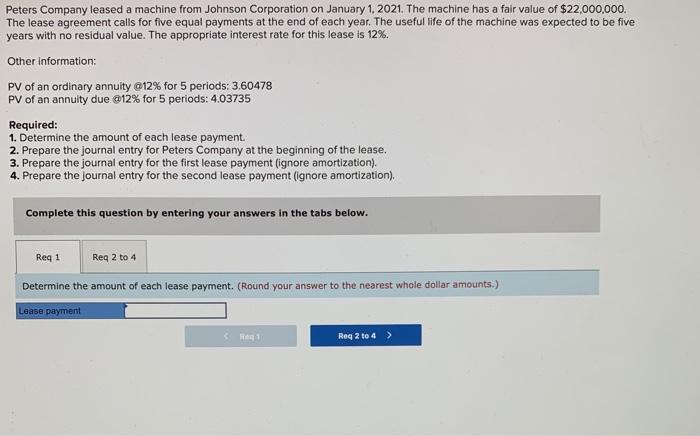

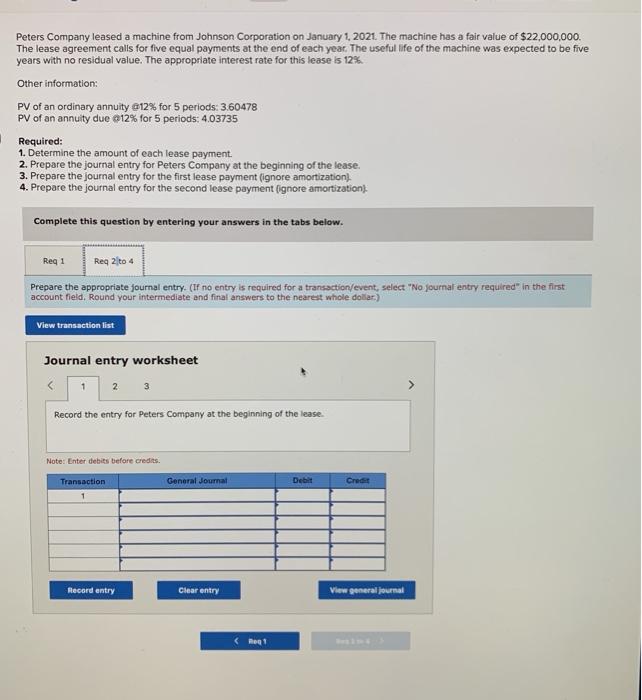

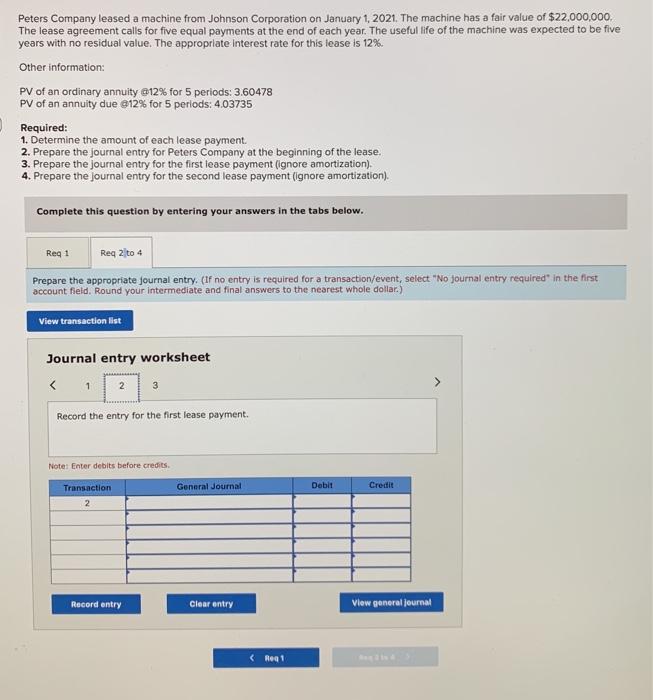

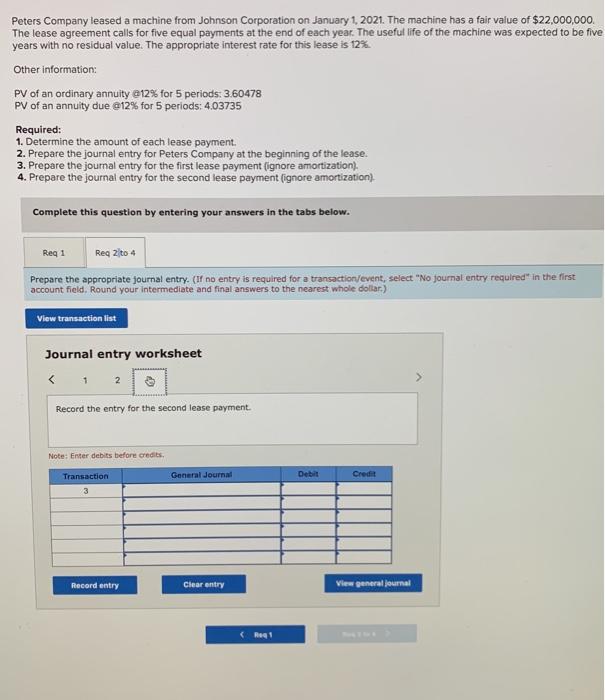

Peters Company leased a machine from Johnson Corporation on January 1, 2021. The machine has a fair value of $22,000,000 The lease agreement calls for five equal payments at the end of each year. The useful life of the machine was expected to be five years with no residual value. The appropriate interest rate for this lease is 12%. Other information: PV of an ordinary annuity 012% for 5 periods: 3.60478 PV of an annuity due @12% for 5 periods: 4.03735 Required: 1. Determine the amount of each lease payment. 2. Prepare the journal entry for Peters Company at the beginning of the lease. 3. Prepare the journal entry for the first lease payment (ignore amortization). 4. Prepare the journal entry for the second lease payment (ignore amortization), Complete this question by entering your answers in the tabs below. Req 1 Reg 2 to 4 Determine the amount of each lease payment. (Round your answer to the nearest whole dollar amounts.) Lease payment Roq 2 to 4 > Peters Company leased a machine from Johnson Corporation on January 1, 2021. The machine has a fair value of $22,000,000 The lease agreement calls for five equal payments at the end of each year . The useful life of the machine was expected to be five years with no residual value. The appropriate interest rate for this lease is 12% Other information: PV of an ordinary annuity @12% for 5 periods: 3.60478 PV of an annuity due 012% for 5 periods: 4.03735 Required: 1. Determine the amount of each lease payment. 2. Prepare the journal entry for Peters Company at the beginning of the lease. 3. Prepare the journal entry for the first lease payment (ignore amortization, 4. Prepare the journal entry for the second lease payment [ignore amortization Complete this question by entering your answers in the tabs below. Reg 1 Req 2 to 4 Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your intermediate and final answers to the nearest whole dollar) View transaction list Journal entry worksheet Record the entry for Peters Company at the beginning of the lease Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general Journal Record the entry for the first lease payment. Note: Enter debits before credits General Journal Debit Credit Transaction 2 Record entry Clear entry View general Journal