Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pete is a single filer. He owns a sole proprietorship (not a specified service business) that reports net income of $148,000. The proprietorship pays W-2

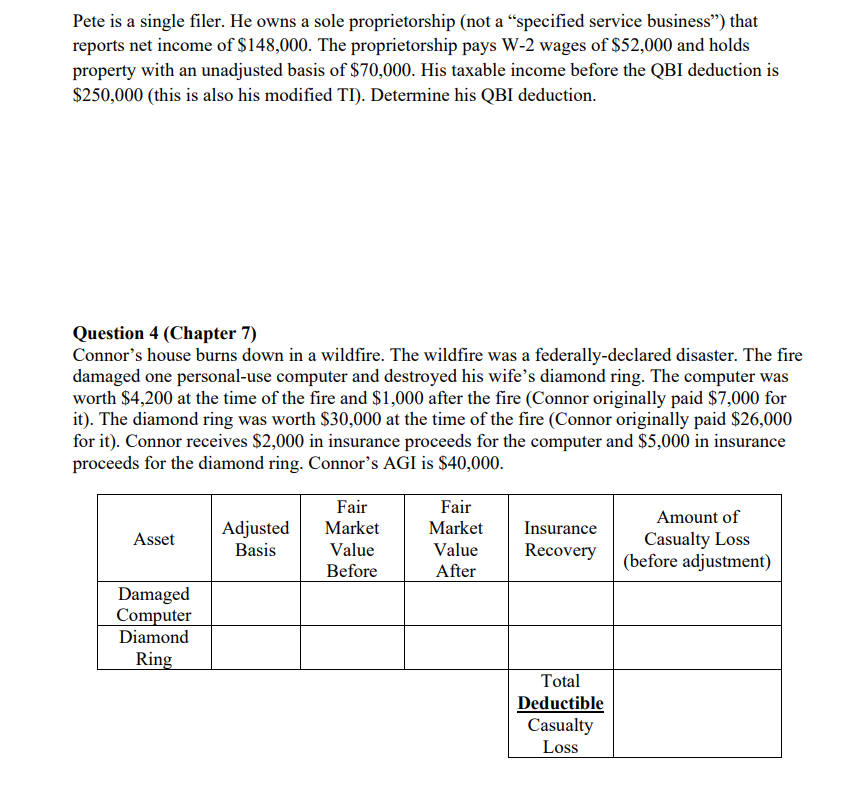

Pete is a single filer. He owns a sole proprietorship (not a "specified service business") that reports net income of $148,000. The proprietorship pays W-2 wages of $52,000 and holds property with an unadjusted basis of $70,000. His taxable income before the QBI deduction is $250,000 (this is also his modified TI). Determine his QBI deduction. Question 4 (Chapter 7) Connor's house burns down in a wildfire. The wildfire was a federally-declared disaster. The fire damaged one personal-use computer and destroyed his wife's diamond ring. The computer was worth $4,200 at the time of the fire and $1,000 after the fire (Connor originally paid $7,000 for it). The diamond ring was worth $30,000 at the time of the fire (Connor originally paid $26,000 for it). Connor receives $2,000 in insurance proceeds for the computer and $5,000 in insurance proceeds for the diamond ring. Connor's AGI is $40,000

Pete is a single filer. He owns a sole proprietorship (not a "specified service business") that reports net income of $148,000. The proprietorship pays W-2 wages of $52,000 and holds property with an unadjusted basis of $70,000. His taxable income before the QBI deduction is $250,000 (this is also his modified TI). Determine his QBI deduction. Question 4 (Chapter 7) Connor's house burns down in a wildfire. The wildfire was a federally-declared disaster. The fire damaged one personal-use computer and destroyed his wife's diamond ring. The computer was worth $4,200 at the time of the fire and $1,000 after the fire (Connor originally paid $7,000 for it). The diamond ring was worth $30,000 at the time of the fire (Connor originally paid $26,000 for it). Connor receives $2,000 in insurance proceeds for the computer and $5,000 in insurance proceeds for the diamond ring. Connor's AGI is $40,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started