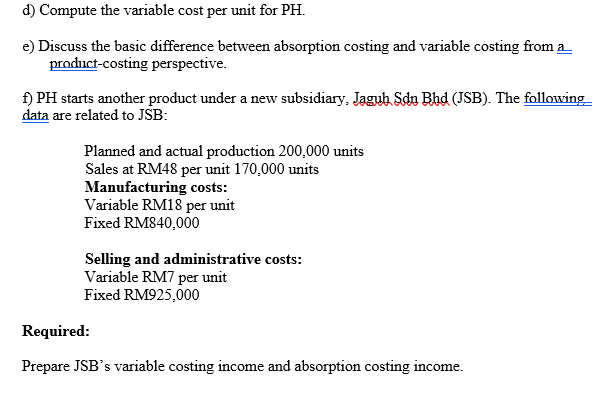

Perwira Holdings (PH) began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's profit or loss statement and end-of-year statement of financial position: Profit or Loss Data: RM Sales revenues (35,000 units @ RM22) 770,000 Gross Margin 210,000 Total sales and administrative expenses 160,000 Financial Position Data: Ending finished-goods inventory (12,000 units) 192,0000 There is no beginning finished-goods inventory. PH achieved its planned production level for the year. The company's fixed manufacturing overhead totaled RM141,000, and the firm paid a 10% commission based on gross sales (RM) to its sales force. d) Compute the variable cost per unit for PH. e) Discuss the basic difference between absorption costing and variable costing from a product-costing perspective. f) PH starts another product under a new subsidiary, Jagub Sdn Bhd (ISB). The following data are related to JSB: Planned and actual production 200,000 units Sales at RM48 per unit 170.000 units Manufacturing costs: Variable RM18 per unit Fixed RM840,000 Selling and administrative costs: Variable RM7 per unit Fixed RM925,000 Required: Prepare JSB's variable costing income and absorption costing income. Perwira Holdings (PH) began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's profit or loss statement and end-of-year statement of financial position: Profit or Loss Data: RM Sales revenues (35,000 units @ RM22) 770,000 Gross Margin 210,000 Total sales and administrative expenses 160,000 Financial Position Data: Ending finished-goods inventory (12,000 units) 192,0000 There is no beginning finished-goods inventory. PH achieved its planned production level for the year. The company's fixed manufacturing overhead totaled RM141,000, and the firm paid a 10% commission based on gross sales (RM) to its sales force. d) Compute the variable cost per unit for PH. e) Discuss the basic difference between absorption costing and variable costing from a product-costing perspective. f) PH starts another product under a new subsidiary, Jagub Sdn Bhd (ISB). The following data are related to JSB: Planned and actual production 200,000 units Sales at RM48 per unit 170.000 units Manufacturing costs: Variable RM18 per unit Fixed RM840,000 Selling and administrative costs: Variable RM7 per unit Fixed RM925,000 Required: Prepare JSB's variable costing income and absorption costing income