Question

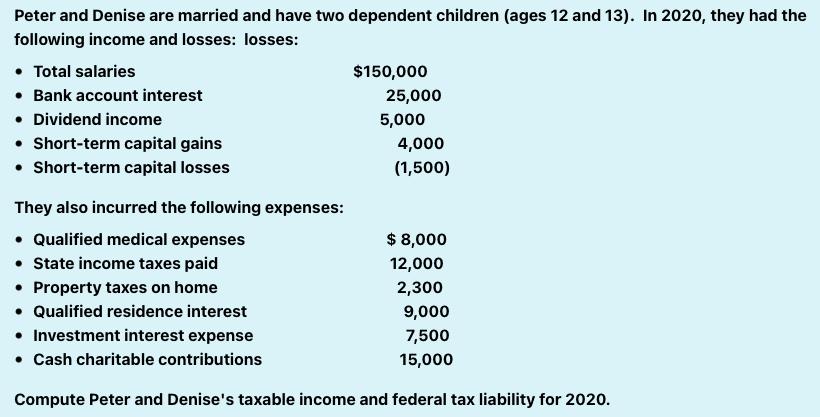

Peter and Denise are married and have two dependent children (ages 12 and 13). In 2020, they had the following income and losses: losses:

Peter and Denise are married and have two dependent children (ages 12 and 13). In 2020, they had the following income and losses: losses: Total salaries $150,000 25,000 Bank account interest Dividend income 5,000 Short-term capital gains 4,000 Short-term capital losses (1,500) They also incurred the following expenses: $ 8,000 12,000 2,300 Qualified medical expenses State income taxes paid Property taxes on home Qualified residence interest Investment interest expense Cash charitable contributions 9,000 7,500 15,000 Compute Peter and Denise's taxable income and federal tax liability for 2020.

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Nov891221 Solution Answers are highlighted in yellow Total S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2017 Comprehensive

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

40th Edition

1305874161, 978-1305874169

Students also viewed these Business Communication questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App