Answered step by step

Verified Expert Solution

Question

1 Approved Answer

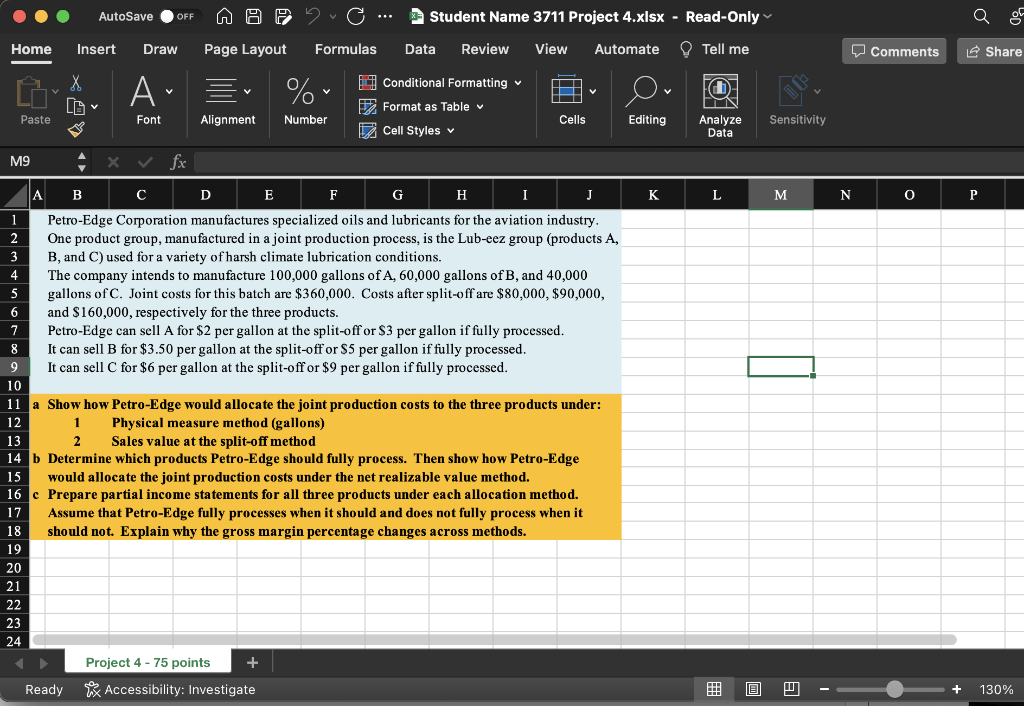

Petro-Edge Corporation manufactures specialized oils and lubricants for the aviation industry. One product group, manufactured in a joint production process, is the Lub-eez group (products

| Petro-Edge Corporation manufactures specialized oils and lubricants for the aviation industry. One product group, manufactured in a joint production process, is the Lub-eez group (products A, B, and C) used for a variety of harsh climate lubrication conditions. | ||||||||

| The company intends to manufacture 100,000 gallons of A, 60,000 gallons of B, and 40,000 gallons of C. Joint costs for this batch are $360,000. Costs after split-off are $80,000, $90,000, and $160,000, respectively for the three products. | ||||||||

| Petro-Edge can sell A for $2 per gallon at the split-off or $3 per gallon if fully processed. | ||||||||

| It can sell B for $3.50 per gallon at the split-off or $5 per gallon if fully processed. | ||||||||

| It can sell C for $6 per gallon at the split-off or $9 per gallon if fully processed. | ||||||||

| Show how Petro-Edge would allocate the joint production costs to the three products under: | ||||||||

| 1 | Physical measure method (gallons) | |||||||

| 2 | Sales value at the split-off method | |||||||

| Determine which products Petro-Edge should fully process. Then show how Petro-Edge would allocate the joint production costs under the net realizable value method. | ||||||||

| Prepare partial income statements for all three products under each allocation method. Assume that Petro-Edge fully processes when it should and does not fully process when it should not. Explain why the gross margin percentage changes across methods. | ||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started