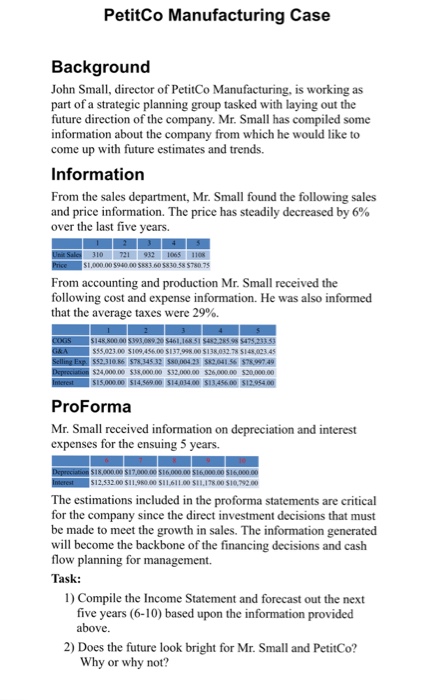

PetitCo Manufacturing Case Background John Small, director of PetitCo Manufacturing, is working as part of a strategic planning group tasked with laying out the future direction of the company. Mr. Small has compiled some information about the company from which he would like to come up with future estimates and trends. Information From the sales department, Mr. Small found the following sales and price information. The price has steadily decreased by 6% over the last five years. 310 721 932 1065 1108 1,000.00 s94000 5883 605830.58 5780.75 From accounting and production Mr. Small received the following cost and expense information. He was also informed that the average taxes were 29%. $148,800..00 S393,089.20 S461,16851 S482285 $475.233.53 $35,923.00 5109,456.00 $137,998.00 5138,032 78 5148 023.45 Selling Exp $52,310.86 $78,3453 $80,004.23 $82,04156 578997 49 Deprcciation $24,00000 $38,000.00 $32000.00 526,00000 s20,000.00 ProForma Mr. Small received information on depreciation and interest expenses for the ensuing 5 years. $12,53200 $11.980.00 511,611.00 $11,178.00 510,792.00 The estimations included in the proforma statements are critical for the company since the direct investment decisions that must be made to meet the growth in sales. The information generated will become the backbone of the financing decisions and cash flow planning for management. Task: 1) Compile the Income Statement and forecast out the next five years (6-10) based upon the information provided above. 2) Does the future look bright for Mr. Small and PetitCo? Why or why not? PetitCo Manufacturing Case Background John Small, director of PetitCo Manufacturing, is working as part of a strategic planning group tasked with laying out the future direction of the company. Mr. Small has compiled some information about the company from which he would like to come up with future estimates and trends. Information From the sales department, Mr. Small found the following sales and price information. The price has steadily decreased by 6% over the last five years. 310 721 932 1065 1108 1,000.00 s94000 5883 605830.58 5780.75 From accounting and production Mr. Small received the following cost and expense information. He was also informed that the average taxes were 29%. $148,800..00 S393,089.20 S461,16851 S482285 $475.233.53 $35,923.00 5109,456.00 $137,998.00 5138,032 78 5148 023.45 Selling Exp $52,310.86 $78,3453 $80,004.23 $82,04156 578997 49 Deprcciation $24,00000 $38,000.00 $32000.00 526,00000 s20,000.00 ProForma Mr. Small received information on depreciation and interest expenses for the ensuing 5 years. $12,53200 $11.980.00 511,611.00 $11,178.00 510,792.00 The estimations included in the proforma statements are critical for the company since the direct investment decisions that must be made to meet the growth in sales. The information generated will become the backbone of the financing decisions and cash flow planning for management. Task: 1) Compile the Income Statement and forecast out the next five years (6-10) based upon the information provided above. 2) Does the future look bright for Mr. Small and PetitCo? Why or why not