Answered step by step

Verified Expert Solution

Question

1 Approved Answer

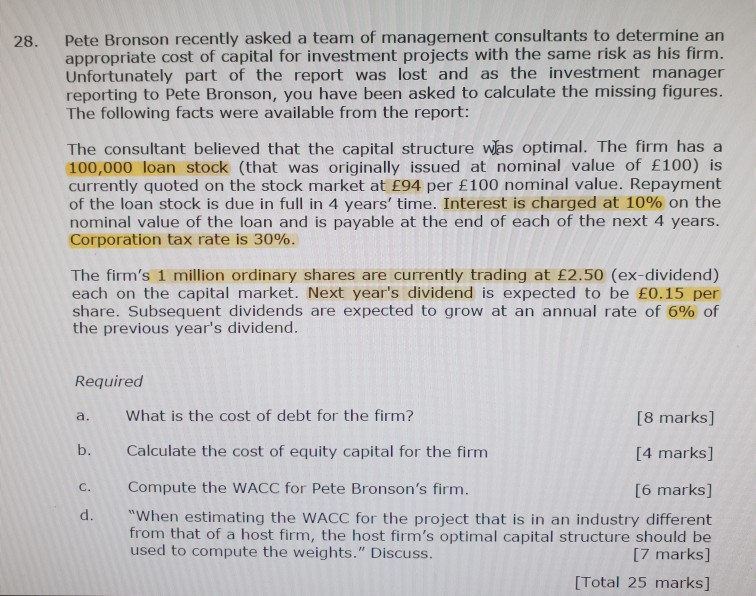

Pete Bronson recently asked a team of management consultants to determine an appropriate cost of capital for investment projects with the same risk as his

Pete Bronson recently asked a team of management consultants to determine an appropriate cost of capital for investment projects with the same risk as his firm Unfortunately part of the report was lost and as the investment manager reporting to Pete Bronson, you have been asked to calculate the missing figures The following facts were available from the report: 28. The consultant believed that the capital structure was optimal. The firm has a 100,000 loan stock (that was originally issued at nominal value of 100) is currently quoted on the stock market at 94 per 100 nominal value. Repayment of the loan stock is due in full in 4 years' time. Interest is charged at 10% on the nominal value of the loan and is payable at the end of each of the next 4 years. Corporation tax rate is 30%. The firm's 1 million ordinary shares are currently trading at 2.50 (ex-dividend) each on the capital market. Next year's dividend is expected to be E0.15 pen share. Subsequent dividends are expected to grow at an annual rate of 6% of the previous year's dividend. Required a. What is the cost of debt for the firm? b. Calculate the cost of equity capital for the firnm C. Compute the WACC for Pete Bronson's firm. d. [8 marks] [4 marks] [6 marks] "When estimating the WACC for the project that is in an industry different from that of a host firm, the host firm's optimal capital structure should be used to compute the weights." Discuss. [7 marks [Total 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started