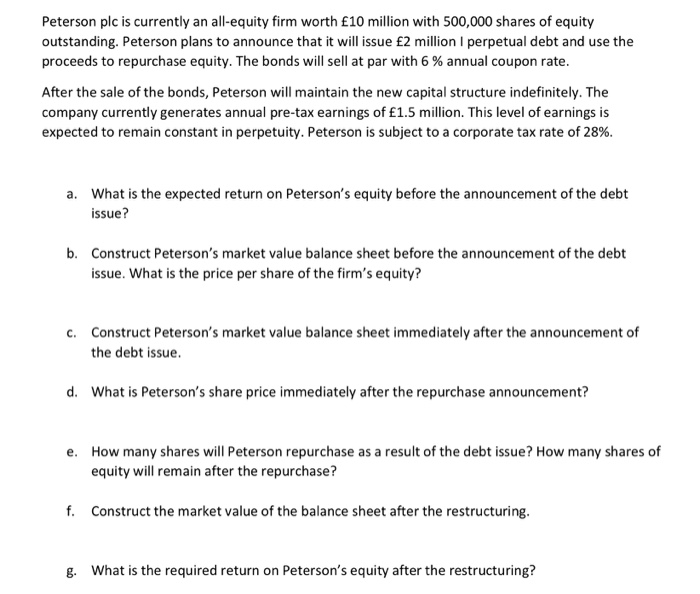

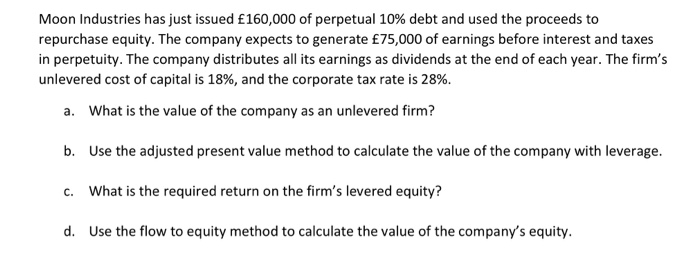

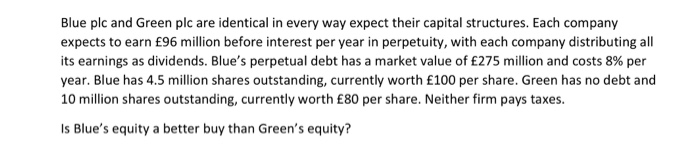

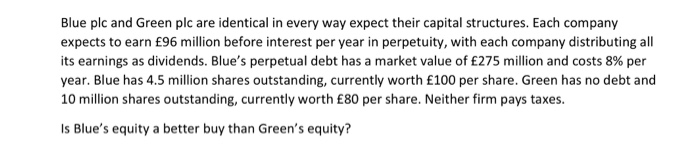

Peterson plc is currently an all-equity firm worth 10 million with 500,000 shares of equity outstanding. Peterson plans to announce that it will issue 2 million I perpetual debt and use the proceeds to repurchase equity. The bonds will sell at par with 6% annual coupon rate. After the sale of the bonds, Peterson will maintain the new capital structure indefinitely. The company currently generates annual pre-tax earnings of 1.5 million. This level of earnings is expected to remain constant in perpetuity. Peterson is subject to a corporate tax rate of 28%. a. What is the expected return on Peterson's equity before the announcement of the debt issue? b. Construct Peterson's market value balance sheet before the announcement of the debt issue. What is the price per share of the firm's equity? c. Construct Peterson's market value balance sheet immediately after the announcement of the debt issue. d. What is Peterson's share price immediately after the repurchase announcement? e. How many shares will Peterson repurchase as a result of the debt issue? How many shares of equity will remain after the repurchase? f. Construct the market value of the balance sheet after the restructuring. g. What is the required return on Peterson's equity after the restructuring? Moon Industries has just issued 160,000 of perpetual 10% debt and used the proceeds to repurchase equity. The company expects to generate 75,000 of earnings before interest and taxes in perpetuity. The company distributes all its earnings as dividends at the end of each year. The firm's unlevered cost of capital is 18%, and the corporate tax rate is 28%. a. What is the value of the company as an unlevered firm? b. Use the adjusted present value method to calculate the value of the company with leverage. c. What is the required return on the firm's levered equity? d. Use the flow to equity method to calculate the value of the company's equity. Blue plc and Green plc are identical in every way expect their capital structures. Each company expects to earn 96 million before interest per year in perpetuity, with each company distributing all its earnings as dividends. Blue's perpetual debt has a market value of 275 million and costs 8% per year. Blue has 4.5 million shares outstanding, currently worth 100 per share. Green has no debt and 10 million shares outstanding, currently worth 80 per share. Neither firm pays taxes. Is Blue's equity a better buy than Green's equity