Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pete's Bikes purchased 40 bikes at $75 each with terms of 3/10, n/30 from Speedsters on July 10. These bikes had a cost of

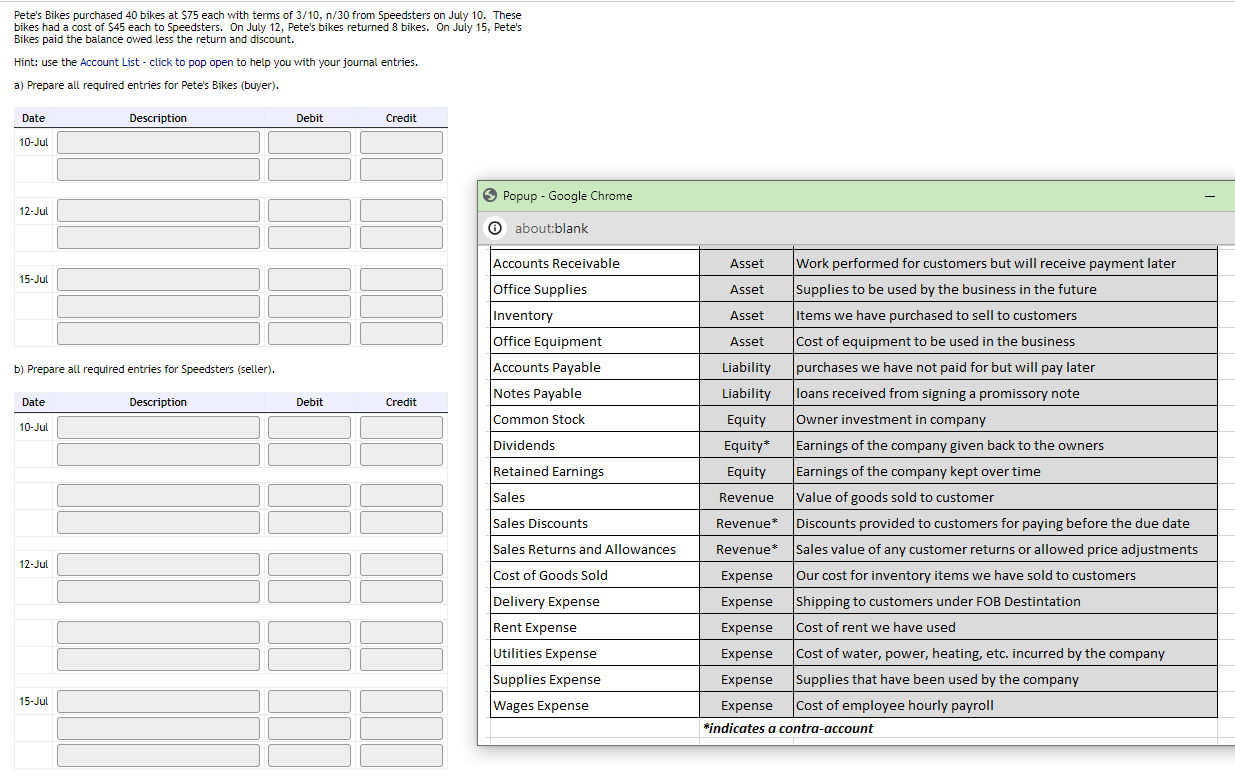

Pete's Bikes purchased 40 bikes at $75 each with terms of 3/10, n/30 from Speedsters on July 10. These bikes had a cost of $45 each to Speedsters. On July 12, Pete's bikes returned 8 bikes. On July 15, Pete's Bikes paid the balance owed less the return and discount. Hint: use the Account List - click to pop open to help you with your journal entries. a) Prepare all required entries for Pete's Bikes (buyer). Date 10-Jul 12-Jul 15-Jul Description b) Prepare all required entries for Speedsters (seller). Date 10-Jul 12-Jul 15-Jul Description Debit Credit Popup - Google Chrome about:blank Accounts Receivable Asset Work performed for customers but will receive payment later Office Supplies Inventory Office Equipment Accounts Payable Asset Asset Asset Liability Notes Payable Liability Debit Credit Common Stock Equity Supplies to be used by the business in the future Items we have purchased to sell to customers Cost of equipment to be used in the business purchases we have not paid for but will pay later loans received from signing a promissory note Owner investment in company Dividends Equity* Earnings of the company given back to the owners Retained Earnings Equity Earnings of the company kept over time Sales Revenue Value of goods sold to customer Sales Discounts Revenue* Sales Returns and Allowances Revenue* Cost of Goods Sold Expense Delivery Expense Expense Discounts provided to customers for paying before the due date Sales value of any customer returns or allowed price adjustments Our cost for inventory items we have sold to customers Shipping to customers under FOB Destintation Rent Expense Expense Cost of rent we have used Utilities Expense Expense Cost of water, power, heating, etc. incurred by the company Supplies Expense Expense Wages Expense Expense Supplies that have been used by the company Cost of employee hourly payroll *indicates a contra-account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer It seems like the text you provided is a mix of different informati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started