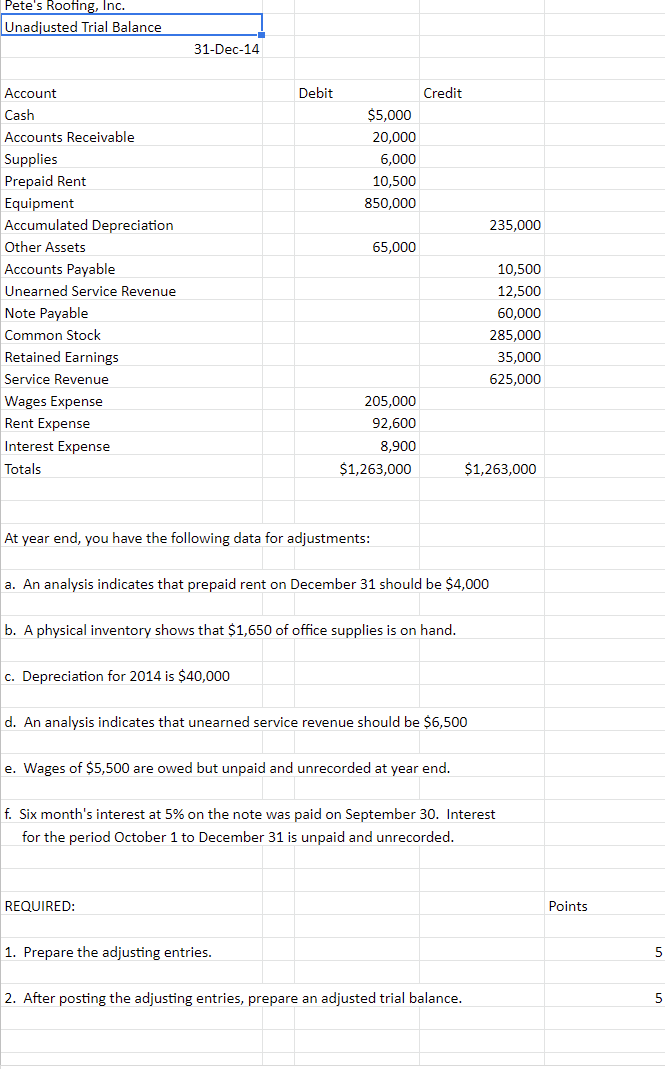

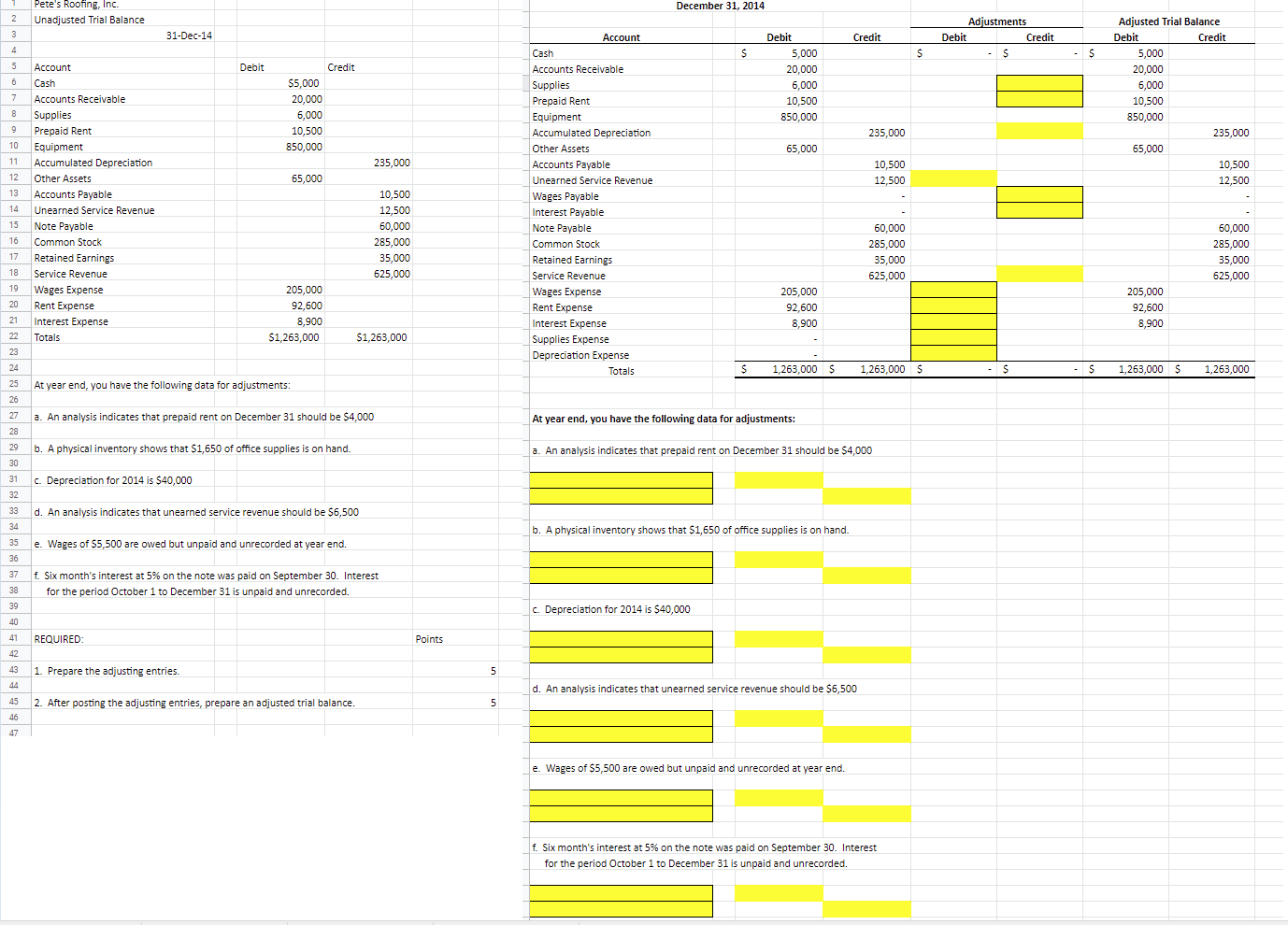

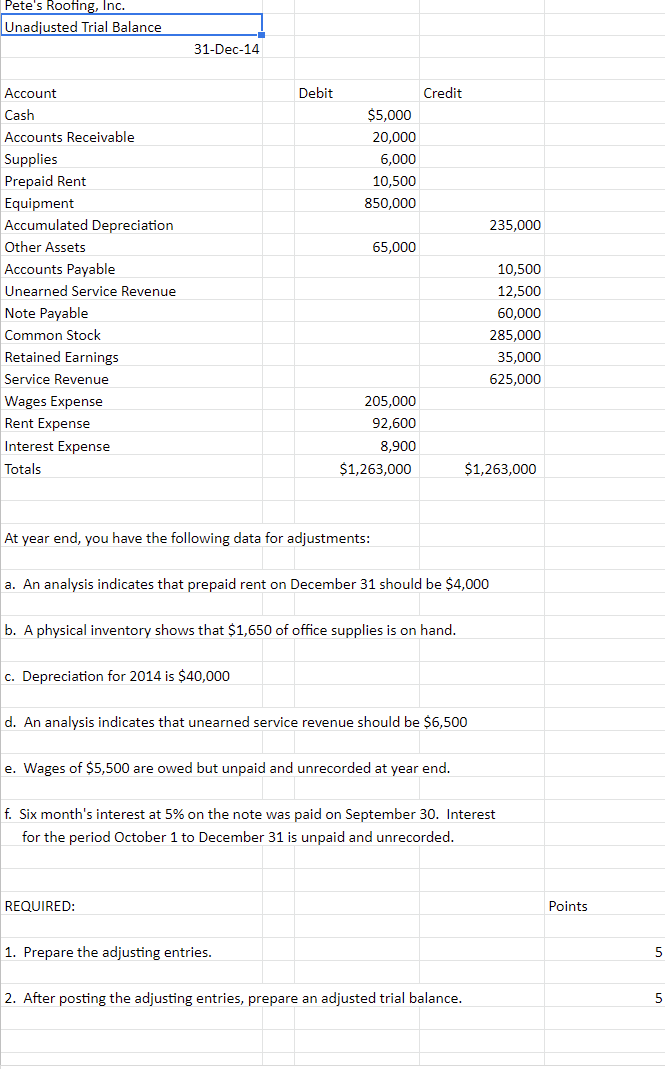

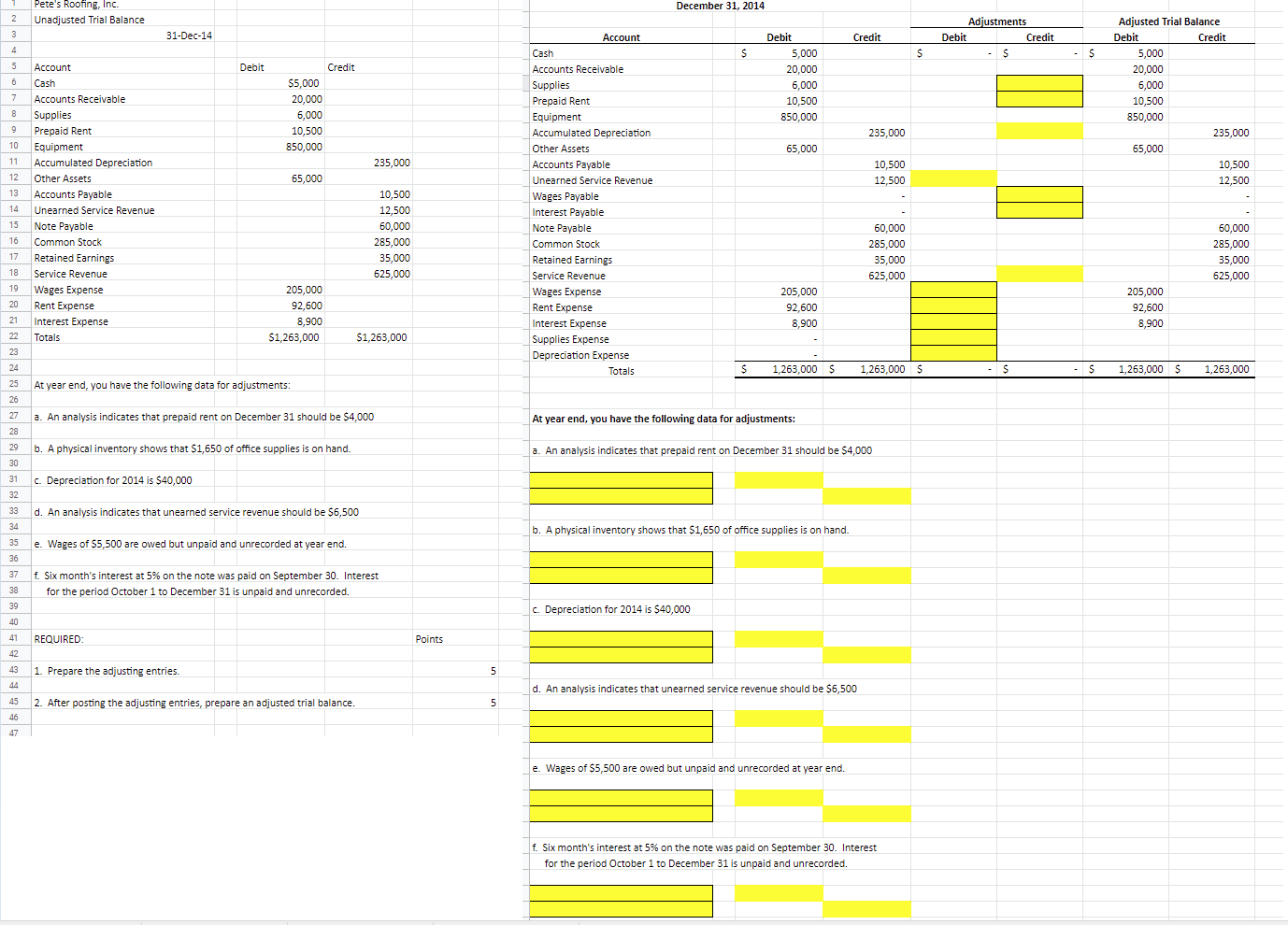

Pete's Rooting, Inc. Unadjusted Trial Balance 31-Dec-14 Debit Credit $5,000 20,000 6,000 10,500 850,000 235,000 65,000 Account Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Other Assets Accounts Payable Unearned Service Revenue Note Payable Common Stock Retained Earnings Service Revenue Wages Expense Rent Expense Interest Expense Totals 10,500 12,500 60,000 285,000 35,000 625,000 205,000 92,600 8,900 $1,263,000 $1,263,000 At year end, you have the following data for adjustments: a. An analysis indicates that prepaid rent on December 31 should be $4,000 b. A physical inventory shows that $1,650 of office supplies is on hand. c. Depreciation for 2014 is $40,000 d. An analysis indicates that unearned service revenue should be $6,500 e. Wages of $5,500 are owed but unpaid and unrecorded at year end. f. Six month's interest at 5% on the note was paid on September 30. Interest for the period October 1 to December 31 is unpaid and unrecorded. REQUIRED: Points 1. Prepare the adjusting entries. 2. After posting the adjusting entries, prepare an adjusted trial balance. 1 December 31, 2014 Pete's Roofing, Inc. Unadjusted Trial Balance 31-Dec-14 Credit Adjustments Debit Credit - S $ - S Debit Credit Debit 5,000 20,000 6,000 10,500 850,000 $5,000 20,000 6,000 10,500 850,000 7 8 Adjusted Trial Balance Debit Credit 5,000 20,000 6,000 10,500 850,000 235,000 65,000 10,500 12,500 235,000 65,000 235,000 10 11 12 13 14 15 10,500 12,500 65,000 Account Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Other Assets Accounts Payable Unearned Service Revenue Note Payable Common Stock Retained Earnings Service Revenue Wages Expense Rent Expense Interest Expense Totals 10,500 12,500 60,000 285,000 35,000 625,000 Account Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Other Assets Accounts Payable Unearned Service Revenue Wages Payable Interest Payable Note Payable Common Stock Retained Earnings Service Revenue Wages Expense Rent Expense Interest Expense Supplies Expense Depreciation Expense Totals 60,000 285,000 35,000 625,000 60,000 285,000 35,000 625,000 17 18 19 20 21 205,000 92,600 8,900 $1,263,000 205,000 92,600 8,900 205,000 92,600 8,900 $1,263,000 22 23 $ 1,263,000 $ 1,263,000 $ - $ - $ 1,263,000 $ 1,263,000 24 25 At year end, you have the following data for adjustments: 27 a. An analysis indicates that prepaid rent on December 31 should be $4,000 At year end, you have the following data for adjustments: 28 a. An analysis indicates that prepaid rent on December 31 should be $4,000 29b. A physical inventory shows that $1,650 of office supplies is on hand. 30 31 c. Depreciation for 2014 is $40,000 32 33 d. An analysis indicates that unearned service revenue should be $6,500 34 35e. Wages of $5,500 are owed but unpaid and unrecorded at year end. 36 37 f. Six month's interest at 5% on the note was paid on September 30. Interest 38 for the period October 1 to December 31 is unpaid and unrecorded. b. A physical inventory shows that $1,650 of office supplies is on hand. 39 c. Depreciation for 2014 is $40,000 41 REQUIRED Points 43 1. Prepare the adjusting entries. 5 d. An analysis indicates that unearned service revenue should be $6,500 45 2. After posting the adjusting entries, prepare an adjusted trial balance. 46 e. Wages of $5,500 are owed but unpaid and unrecorded at year end. 1. Six month's interest at 5% on the note was paid on September 30. Interest for the period October 1 to December 31 is unpaid and unrecorded