Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Petra meets with Alexandria, an insurance agent, to review her need for income replacement insurance. Petra works full-time as a drafting technician for a

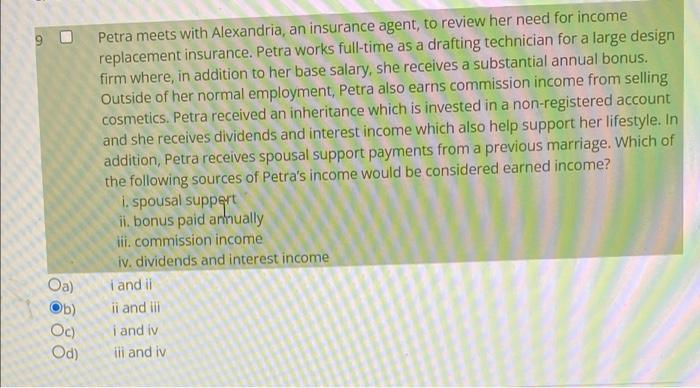

Petra meets with Alexandria, an insurance agent, to review her need for income replacement insurance. Petra works full-time as a drafting technician for a large design firm where, in addition to her base salary, she receives a substantial annual bonus. Outside of her normal employment, Petra also earns commission income from selling cosmetics. Petra received an inheritance which is invested in a non-registered account and she receives dividends and interest income which also help support her lifestyle. In addition, Petra receives spousal support payments from a previous marriage. Which of the following sources of Petra's income would be considered earned income? i. spousal suppert i. bonus paid annually ii. commission income iv. dividends and interest income i and i i and i i and iv 9 0 Oa) Ob) Oc) Od) i and iv

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The Correct Option is B ii and iii Explanation A commission is pay based o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started