Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peters Inc. paid $400 in cash and $6,000 fair value of stock to acquire 65% of the voting stock of Stony Company. Stock registration fees

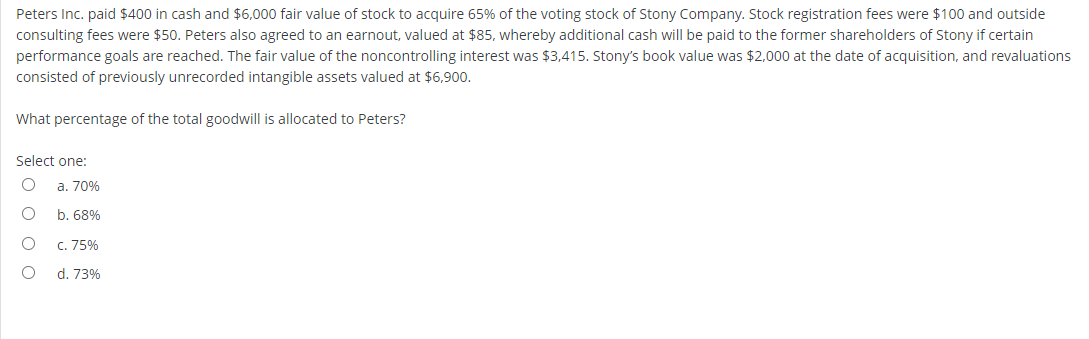

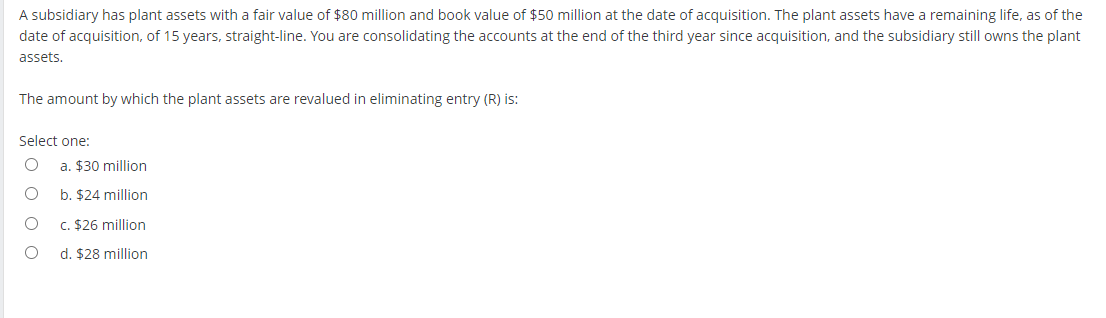

Peters Inc. paid $400 in cash and $6,000 fair value of stock to acquire 65% of the voting stock of Stony Company. Stock registration fees were $100 and outside consulting fees were $50. Peters also agreed to an earnout, valued at $85, whereby additional cash will be paid to the former shareholders of Stony if certain performance goals are reached. The fair value of the noncontrolling interest was $3,415. Stony's book value was $2,000 at the date of acquisition, and revaluations consisted of previously unrecorded intangible assets valued at $6,900. What percentage of the total goodwill is allocated to Peters? Select one: a. 70% b. 68% C. 75% d. 73% A subsidiary has plant assets with a fair value of $80 million and book value of $50 million at the date of acquisition. The plant assets have a remaining life, as of the date of acquisition, of 15 years, straight-line. You are consolidating the accounts at the end of the third year since acquisition, and the subsidiary still owns the plant assets. The amount by which the plant assets are revalued in eliminating entry (R) is: Select one: a. $30 million b. $24 million c. $26 million d. \$28 million

Peters Inc. paid $400 in cash and $6,000 fair value of stock to acquire 65% of the voting stock of Stony Company. Stock registration fees were $100 and outside consulting fees were $50. Peters also agreed to an earnout, valued at $85, whereby additional cash will be paid to the former shareholders of Stony if certain performance goals are reached. The fair value of the noncontrolling interest was $3,415. Stony's book value was $2,000 at the date of acquisition, and revaluations consisted of previously unrecorded intangible assets valued at $6,900. What percentage of the total goodwill is allocated to Peters? Select one: a. 70% b. 68% C. 75% d. 73% A subsidiary has plant assets with a fair value of $80 million and book value of $50 million at the date of acquisition. The plant assets have a remaining life, as of the date of acquisition, of 15 years, straight-line. You are consolidating the accounts at the end of the third year since acquisition, and the subsidiary still owns the plant assets. The amount by which the plant assets are revalued in eliminating entry (R) is: Select one: a. $30 million b. $24 million c. $26 million d. \$28 million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started