Answered step by step

Verified Expert Solution

Question

1 Approved Answer

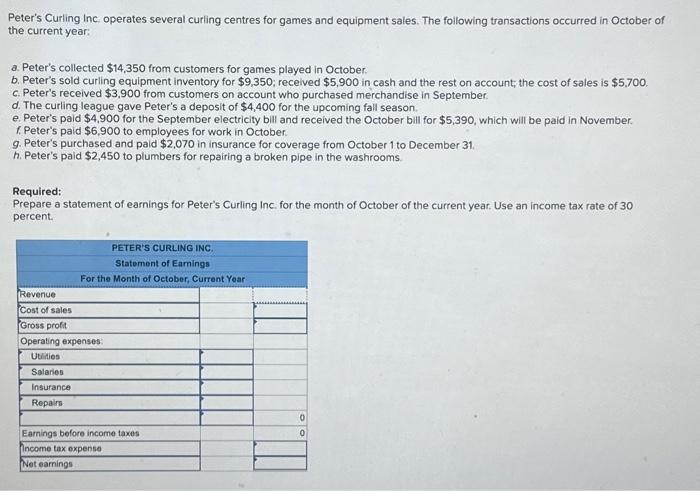

Peter's Curling Inc. operates several curling centres for games and equipment sales. The following transactions occurred in October of the current year: a. Peter's collected

Peter's Curling Inc. operates several curling centres for games and equipment sales. The following transactions occurred in October of the current year: a. Peter's collected $14,350 from customers for games played in October. b. Peter's sold curling equipment inventory for $9,350; received $5,900 in cash and the rest on account; the cost of sales is $5,700. c. Peter's received $3,900 from customers on account who purchased merchandise in September. d. The curling league gave Peter's a deposit of $4,400 for the upcoming fall season. e. Peter's paid $4,900 for the September electricity bill and received the October bill for $5,390, which will be paid in November. f. Peter's paid $6,900 to employees for work in October. g. Peter's purchased and paid $2,070 in insurance for coverage from October 1 to December 31. h. Peter's paid $2,450 to plumbers for repairing a broken pipe in the washrooms. Required: Prepare a statement of earnings for Peter's Curling Inc. for the month of October of the current year. Use an income tax rate of 30 percent. Revenue Cost of sales Gross profit PETER'S CURLING INC. Statement of Earnings For the Month of October, Current Year Operating expenses: Utilities Salaries Insurance Repairs Earnings before income taxes Income tax expense Net earnings 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started