Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pet & Company is considering launching a six-year long project that involves manufacturing glow-in-thedark dog leashes. Pet & Company is a relatively large company with

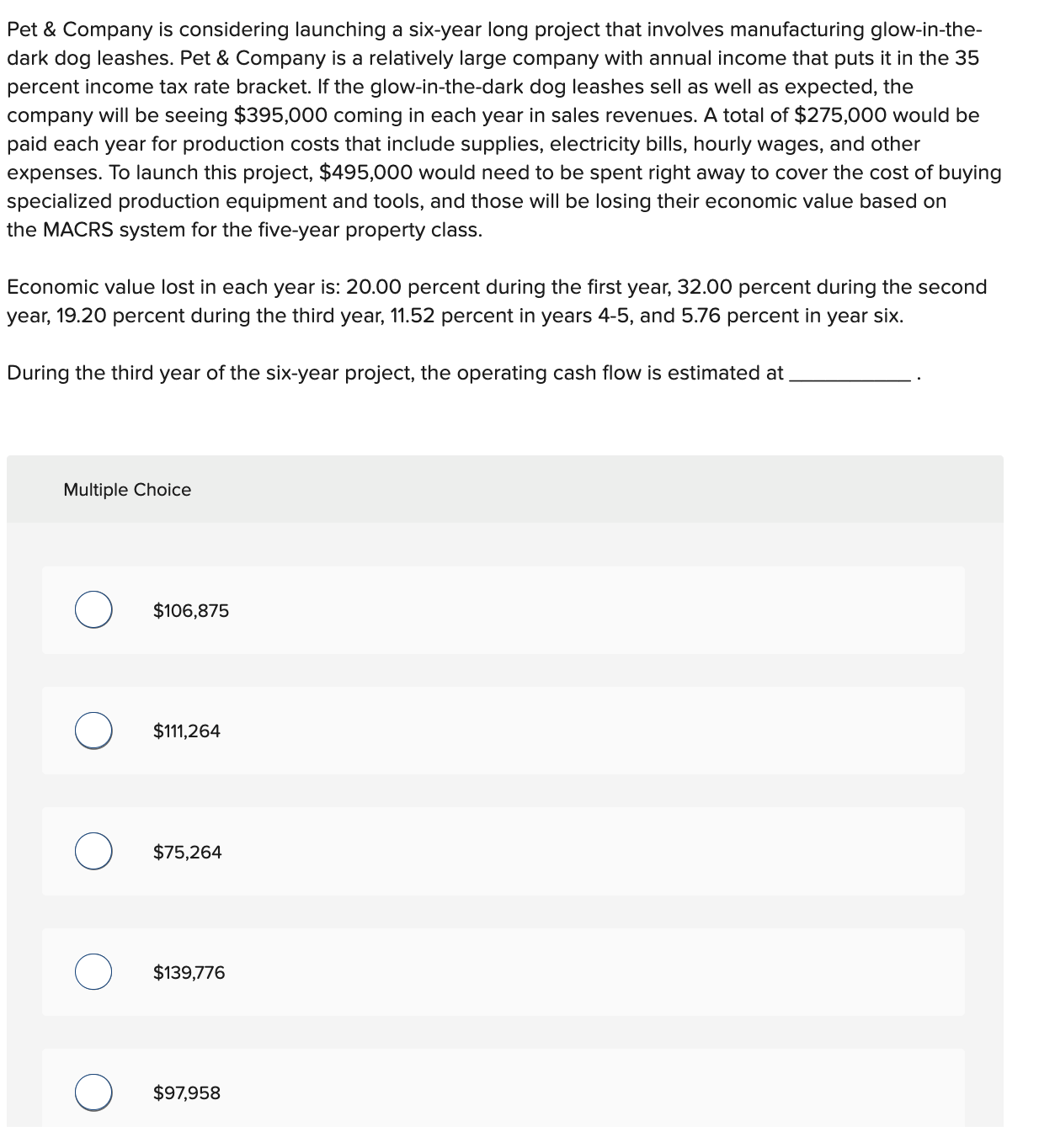

Pet \& Company is considering launching a six-year long project that involves manufacturing glow-in-thedark dog leashes. Pet \& Company is a relatively large company with annual income that puts it in the 35 percent income tax rate bracket. If the glow-in-the-dark dog leashes sell as well as expected, the company will be seeing $395,000 coming in each year in sales revenues. A total of $275,000 would be paid each year for production costs that include supplies, electricity bills, hourly wages, and other expenses. To launch this project, $495,000 would need to be spent right away to cover the cost of buying specialized production equipment and tools, and those will be losing their economic value based on the MACRS system for the five-year property class. Economic value lost in each year is: 20.00 percent during the first year, 32.00 percent during the second year, 19.20 percent during the third year, 11.52 percent in years 45, and 5.76 percent in year six. During the third year of the six-year project, the operating cash flow is estimated at Multiple Choice $106,875 $111,264 $75,264 $139,776 $97,958

Pet \& Company is considering launching a six-year long project that involves manufacturing glow-in-thedark dog leashes. Pet \& Company is a relatively large company with annual income that puts it in the 35 percent income tax rate bracket. If the glow-in-the-dark dog leashes sell as well as expected, the company will be seeing $395,000 coming in each year in sales revenues. A total of $275,000 would be paid each year for production costs that include supplies, electricity bills, hourly wages, and other expenses. To launch this project, $495,000 would need to be spent right away to cover the cost of buying specialized production equipment and tools, and those will be losing their economic value based on the MACRS system for the five-year property class. Economic value lost in each year is: 20.00 percent during the first year, 32.00 percent during the second year, 19.20 percent during the third year, 11.52 percent in years 45, and 5.76 percent in year six. During the third year of the six-year project, the operating cash flow is estimated at Multiple Choice $106,875 $111,264 $75,264 $139,776 $97,958 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started