Answered step by step

Verified Expert Solution

Question

1 Approved Answer

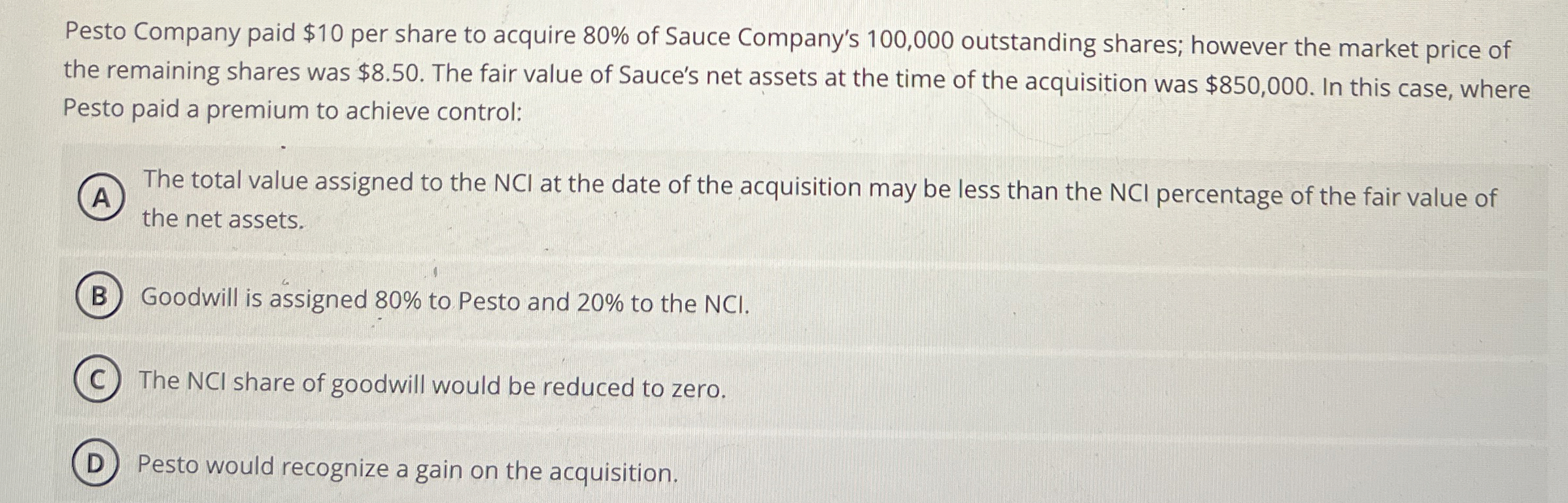

Pesto Company paid $ 1 0 per share to acquire 8 0 % of Sauce Company's 1 0 0 , 0 0 0 outstanding shares;

Pesto Company paid $ per share to acquire of Sauce Company's outstanding shares; however the market price of

the remaining shares was $ The fair value of Sauce's net assets at the time of the acquisition was $ In this case, where

Pesto paid a premium to achieve control:

The total value assigned to the NCI at the date of the acquisition may be less than the NCI percentage of the fair value of

the net assets.

Goodwill is assigned to Pesto and to the NCI.

The NCI share of goodwill would be reduced to zero.

Pesto would recognize a gain on the acquisition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started