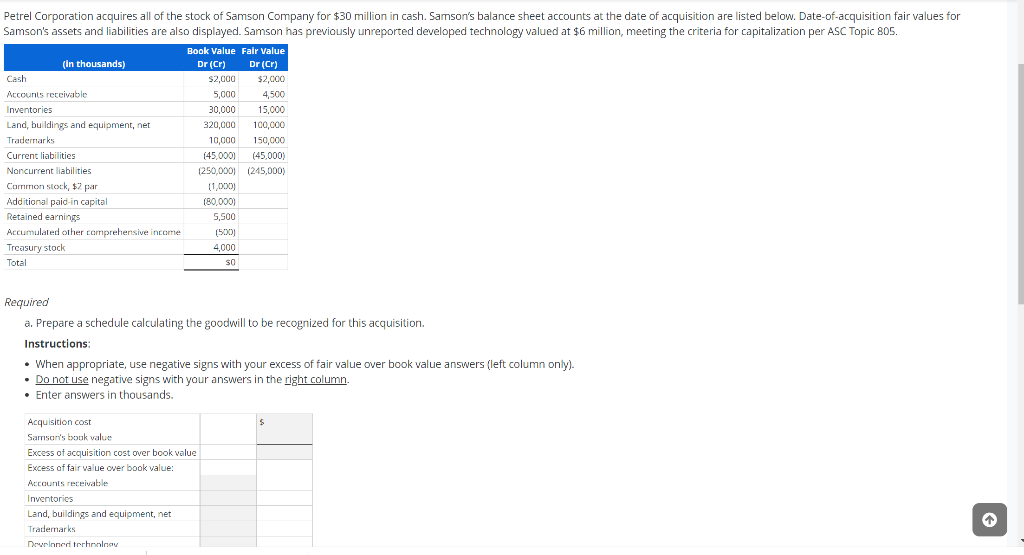

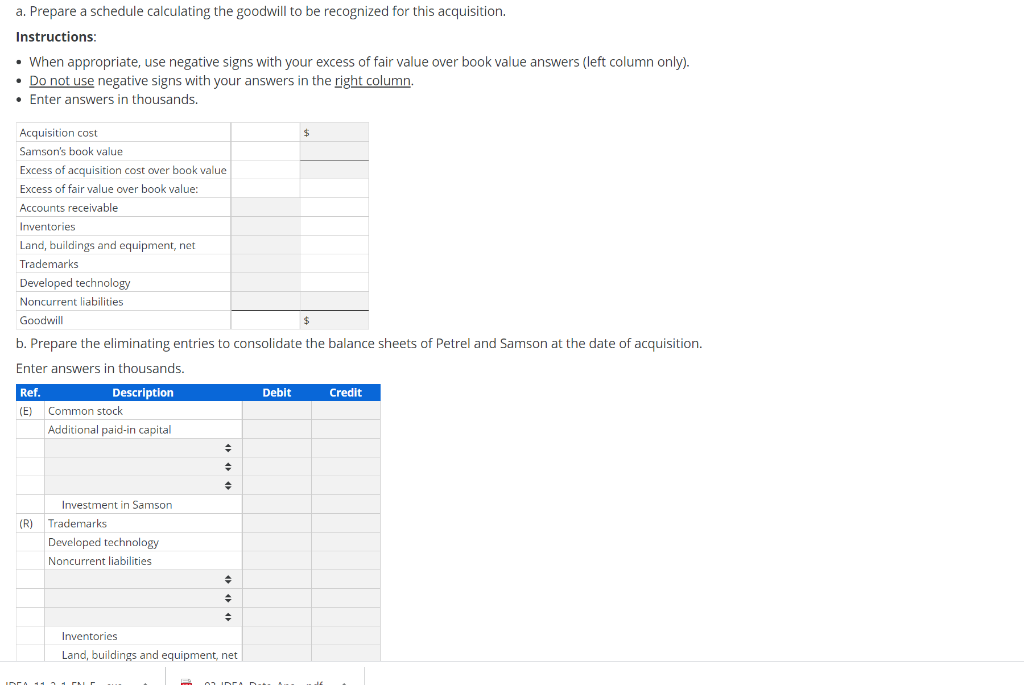

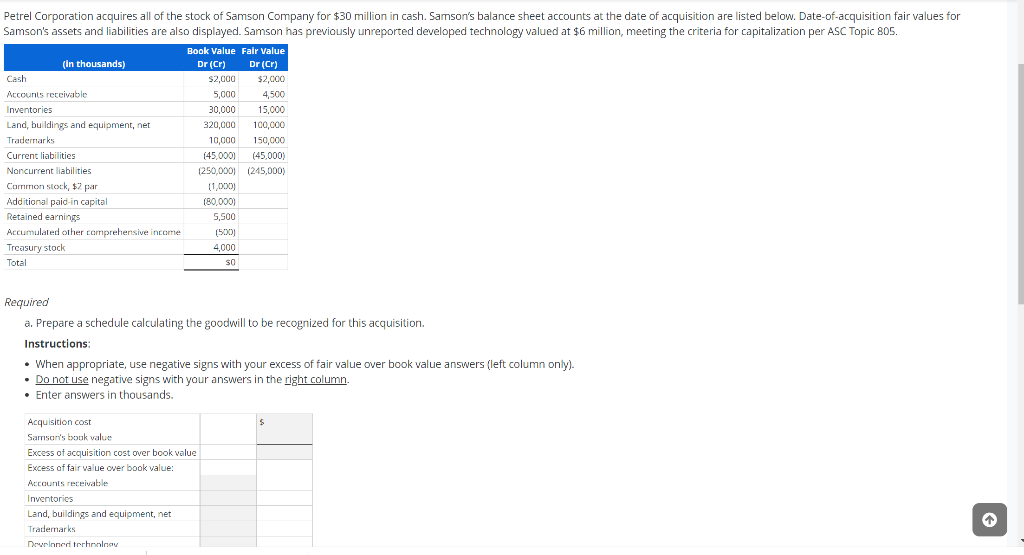

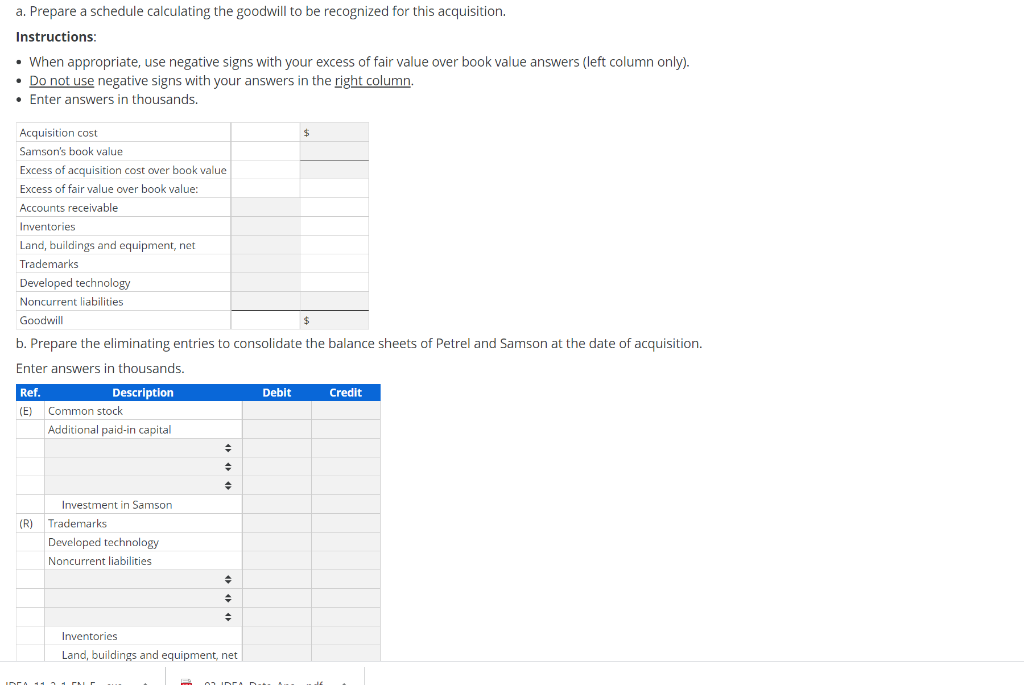

Petrel Corporation acquires all of the stock of Samson Company for $30 million in cash. Samson's balance sheet accounts at the date of acquisition are listed below. Date-of-acquisition fair values for Samson's assets and liabilities are also displayed. Samson has previously unreported developed technology valued at $6 million, meeting the criteria for capitalization per ASC Topic 805. Book Value Fair Value (in thousands) Dr (CF) Dr (Cr) $2,000 $2,000 Accounts receivable 5,000 4,500 Inventories 30,000 15,000 Land, buildings and equipment, net 320,000 100,000 Trademarks 10,000 150,000 Current liabilities (45,000) (45,000) Noncurrent liabilities (250,000) (245,000) Common stock, $2 par 2 (1,000) Additional paid-in capital (80,000) Retained earnings 5,500 Accumulated other comprehensive income (500) Treasury stock 4,000 Total so Required a. Prepare a schedule calculating the goodwill to be recognized for this acquisition. Instructions: When appropriate, use negative signs with your excess of fair value over book value answers (left column only). Do not use negative signs with your answers in the right column. Enter answers in thousands. $ Acquisition cost Samson's book value Excess of acquisition cost over book value Excess of fair value over book value: Accounts receivable Inventories Land, buildings and equipment, net Trademarks Devrinned Irrhnly a. Prepare a schedule calculating the goodwill to be recognized for this acquisition. Instructions: When appropriate, use negative signs with your excess of fair value over book value answers (left column only). Do not use negative signs with your answers in the right column. Enter answers in thousands. Acquisition cost $ Samson's book value Excess of acquisition cost over book value Excess of fair value over book value: Accounts receivable Inventories Land, buildings and equipment, net Trademarks Developed technology Noncurrent liabilities Goodwill b. Prepare the eliminating entries to consolidate the balance sheets of Petrel and Samson at the date of acquisition. Enter answers in thousands. Ref. Description Debit Credit (E) Common stock Additional paid-in capital (R) Investment in Samson Trademarks Developed technology Noncurrent liabilities Inventories Land, buildings and equipment, net