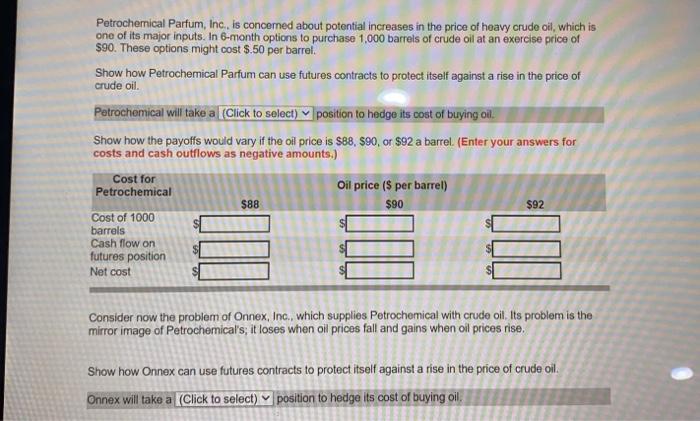

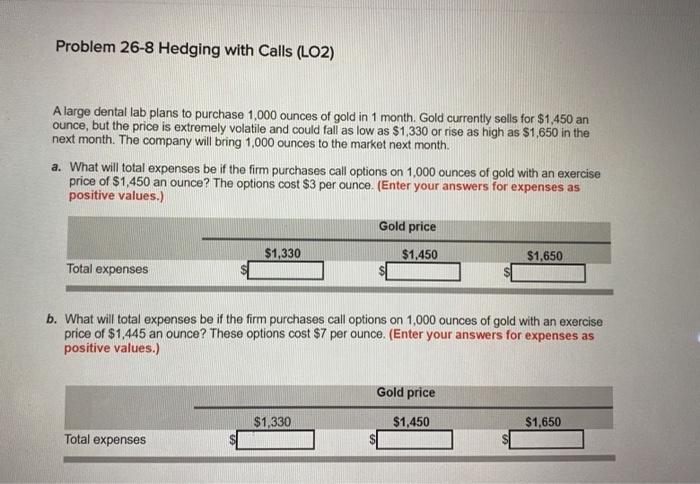

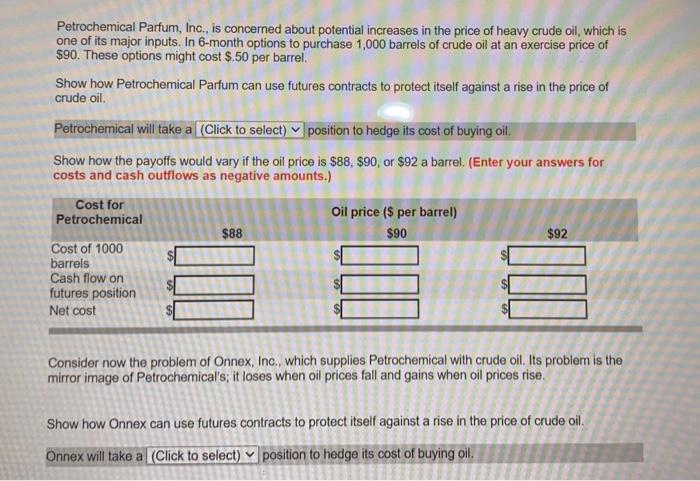

Petrochemical Parfum, Inc. is concerned about potential increases in the price of heavy crude oil, which is one of its major inputs. In 6-month options to purchase 1,000 barrels of crude oil at an exercise price of $90. These options might cost $.50 per barrel. Show how Petrochemical Parfum can use futures contracts to protect itself against a rise in the price of crude oil. Petrochemical will take a (Click to select) position to hedge its cost of buying oil. Show how the payoffs would vary if the oil price is $88, 890, or $92 a barrel. (Enter your answers for costs and cash outflows as negative amounts.) Cost for Oil price (s per barrel) Petrochemical $88 $90 $92 Cost of 1000 barrels Cash flow on futures position Net cost Consider now the problem of Onnex, Inc., which supplies Petrochemical with crude oit. Its problem is the mirror image of Petrochemical's; it loses when oil prices fall and gains when oil prices rise. Show how Onnex can use futures contracts to protect itself against a rise in the price of crude oil. Onnex will take a (Click to select) position to hedge its cost of buying oil Problem 26-8 Hedging with Calls (LO2) A large dental lab plans to purchase 1,000 ounces of gold in 1 month. Gold currently sells for $1,450 an ounce, but the price is extremely volatile and could fall as low as $1,330 or rise as high as $1,650 in the next month. The company will bring 1,000 ounces to the market next month. a. What will total expenses be if the firm purchases call options on 1,000 ounces of gold with an exercise price of $1,450 an ounce? The options cost $3 per ounce. (Enter your answers for expenses as positive values.) Gold price $1,330 $1.450 $1,650 Total expenses b. What will total expenses be if the firm purchases call options on 1,000 ounces of gold with an exercise price of $1,445 an ounce? These options cost $7 per ounce. (Enter your answers for expenses as positive values.) Gold price $1,330 $1,450 $1,650 Total expenses Petrochemical Parfum, Inc., is concerned about potential increases in the price of heavy crude oil, which is one of its major inputs. In 6-month options to purchase 1,000 barrels of crude oil at an exercise price of $90. These options might cost $.50 per barrel. Show how Petrochemical Parfum can use futures contracts to protect itself against a rise in the price of crude oil. Petrochemical will take a (Click to select) v position to hedge its cost of buying oil Show how the payoffs would vary if the oil price is $88, $90, or $92 a barrel. (Enter your answers for costs and cash outflows as negative amounts.) Cost for Petrochemical oil price ($ per barrel) $88 $90 $92 Cost of 1000 barrels Cash flow on futures position Net cost MO Consider now the problem of Onnex, Inc., which supplies Petrochemical with crude oil. Its problem is the mirror image of Petrochemical's; it loses when oil prices fall and gains when oil prices rise. Show how Onnex can use futures contracts to protect itself against a rise in the price of crude oil. Onnex will take a (Click to select) position to hedge its cost of buying oil